The National Infrastructure Commission released their Annual Monitoring Report earlier this week, demonstrating why reliable data is important for infrastructural planning. In it they outline the next steps needed for the government to deliver its ambitions to level up and achieve net-zero.

This blog outlines how an agreed standard for industrial data would enable the initiatives that the National Infrastructure Commission propose, using the examples of local transport and an infrastructure bank.

What is the National Infrastructure Strategy?

Many of the government’s ideas were laid out at the end of 2020 with the publication of the UK’s first ever National Infrastructure Strategy. The strategy set out their plans to transform UK infrastructure in order to level up the country, ‘strengthen the Union’ and achieve net zero emissions by 2050.

The strategy was based on expert advice from the National Infrastructure Commission. The Commission is the body responsible for providing independent analysis and advice to the government to help the UK meets its long term infrastructure needs.

Sir John Armitt, chair of the Commission, writes in his foreword to the Annual Monitoring Report: “We anticipate that publication of the National Infrastructure Strategy will catalyse decision-making and investment across all sectors, helping to address the challenges of levelling up the UK’s economic geography and achieving net zero. Infrastructure can also help create the conditions for a market led recovery from the major economic impacts of the Covid-19 pandemic.

However, he goes on to warn that, “achieving this will require detailed planning, and delivery roadmaps backed up by stable funding plans and, where relevant, clarity of regulatory oversight. These are critical factors for the successful delivery of the policy aspirations and targets the government has now provided.”

Reliable, consistent, real-time data is crucial to this endeavour.

The report also outlines the strategic importance of many of the sectors involved in decarbonisation and achieving net zero, which The Data City is mapping at the time of writing.

Industrial data analysis becomes a core capability

Data is a vital part of the national infrastructure. An agreed standard for industrial data would enable a number of key initiatives that the National Infrastructure Commission have proposed. Let’s take two examples from the report: the recommendations to set up an infrastructure bank and to create a new model for long term, locally led urban transport.

Setting up an Infrastructure Bank

Among the priorities that it sets for 2021, the report outlines the importance of a firm funding commitment. The government committed to invest £27 billion in economic infrastructure in 2021/22 in the National Infrastructure Strategy. It also accepted the Commission’s proposal to set up an infrastructure bank to catalyse private sector investment and anchor it in long-term strategy.

Accurate, consistent and real-time industrial data needs to be at the heart of this endeavour. We’ve argued about the flaws in SIC elsewhere on the blog. However, it is worth repeating that the current industrial classification system is incapable of supporting a national investment strategy.

The current industrial classification system is static and relies on companies self-classifying themselves at Companies House. The data lags reality and under-represents newer industries while over-representing ones that are declining in importance.

The infrastructure bank needs queryable, reliable, real-time data on all UK companies to successfully guide and attract private sector investment.

Data for long term, locally led urban transport infrastructures

The report states, “the government has partially endorsed the Commission’s recommendations that cities should have the funding and powers they need to pursue ambitious, integrated infrastructure strategies”. It argues that the government needs to go further to achieve its ambitions. It states “work should start now on identifying priority cities for a pipeline of major projects, and setting aside funding in the order of £30billion by 2040 to support development of specific programmes in partnership with cities. City authorities should be set the goal of raising at least 25 per cent of the cost of any major improvements locally, with government working with them to ensure the right mechanisms are available for raising this funding.”

Being able to identify emerging growth sectors is an important capability for cities to have if they are to attract infrastructure investments.

For example, the report recommends a move to a new model of long-term and locally-led investment in transport networks within cities and says that this is critical to supporting future economic growth and levelling up. It also calls for funding to be made available on a rolling basis, supported by legislative change to enable this for cities in England.

But how does a city plan future transport networks without a clear view of the types of companies, employment numbers and their characteristics? This is an outstanding issue that the report highlights; “how can cities be helped to better join up their local infrastructure strategies with policies on skills, housing, and industrial strategy?”

That question should also be considered as part of the upcoming English Devolution and Local Recovery White Paper, which will contain recommendations on how to provide local government with the best tools with which to make decisions.

At the moment the flaws in official industrial data (SIC Codes especially) means cities are left to figure this out themselves, often commissioning consultants to create one-off snapshots of their industrial base and forecasts of future growth. This is clearly unsustainable, and doesn’t enable long term planning supported by real-time data that can be drawn upon at any time.

A new standard in industrial classification

The report states, “The private sector is responsible for the majority of the UK’s economic infrastructure investment.” This is also true of data. The absence of a reliable infrastructure for industrial data means that there is a lack of consistency in classifications, data types, sources and analysis. This will always hold back coherent infrastructure planning and investment decisions at national and local levels.

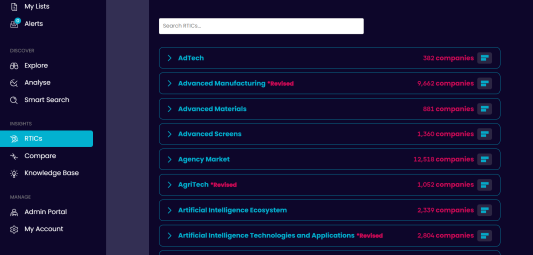

It is exactly why we’ve adopted a different approach that overcomes the deficiencies in standardised industrial classification by using 400GB of companies data on over 830,000 companies in the UK. We combine sector-level expertise with machine learning to produce comprehensive, real-time lists of companies in every sector.

The quality of the data that this approach produces means that we’re now working with a number of government agencies and departments to map emerging economic sectors – and their regional concentrations – in order to support better policy decisions, investment and economic growth.

We are excited about the prospect of our collaboration with government departments and local authorities creating a new standard in industrial classification.