Product & Working out loud

The Data City Blog

Latest news and views

We’re committed to a culture of working out loud. Sharing our ideas and work as early as we can, and getting feedback from our community.

Find thought-pieces, research papers, product updates, company news and much more on The Data City blog.

Filter by category

Search for an article

Product

Industry Engine Release Notes

Industrial Strategy

Providing clarity on the Industrial Strategy’s IS-8 sectors

Product & Working out loud

Update to our growth rate methodology

Insight & Thought Piece

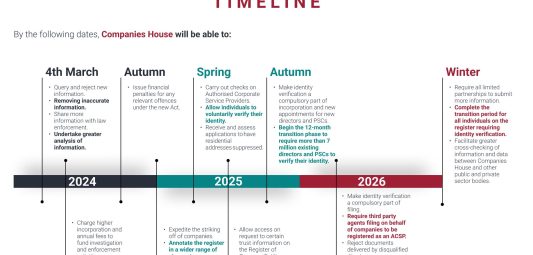

The Economic Crime and Corporate Transparency Act and the effect on The Data City data

SIC & Thought Piece

SIC 2026: What does it mean for industry classifications?

Advanced Screens & RTICs

Exploring the Advanced Screens RTIC

FinTech & RTICs

A look at the UKs FinTech Industry

Events & Insight

Banks still using SIC codes? That’s criminal

Real-Time Industrial Classifications

Download our free RTIC Industry reports

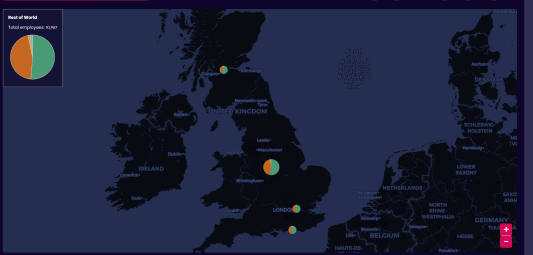

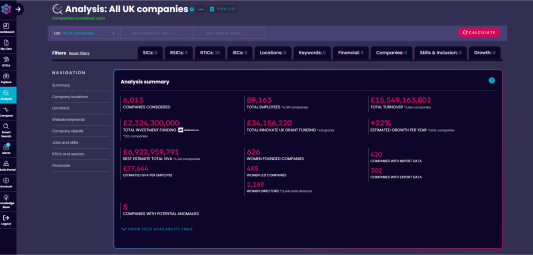

Our platform offers over 400 Real-Time Industrial Classifications (RTICs), created in partnership with industry experts.

Interested in exploring market insights, sector trends, employee data and growth statistic for the country’s fastest-growing industries?

Download one of our free market reports today.