A fresh look at EdTech

The education technology sector has shifted dramatically in the past five years. From pandemic-driven growth to a more stable and focused phase, the companies in this space are no longer just experimenting with digital tools they’re building essential infrastructure for modern learning.

To reflect this shift, we’ve updated the Real-Time Industrial Classification (RTIC) for EdTech. The original version was created in 2021 using resources from BEIS. But since then, the sector has moved fast, with new types of companies emerging and older categories falling out of step with how the industry now operates.

How it was developed

From helping children learn to read in more accessible ways, to creating educational games, companies working in this sector are reshaping how knowledge is shared, skills are built, and opportunities are accessed. For many, EdTech creates a pathway where traditional education may have fallen short, whether that is due to location, cost, confidence, or time. Companies in EdTech are literally shaping the future’s, future.

By mapping and maintaining an up-to-date view of EdTech as a sector, we are not just tracking an industry, we are helping shine a light on the companies actively reshaping what learning can look like for the 21st century.

This update was a major one for EdTech, we observed massive changes in the industry and as a result, new verticals were formed and redundant ones died to more accurately classify and capture the industry as it really is. To do this we needed to get into the weeds of what was going on in the industry and a key report that the new verticals were created upon was the House of Lord’s “Educational technology: Digital innovation and AI in schools“.

For context EdTech’s old verticals were;

- Artificial Intelligence

- Devices

- Digital learning

- Immersive learning

- Learning Management Systems

The new verticals are;

- Artificial Intelligence

- Devices

- Immersive learning

- Learning Management Systems

- Gamification (Platforms using game like mechanics to make learning fun and engaging)

- Learning Apps and Software Providers (companies providing software and/or app to aid in teaching and/or learning)

- AI Detection/Authentication (companies providing services that help detect ai involvement and prevent academic cheating and or plagiarism)

Looking at the industry from a high-level perspective

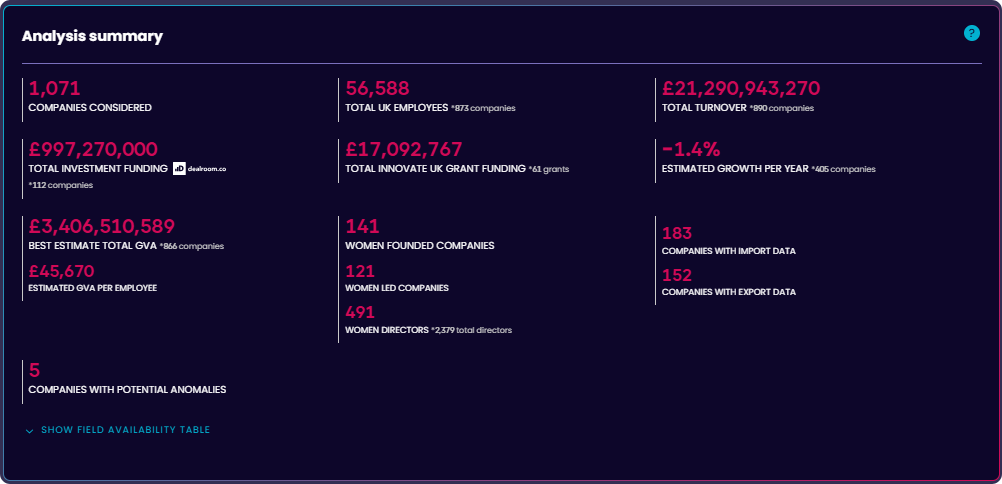

Looking at the industry from a high-level perspective, we can see all the key stats. Comprising of 1,071 companies, a total turnover over of £21.2 billion and with GVA per employee reasonably high, it suggests that EdTech as a sector remains productive and is still clearly attractive to investment, with just under £1 billion invested.

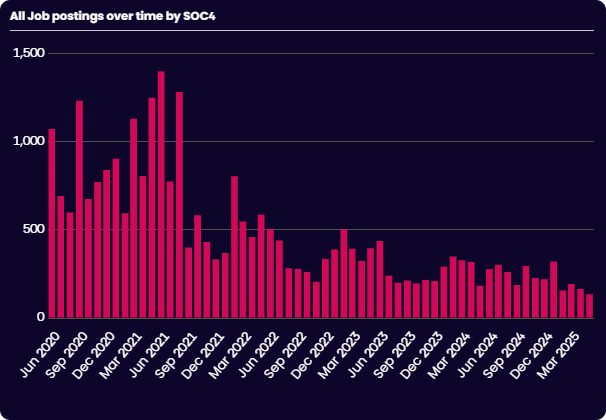

Diving a bit deeper, the Industry Engine shows EdTech is experiencing a contraction with a growth rate of -1.4%. This is to be expected five years after the pandemic, as schools return to more traditional and less tech reliant education. This is further evidenced by the job postings in the sector, supplied by our data partner Lightcast where we can see a sharp and consistent decline in job postings since pandemic highs. However, it is not all doom and gloom for EdTech as the contraction was to be expected and is minimal, thus suggesting EdTech is maturing as an industry and the companies that were too reliant on consistent investment leave the industry.

The new verticals

So, what’s new with the update? Well say hello to EdTech’s three new verticals, Gamification, Learning Apps and Software Providers, and finally, AI Detection/Authentication.

First Gamification, this vertical comes from the rise in companies providing gamified learning, making learning more accessible and engaging. Companies like Duolingo or Kahoot are examples of companies that are actively changing how we learn though mechanisms commonly found in games like being rewarded with points or maintaining a streak by completing daily challenges. Their methods are making learning less like traditional school teachings and more like just having fun!

Second is Learning Apps and Software Providers. With education becoming more digital companies are producing unique solutions, this vertical captures that. Think general softer providers like Flexisaf and online exam platforms like Inspera, online workspaces like Pebble Pad and personalised apps that provide tutoring platforms like Trots Tutor.

And finally, AI Detection/Authentication. As a response to the rise in AI and the challenges of catching plagiarism, systems must be and have been created to help educators in this fight. For example, Turnitin, these companies help prevent the use of AI in education when AI should not be used. While this vertical is small right now, it is defiantly becoming more important as AI rapidly improves.

Now it is time to talk about what is no longer in EdTech. Since the pandemic EdTech has grown and matured over these five years and the Digital learning vertical has grown too broad in scope to accurately capture the activities of the EdTech industry. This is where The Data City truly shines as the most accurate view of the UK economy available. The Data City actively creates a real time view of the UK economy as industries breakdown and become more granular.

Looking forward

The EdTech sector is evolving quickly and often in unexpected ways. What began as a digital extension of the classroom has grown into a complex industry reshaping how we learn, teach, and think about education. From AI essays to gamified language apps, the landscape is no longer about access, it is about adaptability, experience, and trust. That is why it is crucial to have data that evolves with the industry.

At The Data City, we go beyond static SIC codes and outdated classifications. Our platform uses real-time data, advanced AI models, and continuous updates to build an economic map that reflects the true shape of modern industries as they exist today, not as they were five years ago.

For EdTech, this means finding the companies driving innovation, identifying emerging trends as they gain traction, creating sector definitions that are useful for policymakers, investors, and educators.

The goal remains the same! To provide a live, accurate, and actionable view of the UK’s dynamic sectors.

Sign up for a free trial and see the data for yourself today.

Please note: The data from The Data City is accurate at the time the article was written but may change over time due to the dynamic, real-time nature of our data. For the latest insights, visit our platform.