The Tech Nation annual report into the health of the industry – released yesterday – highlights the successes and priorities in many of the sectors that we’re actively mapping here at The Data City.

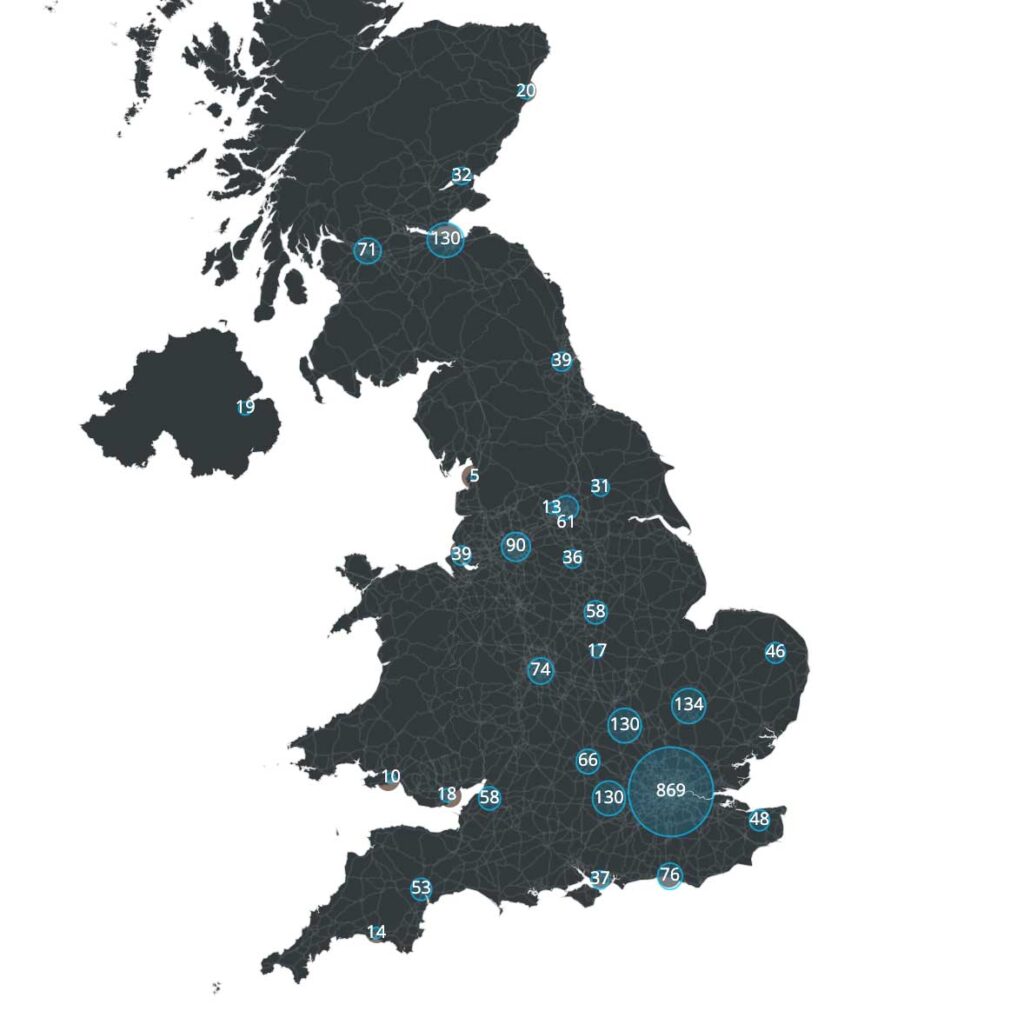

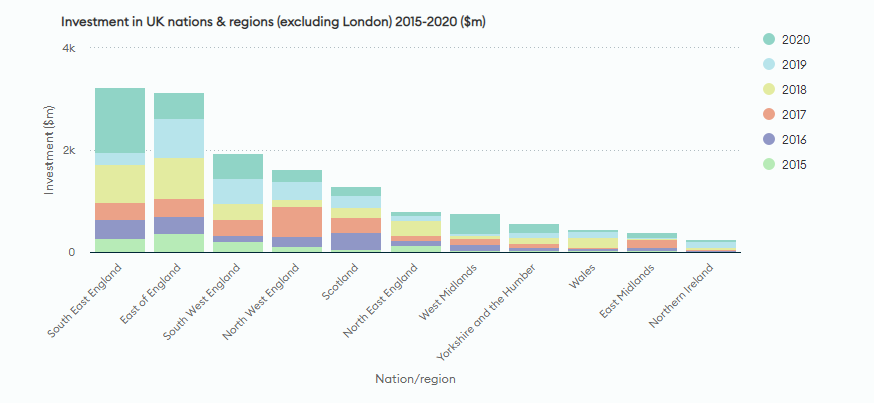

London dominates the VC investment picture and, as we’ll go on to show, there are opportunities to build on the success at national level outside the South East. This is particularly true of two of the most interesting sectors highlighted in the report – deep tech and impact tech.

The national picture

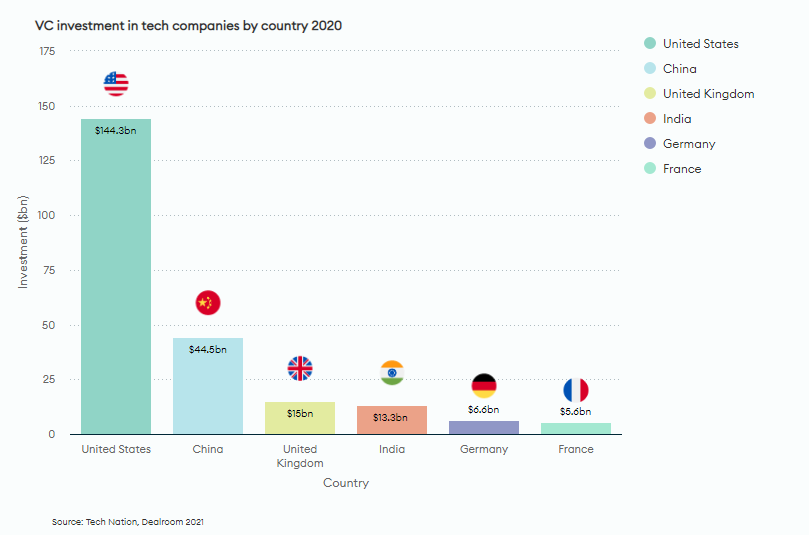

The report describes how VC investment in UK Tech is now third in the world. The UK has drawn further ahead of tech hubs in Europe including Germany and France in 2020.

Investment naturally slowed in the first stages of the pandemic but has returned strongly leading to the British high-growth sector being valued at $585bn. The UK tech start-up and scaleup ecosystem is now valued at $585bn – 120% more than in 2017. This is more than double the next most valuable ecosystem, Germany, at $291bn.

The report outlines how tech is becoming more important for the UK economy. The rate of tech GVA contribution to the UK economy has grown on average by 7% per year since 2016.

Deep tech and impact tech highlighted in the Tech Nation annual report

Gerard Grech, chief exec of Tech Nation, outlines three areas of considerable progress in his foreword. He says that the gap between tech investment in the UK, China and the US closed more quickly in 2020 compared to other years. He also points out investment in deep tech and impact tech as a success story for 2020-21.

These two emerging areas are of real interest to us and our clients at The Data City.

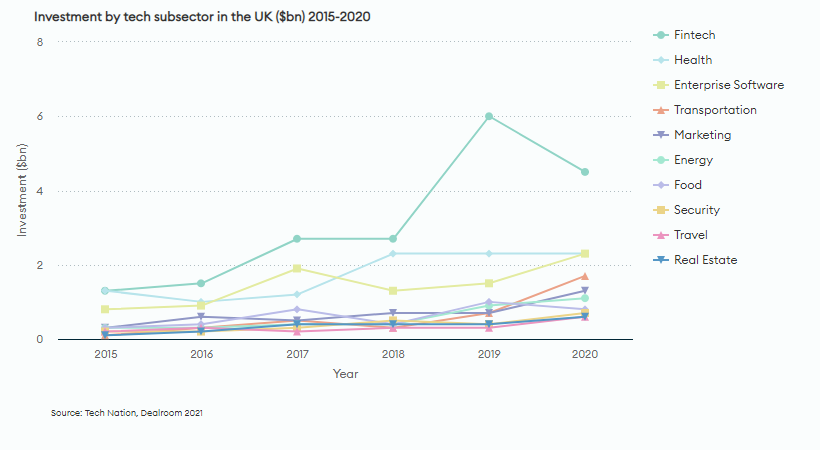

Deep tech refers to companies involved in areas such as blockchain and biotech, often making heavy use of AI (Artificial Intelligence). Investment in deep tech rose 17% to just under $4bn in 2020.

Impact tech describes companies who are creating technology solutions to environmental and social problems. The sector attracted $2.6bn in 2020, double the amount it raised in 2018.

As the chart below, taken from the report, shows there was year on year growth in most sub-sectors of tech.

London dominates UK tech investment

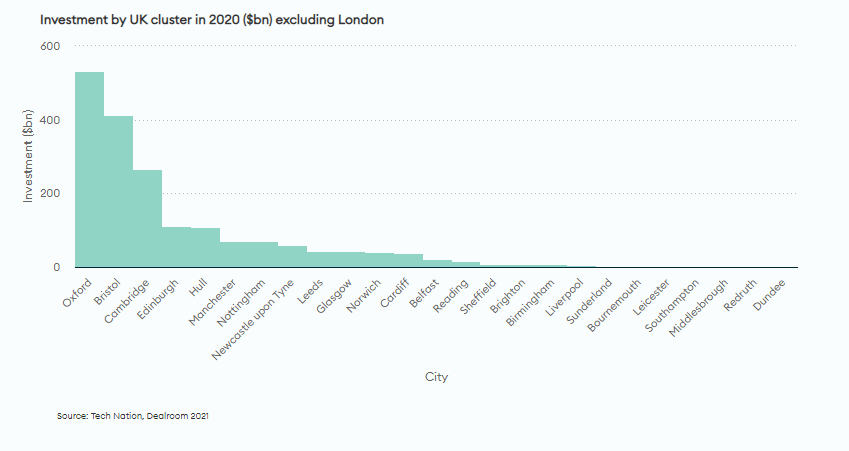

Unsurprisingly, London dominates the UK investment picture. The percentage of total UK VC investment made into London has increased from 73% to 88% between 2018 and 2021.

In order to realise the potential of the UK’s global tech credentials, we need to do more to attract investment outside London and the South East.

The PM’s levelling up agenda has yet to bear out in VC investment figures. However, our work mapping the UK’s emerging sectors shows potential for this to change. There are strong clusters of emerging sectors in areas of the country that are not currently attracting substantial investment.

For example, we found clusters of companies involved in decarbonisation in the UK’s traditional industrial hubs. Let us take one as an example.

Impact and AgriTech

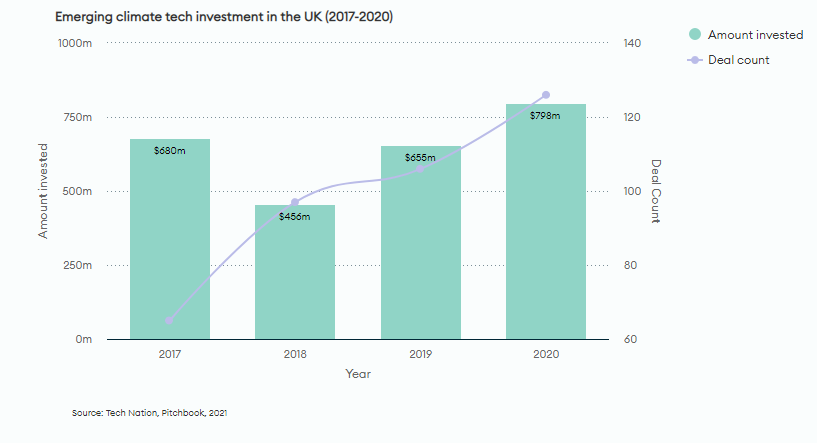

The UK is ranked third in the world for impact tech investment. According to Tech Nation, the UK saw a 21% increase in investment in climate tech and agriculture companies. This reached a record $798m in 2020.

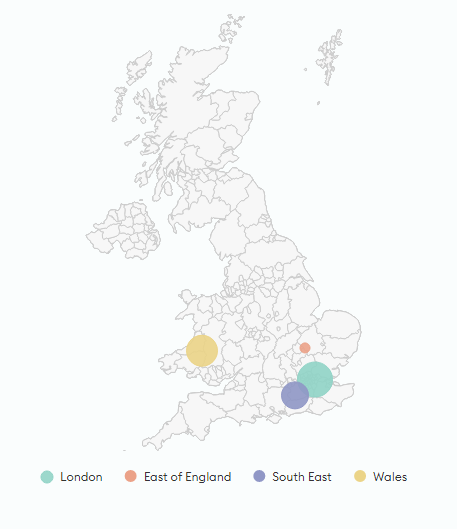

A comparison of two maps illustrates the opportunity for additional investment outside London.

The first map from Tech Nation (above) plots UK climate and agriculture clusters by emerging tech investment raised in 2020. The second (below) plots the location of AgriTech companies and is taken from The Data City’s 2021 AgriTech data. Note that the map to the right does not contain any climate clusters.

As always, Tech Nation’s annual report highlights the success of UK tech on the world stage. It also illustrates the opportunity to use investor appetite to grow innovative companies in emerging sectors outside of London and the South East of England.

Our datasets suggest that there is plentiful opportunity for regional bodies to attract investment, and for investors to find the next unicorn roaming the UK’s regions.