How Clifden Consulting streamline their research process with The Data City

Find out how deal origination and sourcing specialists Clifden Consulting use The Data City platform and ML list builder to fill a gap in their research process.

Venture capital, private equity, and investment professionals trust The Data City as part of their deal origination process to uncover high-growth companies and emerging sectors.

The Data City empowers investors to see the market differently, breaking free from outdated deal origination processes. Our AI-driven platform uncovers emerging sectors and high-growth companies in real-time, giving you the insight to spot untapped opportunities and lead the next wave of investments.

Unlock the full market with real-time data. Our platform covers over 9 million UK companies, enabling you to discover businesses overlooked by outdated SIC codes and other platforms. Quickly identify bootstrapped start-ups and high-growth innovators, with detailed growth metrics, financials, and estimates where traditional data is lacking.

Venture beyond traditional sectors and uncover new areas of investment. Explore our database of over 400 Real-Time Industrial Classifications (RTICs), from AgriTech and AI to Net Zero and Quantum – accessing market trends and insights.

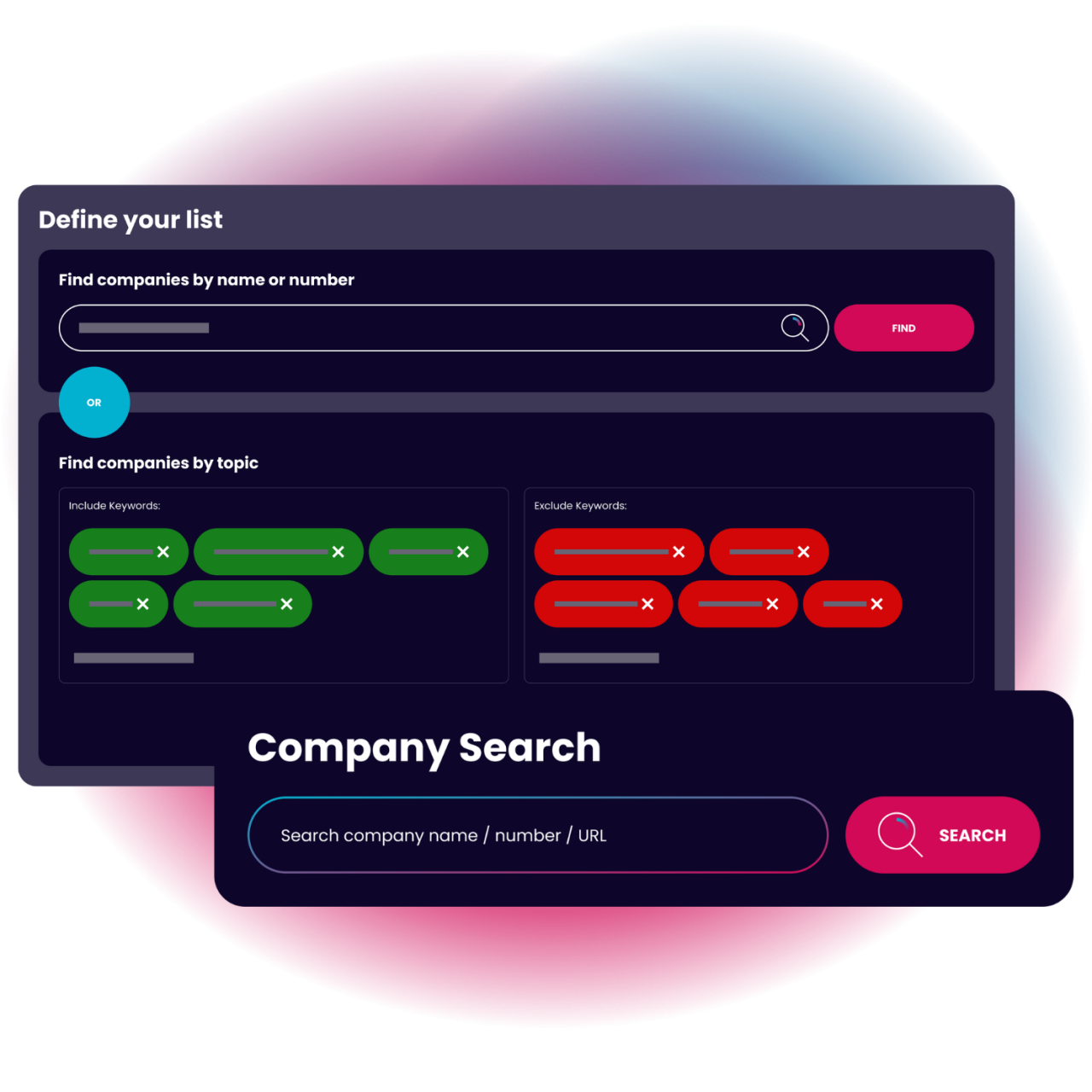

Stop wasting hours manually building company lists. Break free from outdated SIC codes and generic industry filters. With The Data City’s AI list builder, you can instantly find more of the companies that match your investment criteria. Add a few sample companies, and we’ll help you find the rest.

Make smarter, faster investment decisions using data you can trust. Evaluate high-quality opportunities with comprehensive company profiles, including financials, growth indicators, director information, funding, and more. All from trusted sources like Companies House, Dealroom, Innovate UK, Lightcast, 360 Giving, and Creditsafe.

Use our ML list builder to find ‘lookalikes’ of companies you’re interested in. Feed in current clients from your portfolio or even lost deals to find more opportunities.

Stay ahead of the curve, with the ability to map emerging sectors. Use Analyse to visualise entire ecosystems and easily spot industry trends.

Remove the guesswork. Provide unrivaled support for your portfolio, helping qualify acquisition targets with our comprehensive company data.

Find out how deal origination and sourcing specialists Clifden Consulting use The Data City platform and ML list builder to fill a gap in their research process.

Yes, we do! You can sign up for our 7-day free trial online today. This gives you a chance to get hands-on with our machine learning list builder, discover our RTICs, and explore our real-time database of over 9 million UK companies.

You sure can! When you sign up for a free trial, you’ll also gain access to a one-to-one demo with one of our analysts, where you can learn more about our features.

All licences and plans include comprehensive support as standard. Customers receive access to a dedicated account manager, available to assist with any questions or support needs.

In addition to our standard support, every plan includes one day of support from our Data Services team, ensuring you make the most of the platform. Our team of data scientists and consultants can help define your use case, build bespoke lists, answer your research questions and more.

We pride ourselves on our transparency when it comes to pricing, allowing you to understand what’s included before you get in touch. Unlike many of our competitors, you’ll find our costs clearly outlined on our website.

We offer a range of packages tailored to the needs of your organisation and the size of your team.

The Data City isn’t just another data provider; we’re redefining how industries are classified and understood.

Our mission is to build the new standard industrial classification system, liberating our clients from outdated SIC codes and enabling them to discover and invest in industries addressing the world’s key challenges and opportunities.

Unlike others who rely on outdated data, limited databases, and buzzwords, we offer a real-time view of companies in the UK and beyond.

Our Real-Time Industrial Classifications (RTICs) set us apart. Developed in partnership with the UK government and leading academics, our platform features over 400 bespoke RTICs, providing unparalleled insight into emerging sectors.

With the ability to build custom classifications using our machine learning technology, our innovative approach to developing alongside our customers and partners, and our comprehensive dataset, you’ve only just scratched the surface of how we compare to ‘similar’ products on the market.

Start your free trial today and discover how The Data City can help you revolutionise your deal origination process.