RTICs & Working out loud

The Data City Blog

Latest news and views

We’re committed to a culture of working out loud. Sharing our ideas and work as early as we can, and getting feedback from our community.

Find thought-pieces, research papers, product updates, company news and much more on The Data City blog.

Filter by category

Search for an article

Product & Working out loud

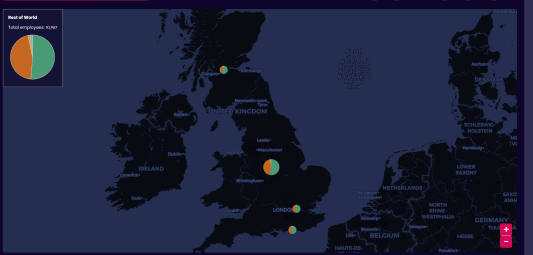

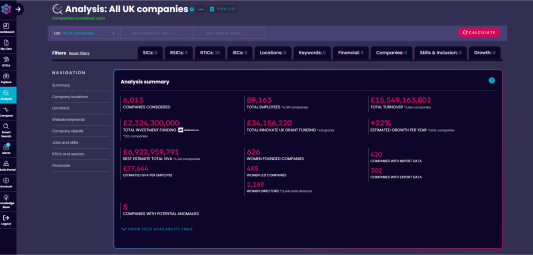

What do companies do where?

Product

Industry Engine Release Notes

Industrial Strategy

Providing clarity on the Industrial Strategy’s IS-8 sectors

Product & Working out loud

Update to our growth rate methodology

Insight & Thought Piece

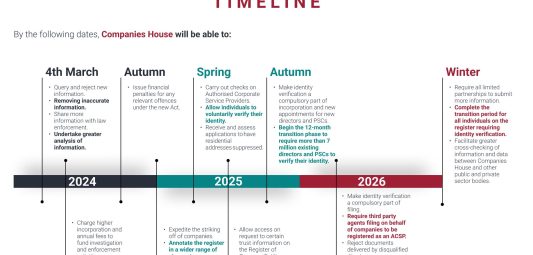

The Economic Crime and Corporate Transparency Act and the effect on The Data City data

SIC & Thought Piece

SIC 2026: What does it mean for industry classifications?

Advanced Screens & RTICs

Exploring the Advanced Screens RTIC

FinTech & RTICs

A look at the UKs FinTech Industry

Events & Insight

Banks still using SIC codes? That’s criminal

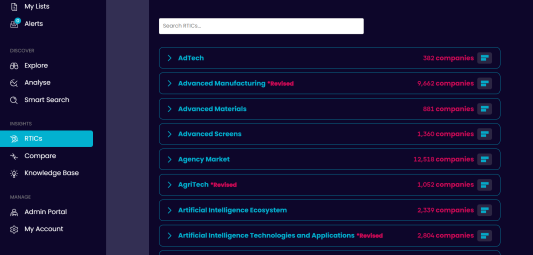

Real-Time Industrial Classifications

Download our free RTIC Industry reports

Our platform offers over 400 Real-Time Industrial Classifications (RTICs), created in partnership with industry experts.

Interested in exploring market insights, sector trends, employee data and growth statistic for the country’s fastest-growing industries?

Download one of our free market reports today.