In financial services, Know Your Business (KYB) is essential for establishing compliant, transparent relationships with business clients.

Banks, insurers, and other financial institutions rely on KYB processes to confirm they’re dealing with legitimate businesses by verifying ownership structures, assessing risk, and preventing fraud.

But with a lack of access to accurate and automated business data the KYB onboarding process can be a time-consuming, costly, manual process.

Here’s where The Data City comes in. As a leader in real-time business data, The Data City uses AI-driven technology to tackle the challenges of outdated classification systems often used in the KYB process, like the UK’s Standard Industrial Classification (SIC) codes.

Our mission is to enhance clarity in business classifications for smoother, more accurate KYC and KYB processes through our innovative Real-Time SIC Codes (RSICs).

What is Know Your Business (KYB)?

KYB, or Know Your Business, is a compliance process used by financial institutions to confirm the legitimacy of business clients, understand ownership structures, assess risk, and gain clarity on company activities.

While KYC focuses on individuals, KYB examines entities, verifying corporate structures and business activities to meet AML regulations.

A strong KYB process involves three main steps: Initial Verification, to confirm business registration, ownership, and activities; Ongoing Monitoring, to keep data current as business structures and activities evolve; and Risk Assessment, to evaluate each business’s risk level, enabling informed decisions from onboarding onward.

The SIC code challenge in KYB

SIC codes have traditionally been the standard for categorising companies by industry for financial institutions aiming to understand business activities and assess risk.

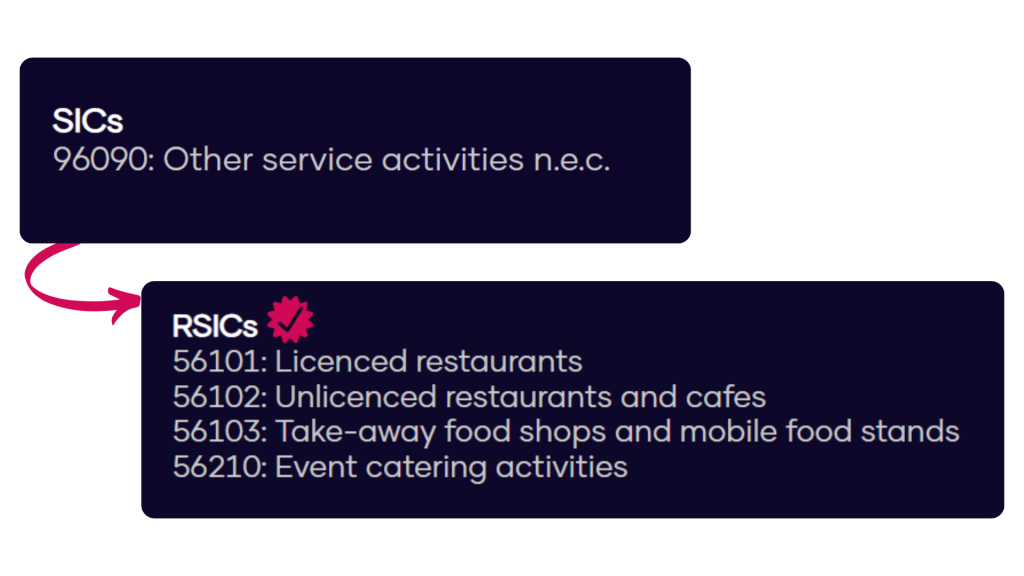

However, SIC codes, which are self-selected during business registration, often fall short of providing clear, accurate insights.

SIC codes were never designed with the granular detail required for today’s compliance and risk management.

Many companies, particularly those engaged in specialised or emerging sectors, are classified under vague categories like “other service activities,” which reveal little about what the business actually does.

With over 1.4 million UK companies, representing 40% of the workforce, falling into these “other” classifications, financial institutions are left navigating this lack of clarity.

This lack of detail in business classification impacts compliance, risk assessment, and onboarding, leaving teams exposed to inaccurate data and increasing the risk of fraud.

Introducing RSICs

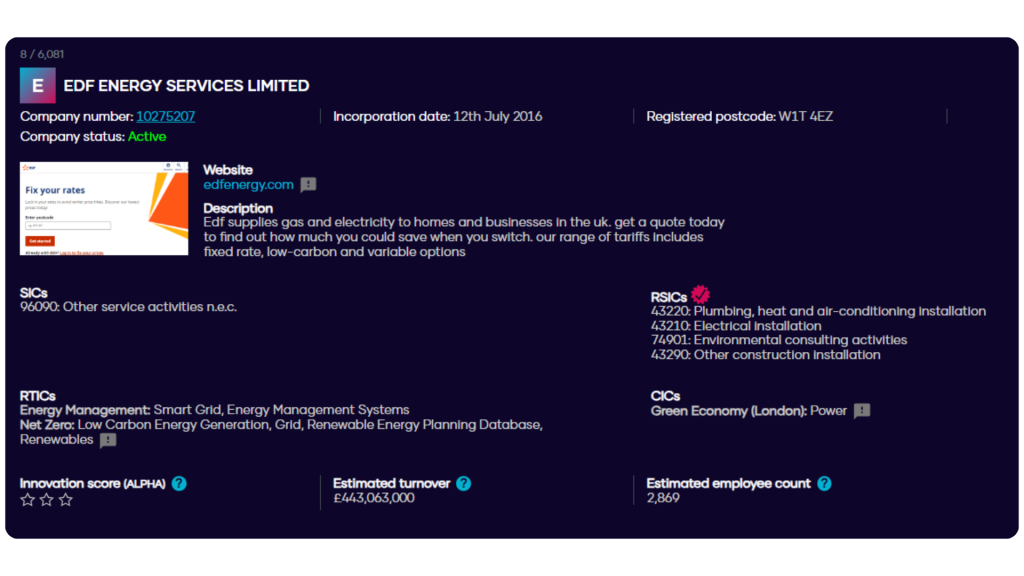

To address these challenges, The Data City developed Real-Time SIC Codes (RSICs), an AI-driven system that brings precision and clarity to SIC classifications.

RSICs provides KYB teams with accurate, real-time descriptions of what companies actually do, filling in the gaps left by traditional SIC codes.

By using AI to refine, update, and correct classifications, RSICs helps organisations move beyond vague labels and ensures they are working with up-to-date, granular data.

At The Data City, we understand that financial services rely heavily on accurate data for compliance and risk management.

With RSICs, we’re solving SIC code limitations by delivering reliable, clear classifications in real time. Here’s how RSICs can benefit teams in KYB, KYC, customer onboarding, and risk assessment:

- Enhanced business clarity: RSICs replaces outdated “other” classifications with precise activity descriptions, reducing uncertainty in KYB and KYC processes.

- Improved efficiency: RSICs eliminates the need for manual reviews, speeding up onboarding processes and freeing up resources.

- Compliance confidence: With accurate classifications, KYB and KYC teams can conduct AML and risk assessments with greater confidence, meeting regulatory requirements more efficiently.

Why KYB teams should care about RSICs

KYB is evolving, and having accurate, real-time data is essential.

Financial institutions are finding that the limitations of SIC codes don’t just hinder understanding, they impact critical aspects of compliance and client relationship management.

With RSICs, KYB teams can enhance their workflows, maintain compliance, and gain a better understanding of business clients, all without the obstacles posed by traditional SIC codes.

For financial services professionals looking to elevate their KYB and KYC processes, RSICs offers a modern, precise approach to business classification.

At The Data City, we’re committed to helping organisations overcome outdated data barriers with AI-powered insights.

To learn more, check out our technical blog on RSICs or contact us for a demo.