We’ve developed a new way to find companies and understand the sectors they operate in. It is an alternative to Standardised Industrial Classification (SIC).

We created it because it is becoming increasingly difficult and less meaningful to group companies into distinct categories. Taking Amazon as an example – are they a retailer and marketplace? A delivery service? An advertising platform? A grocer? A web services provider? Of course, Amazon is all of these things and more. Like many companies they break the old rules of classification. They don’t fit into a Fordist, or even a post-Fordist, supply chain model.

In this post we describe how our machine learning finds companies using three different approaches to find companies. This is important because modern day supply chains are complicated and far from linear.

The three approaches are:

- The technology approach

- The functions approach

- The service approach

Why SIC and the ‘supply chain’ approach often fails to find companies

There are a number of limitations with SIC:

- SIC Codes follow a rigid hierarchy that was designed for a by-gone industrial age

- This rigidity doesn’t allow for new industrial trends such as unbundling

- Businesses self-select their SIC Code at Companies House. The codes haven’t been updated since 2007, meaning that they underserve new types of business

- They rely on the business keeping them up to date. Businesses might pivot without updating their SIC Code, meaning that they are no longer categorised correctly

- SIC often describes long-established supply chains. In today’s economy supply chains are now more of a supply mesh. They’re better characterised as a series of linking components rather than a chain where one sector produces something and hands it to the next.

Our mission is to understand the economy more accurately, in more detail, and with less delay. We believe that everyone working to help companies thrive can do a better job when they understand what companies do and how well they are doing.

Classifying companies by their own language

We classify companies by what they say they do on the web instead of the SIC code they chose when they registered. We then add data on how many people a company employs, where it operates, what its turnover is, and much more, including up to six years of historical financial information. Finally, we make it easy to explore, analyse, and map those companies, their finances, and their activities.

These new data sets are called Real Time Industrial Classifications, or RTICs. Because RTICs use the companies’ own language companies it’s a method that can easily adapt to the needs and interests of different projects and research briefs. We can train the algorithm to find companies using any set of keywords or concepts. Importantly, it means we produce datasets that are representative of selected technologies, functions and services independently of any other standard of industrial classification.

Let’s look at each of the three approaches in more detail. We’ll use the example of FinTech to help explain how they vary.

Using the three approaches in FinTech

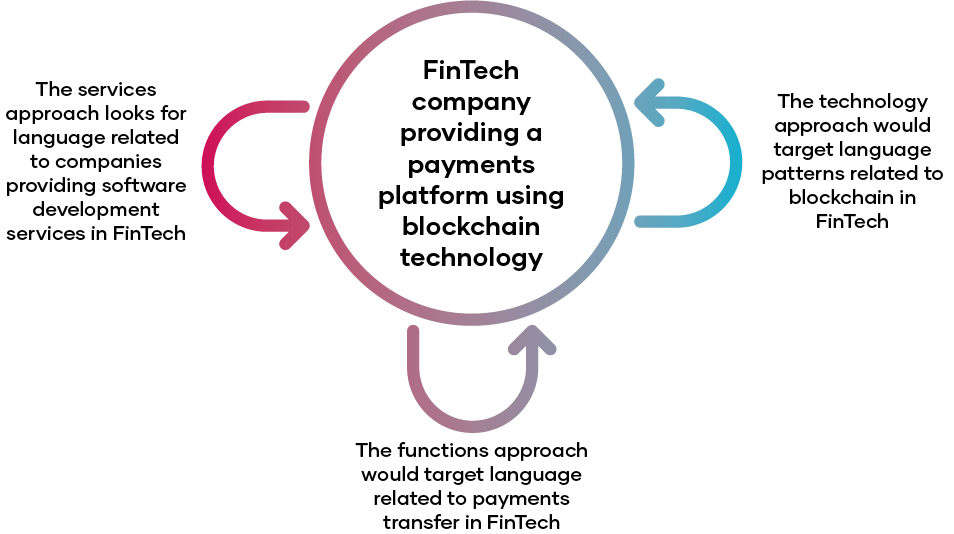

Let’s say that we were trying to find a company in a niche. We’re looking for FinTechs that provide payment platforms based on blockchain technology. Here’s how we’d use the three approaches to find them.

The technology approach

We find companies according to the enabling technology they create, sometimes agnostic of the sector in which the technology is used. In this example, we’d look for companies that talk about creating blockchain technology for the FinTech sector on their website.

The functions approach

We find companies according to what they do. In this example we’d look for companies whose website talks about providing payment transfers for their customers.

The services approach

We find companies that provide a service to the sector in question. In this example, we’d look for companies whose website talks about providing software development services to FinTech companies.

Blending all three approaches

A blend of these three approaches provides a good and wide view of the sector in question. It also allows for greater tailoring and nuancing depending on the type of companies that you want to appear in the final dataset.