The power of AI technology extends far beyond its own industry, with the potential to transform countless others and revolutionise the way we live. With its remarkable ability to enhance profitability and eco-friendliness, AI has quickly become one of the most important tools at our disposal. As such, a deeper understanding of the sector is crucial to capitalise on the wealth of talent and resources available. For a deeper dive into the methodology behind this data, check out the paper we wrote with Dr. Caroline Chibelushi. But if you’re keen to stay up-to-date on the latest industry trends and insights, read on!

The AI sector

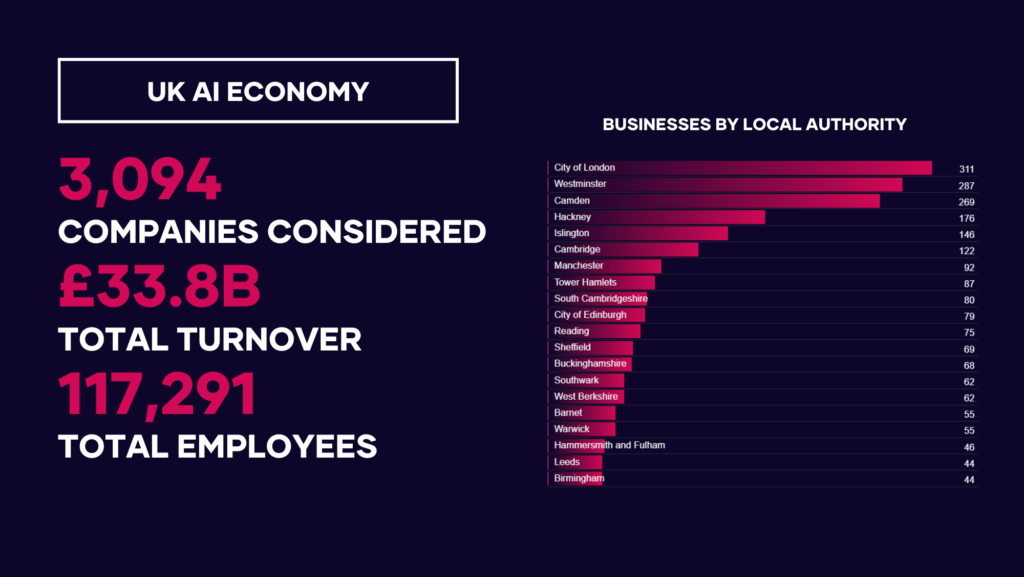

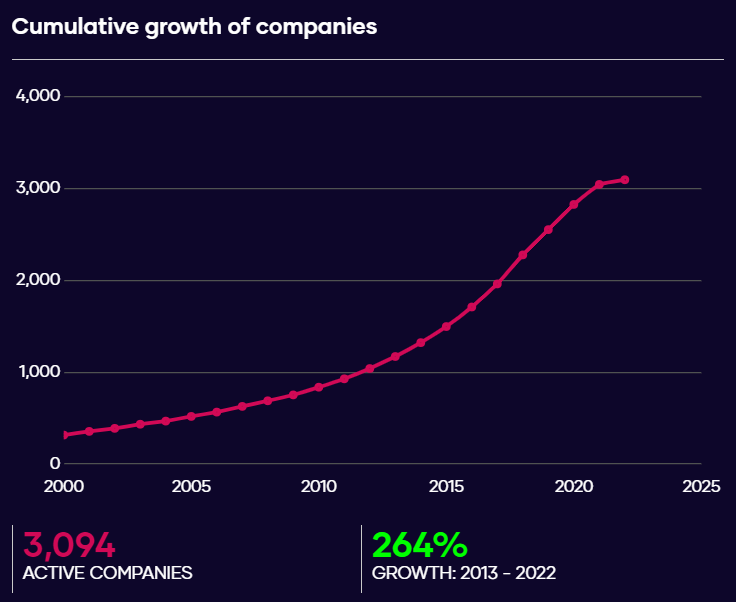

Currently, the AI sector has 3,094 active businesses in the UK that make more than 33.8bn in turnover and employ 117k people. The average company growth rate is 9.3%, making it the second fastest growing RTIC. The productivity by employee is at an average 288.5K/year (employee contribution to turnover), making it one of the most profitable and labour efficient economies in the country.

However, knowing the performance of the industry at the national level is not enough. Understanding the differences between regions is crucial for effective policy-making and identifying opportunities, which is where something like our company growth stage metrics could come into play. The interactive map below summarises a few data points, ranging from average company growth to aggregated private equity and grant funding received. Local Authorities have been coloured considering the average company growth percentage, letting us know straight away where the fastest growing AI companies are. Click on each of them to know more.

The growing AI industry

This map shows that most of the growing AI industry is concentrated in the South East. Chelmsford has a small population of AI business, however, they are growing at an average of 36.74% a year. There are also cases like South Cambridgeshire, with a population of 80 AI businesses growing at an average rate of 17.68%, confirming the existence of a healthy and promising regional economy. Nonetheless, the data also unveils an interesting growth story featuring regions in the North East and Scotland. Local Authorities like County of Durham, Northumberland or South Lanarkshire have a rather small number of AI companies that are growing very fast. This indicates the existence of great talent in these regions, but funding data may indicate a lack of support.

The data shows that the regions that received more funding are not always the ones growing at a fastest rate. This is specially clear in the North East of England: while companies in Newcastle Upon Tyne received €7.76 million in private equity funding and £1.22 million in grants, they are growing at a considerably slower pace than companies in local authorities that received no funding at all. It reinforces a view of investment in the UK that favours areas in the South at the detriment of other regions.

This is specially important for a young industry such as AI, where 2.2K companies out of 3.1k are defined as a Start-up. Encouraging investors to distribute funding across different regions can contribute to building a strong AI sector at the national scale that has a strong representation and application at the local scale, and that benefits other regional economies.

Wrapping up AI

Building reliable datasets about the AI economy is instrumental for sustainable economic development. We need to understand the strengths of the UK as a whole, but also the regional context. With our work, we aim to contribute to this purpose. If you are interested in the data, our methodology or any of of the insights discussed above, get in contact with us!