Last year we were very lucky to be approached by one of our most impactful platform and data users, The Productivity Institute, to find clusters of companies working on non-medical applications of engineering biology.

Engineering biology is the application of engineering principles to design and manipulate biological systems for practical purposes.

We are all more used to the medical applications of engineering biology, such as creating new drugs. However, this knowledge and technology is also key for the development of sustainable materials, or improving agricultural processes.

The Productivity Institute needed to find these companies and identify existing clusters, making us an optimal partner. Our classification methods go beyond SICs and allow us to find relevant companies working in the field. Likewise, we have built up our expertise in mapping innovation clusters thanks to the work we completed for the Department for Science, Innovation and Technology.

Our analysis was published in the report Mapping the Innovation and Commercialisation Infrastructure for Non-Health Applications of Engineering Biology in the UK. In this blog post we will talk more about the published report and how our data was used.

The Data and the Method

We used the platform and the expert knowledge of our partners to create a dataset containing 100 companies with 162 operating addresses working across 4 different non-health applications of engineering biology (Agriculture and Food, Chemicals, the Environment and Materials).

Even though it was not a large sample, we decided to run the clustering algorithms to understand whether the results were representative and useful to understand the sector. In this case, we used the same algorithm as we did for the DSIT cluster identification exercise, HDBSCAN, which deals with clusters of different densities better than others.

Even though our sample was small due to the developing nature of this industry, it yielded interesting results.

The Outputs and the Learnings

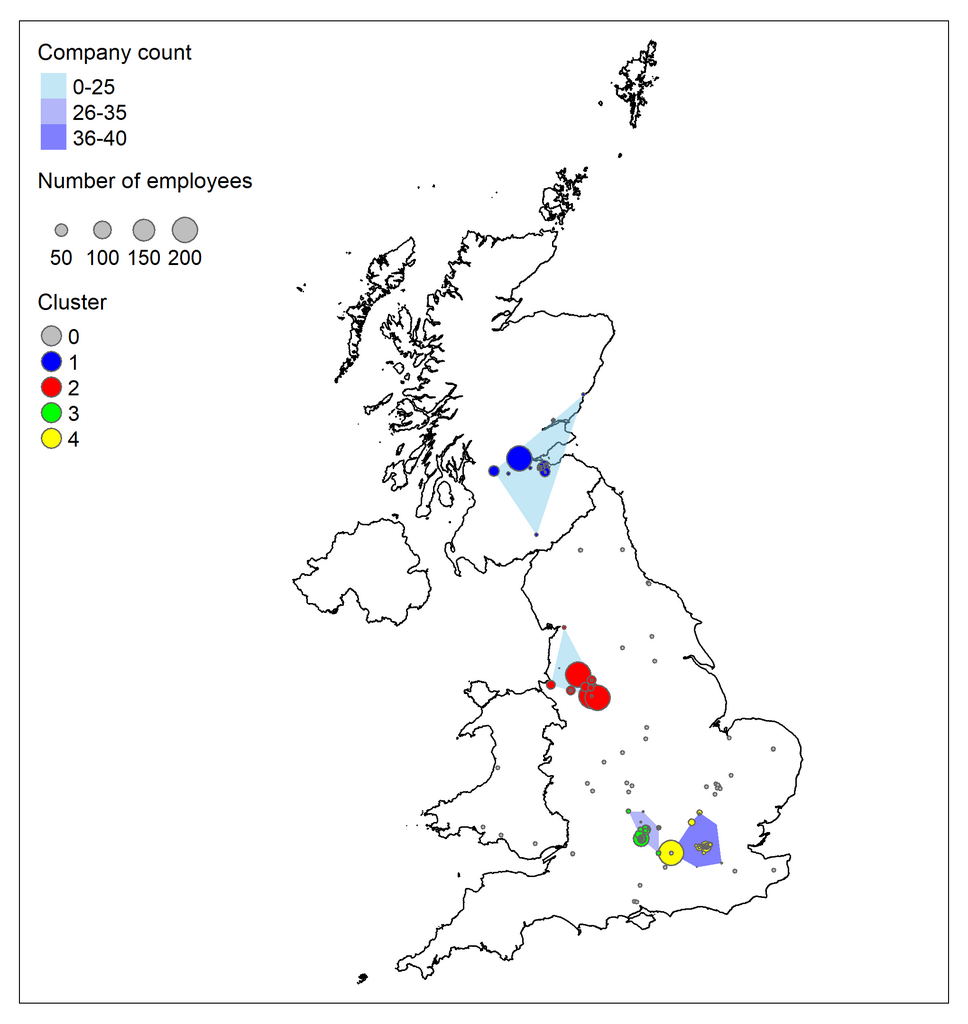

We were able to produce a set of maps that represented the geographical spread of the companies and the clusters. Our results align with previous research published by DSIT in 2023, showcasing that our outputs are cohesive with official views of the sector.

We built upon existing knowledge by highlighting where in this previously identified clusters companies working on non-health applications of engineering biology are. You can see the results for yourself in the cluster maps below.

This first map shows 4 clusters of companies working in non-health applications of engineering biology. This is a key results that helped us and our partners understand the geography of the sector.

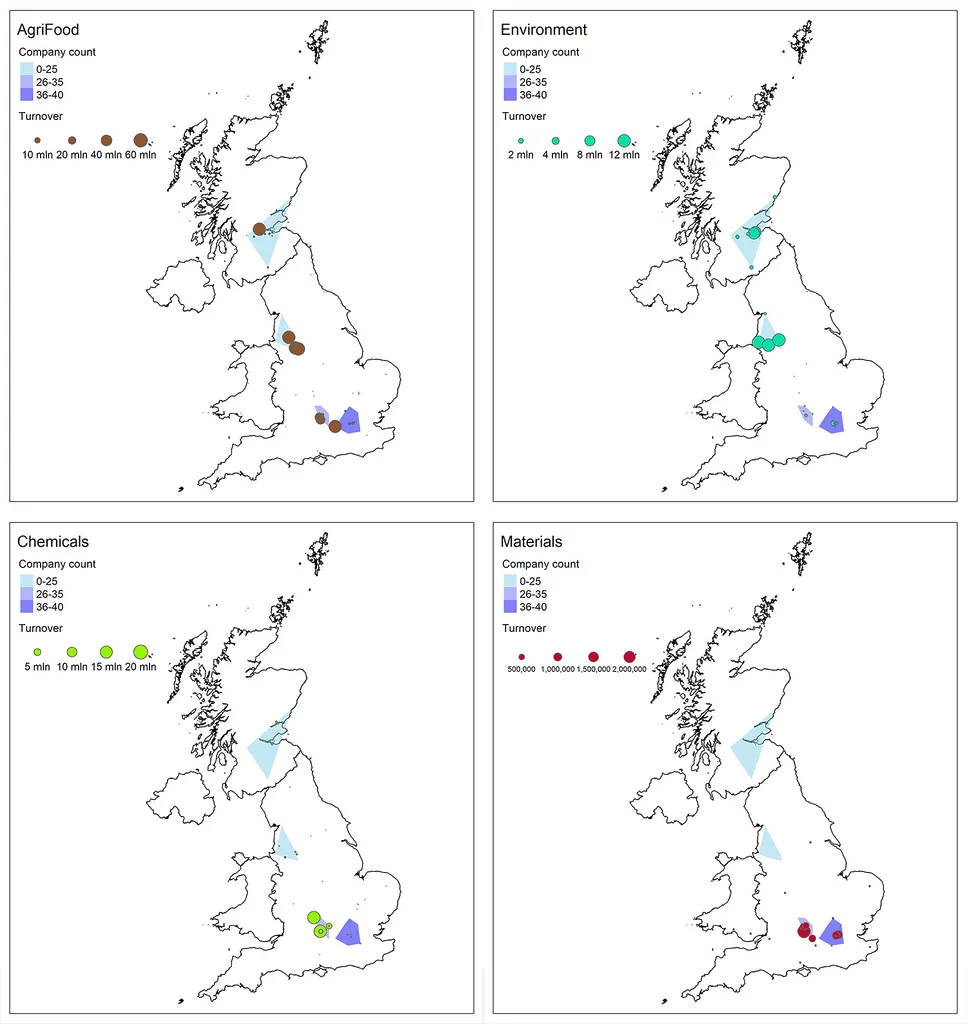

But we went a step further and mapped the companies considering their specialisation.

The image above breaks down the companies by subsector and maps them onto the clusters shown in the previous map (the blue polygons) to understand the companies’ location in the clusters.

For instance, we can see that companies dedicated to Chemicals and Materials concentrate in the southern clusters whereas those focusing in the Environment are largely located in northern clusters.

Wrapping up

Altogether, this project was key for our partners to understand the way these companies locate in space and how they agglomerate. This is key information for policy-makers, investors and researchers, who will be able to strengthen decision-making thanks to evidence.

Do you want to understand UK clusters for an emerging sector? Get in contact with us—we’re always happy to help! Or explore your industry with a free trial of our machine learning platform.