Robotics is not a thing of the future anymore—the development of the field during the last decades is fascinating. Honda’s ASIMO robot and the Saul Robot, developed by Xenex and The 633rd Medical Group to kill bacteria and viruses such as Ebola, are two examples of how automation is transforming the way we approach challenges. The UK has a long history in the sector and it has the potential to continue at the forefront of global innovation.

We created an Autonomy and Robotics RTIC in partnership with the Satellite Applications Catapult, and we have learned a few things about the sector in the UK: it is mostly based in urban areas, it engages with autonomous vehicles and has a healthy compound average company growth of 8.1%. Let’s dive into Robotics!

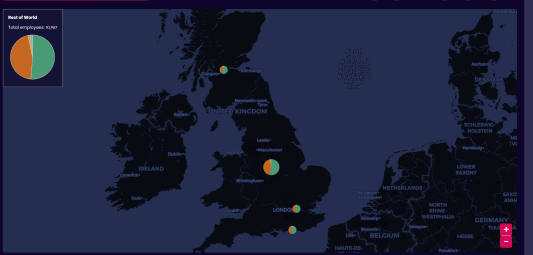

Where are robotics companies located?

Our Autonomy and Robotics RTIC captured 966 companies that employ over 21.7k people. These stats suggest that the sector produces significant value added to the economy, so it is important to identify the spaces that host the industry.

Our company location data, which includes both registered and trading addresses, makes it possible to define the geographic distribution of the sector. In this case, 4 out of 5 Local Authorities are predominantly urban.

Locations of Autonomy & Robotics Companies

The interactive heatmap above represents the geography of the sector. The benefit of heatmaps is that they allow you to uncover detail hidden by traditional summary statistics.

Our aggregates identify urban local authorities as popular areas for the industry. However, the map showcases that there are industry corridors across more rural areas. Hence, this representation of the industry can inform policymakers and investors of strategic areas and opportunities with the potential of strengthening communities and the industry overall.

What do robotics companies talk about on their websites?

We have website text data for autonomy and robotics companies. Thanks to this data, our platform can find over-indexing keywords, giving us an overview of existing narratives and practices for a group of companies.

The values in the table below represent how likely robotics companies are to use certain language on their website in comparison to the average UK company. For example, companies in robotics are 4612 % more likely to use the key phrase “autonomous vehicle” than the average UK company.

Sector Keywords Enrichment

| autonomous vehicle | 4612% |

| human machine | 4500% |

| robotics | 4121% |

| smart factory | 3321% |

| autonomous vehicles | 2988% |

| industry 4.0 | 2290% |

| deep learning | 2153% |

| neural networks | 1743% |

| autonomous | 1379% |

| driverless | 1155% |

| additive manufacturing | 1115% |

| sensors | 817% |

| automation | 774% |

| machine learning | 575% |

| artificial intelligence | 534% |

We find that autonomy and robotics companies tend to talk about autonomous vehicles frequently, showcasing that there might be intense collaboration between both sectors. We also find that robotics companies tend to talk about industry 4.0 and advanced manufacturing, building a link with industrial automation processes.

What is the sector’s growth?

As an average, robotic companies have grown at an average 8.1% per year since 2000. This is a compound average growth rate that give us a very good indication of how the average robotics company is doing. This data point also allow us to find high growth companies such as Gibson Robotics, which has an estimated growth rate of 164%, or Vikaso, with an estimated growth rate of 145%.

The foundation year of the companies in the RTIC also tells us a lot about sector growth. It makes it possible to measure the cumulative growth of companies across the years. The line graph below represents the increasing number of companies working in the field of autonomy and robotics. The total number of companies in the sector has grown by 85.3% in the last 10 years, increasing from 519 in 2013 to 962.

Conclusion

The UK has very valuable capital and talent associated with the sector of Autonomy and Robotics. This is demonstrated both by the private sector and a dense network of professional and research organisations like the British Automation & Robot Association or the Bristol Robotics Laboratory. Empowering the organisations working in the field has the potential to normalise smart factories and driverless cars, for instance, and push for new ways of interacting with technology. This is why it is important that we create evidence about the companies leading these changes.

If you’d like a taste of the platform we have a free trial—no payment details or demo required. If you want to know more about this work specifically, please get in touch!