Banks and FinTechs are under more scrutiny than ever.

Regulatory pressure is increasing. AML obligations are tightening. And for any institution onboarding a business customer, the expectations are clear: you need to know your customer. But also, critically, you need to know what their business actually does.

Unfortunately, most banks are still relying on information that’s self-declared or based on outdated classifications like SIC codes. This creates a major problem.

What companies say vs. what they do

Most onboarding processes still rely on self-declared business descriptions, outdated classifications and basic registry checks. But as we’ve seen time and again, what a company says it does, or how it’s registered, isn’t always accurate.

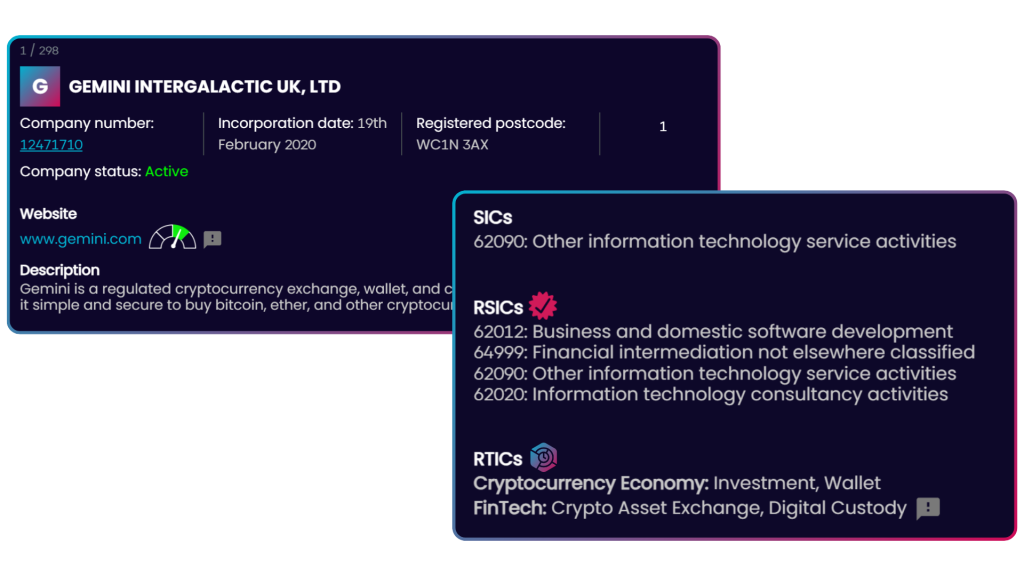

One example from our platform is a regulated cryptocurrency exchange. On paper, its official SIC code is 62090: Other information technology service activities — a vague, catch-all classification for IT businesses.

However, using The Data City’s Real-Time SIC Codes (RSICs), we assigned four more accurate codes reflecting the company’s actual operations, including financial intermediation and software development.

Meanwhile, our Real-Time Industry Classifications (RTICs) correctly identified the company as operating in FinTech: Crypto Asset Exchange & Digital Custody, and the Cryptocurrency Economy.

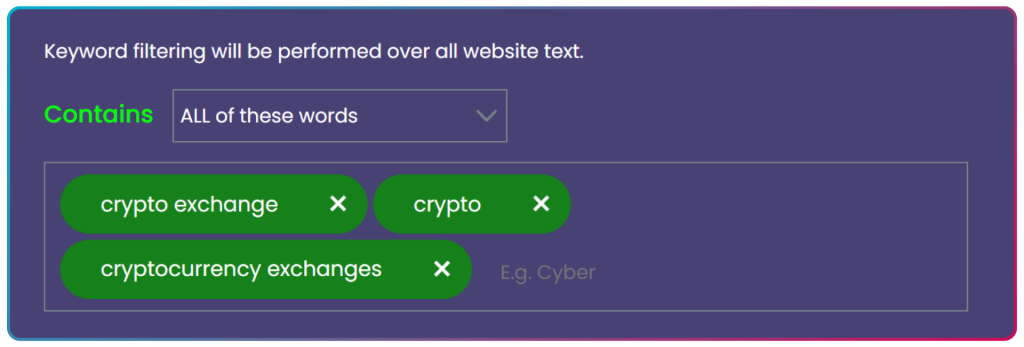

In addition to improved classification, our keyword filters can pinpoint companies based on high-risk terms — in this case, detecting “crypto exchange” directly from the firm’s website.

This kind of enhanced, real-time classification can mean the difference between standard onboarding and triggering the appropriate risk controls.

Why traditional systems aren’t working

The real issue here is that traditional classification systems – including SIC codes, NAICS codes, and even many in-house classification frameworks – are broken.

They were designed for a different era and struggle to reflect the complexity of the modern economy or track changes to companies over time. They’re vague, out of date, hard to maintain, and often wrong, especially when companies pivot, expand into new sectors, or evolve rapidly in response to market changes.

The result? Banks and FinTechs are making risk decisions on bad data. They’re over-relying on manual checks. They’re missing red flags. And, in some cases, they’re getting fined, like Santander’s recent £107 million penalty for AML failures linked to misclassified business customers.

What we built at The Data City

At The Data City, we’ve created a solution designed for this exact problem.

We use AI and website data to classify companies based on what they actually do. At the heart of our solution are two core innovations:

- Real-Time SIC Codes (RSICs): Our modernised version of the traditional SIC system. RSICs use AI to analyse a company’s website, then automatically assign up to four classifications from the SIC system, providing more relevance and accuracy.

- Real-Time Industrial Classifications (RTICs): A completely new classification layer built to reflect the modern economy — covering emerging sectors like FinTech, Crypto, and AI which are missing from traditional methods.

We are also able to use keyword searches to detect businesses high-risk indicators like “FX”, “crypto”, or “remittance” in real time.

All of this is available through our platform, or via API, database, or bulk file, making it easy to plug directly into onboarding, risk, and compliance workflows. It’s fast, reliable, and regulator-aligned.

Why this matters now

Firms are under pressure from regulators. Whether it’s JMLSG guidance or FCA Principle 3, the message is the same: you must take reasonable care to organise and control your affairs responsibly. And that includes understanding your customers.

For compliance teams, operations leads, and risk managers, this isn’t just a technical challenge. It’s a strategic one.

If your classification data is wrong, everything else downstream, including transaction monitoring, risk scoring, EDD, starts on the wrong foot.

A better way to know your business customers

The answer isn’t just more checks, it’s better data. The Data City provides that, and we’re already working with some of the most innovative public sector bodies and financial institutions in the UK.

If you want to:

- Onboard faster

- Flag risk earlier

- Meet compliance standards with confidence

- Avoid massive regulatory fines

…then we should talk.

You can explore our banking and FinTech solution today or sign up for a free trial to see the data in action.