During my time working at The Data City I have had the opportunity to work on a great variety of projects. There’s loads to like about this. I get to meet lots of great professionals and have the chance to engage with high-stakes decision-makers, for example. However, the most important thing I get from projects is the learnings I draw from the process.

We recently completed our Fintech RTIC, which was built with the collaboration of Innovate Finance and Accenture, and it informed the recently published report “The FinTech Impact Report: Working through the world’s to-do list”.

I want to highlight that approaching a developing industry, creating representative categories and capturing the right companies is challenging. In this post, we want to share some of the learnings we got from the experience.

An evolving sector

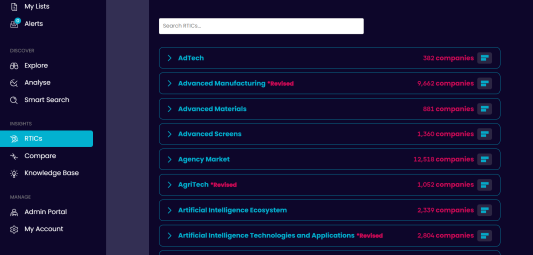

The first thing we need in order to start mapping a sector and building an RTIC is a sector taxonomy. This is a framework that articulates a sector in terms of different pockets of activity and associates relevant language with each of them.

In the case of Fintech, this is easier said than done.

During the last years, there has been an amazing diversification of financial technologies and their role for both financial institutions and the general public. Hence, we had to adapt to this context. We first started with a taxonomy for Fintech that was published in an academic journal, then we followed with a proprietary taxonomy by Innovate Finance, and lastly decided to adopt the University of Cambridge’s definition of the sector.

All approaches had pros and cons, and we finally decided to use the taxonomy that represented the sector more accurately from different points of view.

It is very important to be flexible and re-approach existing work frequently when working with rapidly changing sectors such as Fintech. If this attitude could be shared by the main professional bodies and Fintech researchers, we could make sure that we do not reproduce obsolete taxonomies and push for an always-evolving model of the sector.

Our evolving technology

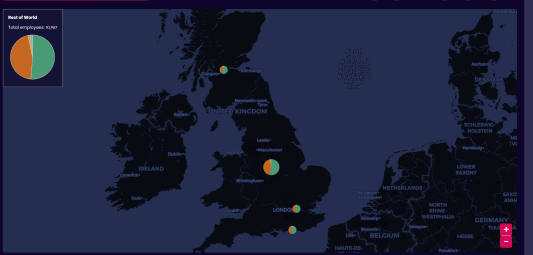

Over the years, our platform has significantly improved and we update our data more frequently than ever before. This has clear benefits, the main one being that our users have access to better data more often.

However, this needs to be managed effectively when mapping a sector (especially over a long period of time). Company website text updates have the potential to impact the way our machine-learning technology maps a sector. If we are working on a project with a client, previously reviewed lists may change or look different.

This has enabled us to develop new methods to deliver data in a project context that considers our current rhythm of data updates.

Learnings

Overall, this piece of work has been critical for us to understand that, in a project context, neither sectors nor our technology are static.

We have to make sure that our methods to capture emergent industries evolve as fast as the industries themselves do. The rhythm of developments in technology and industry are fast-paced, which means we should be too.

Hopefully you enjoyed this peak behind the curtain of the recent FinTech report. Do give it a read, and get in contact with us if you’re interested in further discussion.