The strategic importance of understanding the relationship between the private sector and academia is relevant for most sectors, but even more if we talk about Life Sciences. This is one field that often adapts academic research and innovations into commercial products. Hence, it is important to know the companies and universities working together, the research communities they create and their location. We found 93 organisations registered as companies in Companies House working in the field of Life Sciences that were part of the same community while being close by.

These are relevant companies. In aggregate terms, they have raised 1.6bn in private equity funding and 327k in grants. These are two indicators of high trust, from an investment standpoint, in these companies’ R&D capabilities. Another relevant point is that 65 of them are Established businesses, showcasing that large enterprises might participate more in academic research.

The method

In Life Sciences, research papers are fundamental to disseminate the work companies and universities complete together. So we used the papers’ citations data produced by Microsoft to quantify their collaboration in research. If organisations publish three papers or more together in the field of Life Sciences, we understand they collaborate in research significantly. However, it is important to note that the data includes organisations that are not companies (like hospitals). We run the analysis over all organisations and then extracted those registered as companies in Companies House.

Approaching the data this way makes it possible to articulate the private-academic research ecosystem as a network. In this sense, the organisations are linked by the papers they publish together. And this information allows us to discover research communities. We can understand communities as groups of organisations that engage more amongst themselves than with the rest of organisations in the network.

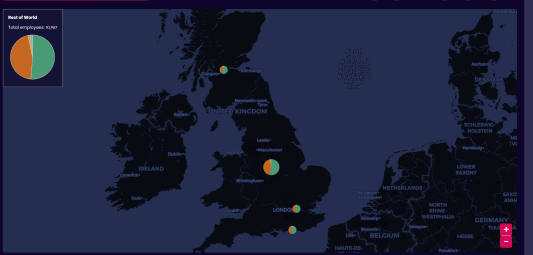

The first thing that we learned is that research communities are often disperse. This means that the companies/universities do not need to be geographically adjacent to be part of the same research community. However, we noted that some companies/universities in a community were aggregated in space, so we looked for spatial agglomerations. This is the insight that you can get from the map below. The colour dots represent companies/universities within the same community in a spatial agglomeration, and the grey dots those that were in a community but not in a spatial agglomeration.

Exploring the results on the map gives us a great insight into the location of research communities in Life Sciences. We want to highlight three important findings. First, there is an overlap of 6 communities in London, making the city a principal location to understand R&D communities in Life Sciences. Then, we can see strong localised communities, like Oxford’s and Liverpool’s, which can suggest regional specialisation in the field. Ultimately, we can see how a community can develop two distinct spatial agglomerations, as with the case of Community 6 in Scotland, which appears split between Edinburgh and Glasgow.

Learnings and conclusions

Harnessing the power of research and innovation is fundamental for the UK to maintain its global leadership in high technology sectors as Life Sciences. But, for this, we need reliable data on the organisations that make it happen. We need to know who they work with and where. This information is fundamental for policymakers and other research and innovation organisations that want to collaborate in strengthening existing research communities, or create new ones. This is why we have dived into this work. If you are interested and want to talk about it, please get it touch!