FinTech is one of the UK’s fastest-growing sectors – driven by innovation, investment and demand for smarter financial services.

Using The Data City’s real-time data, we’ve identified some of the UK’s top fastest-growing FinTech companies. These businesses represent just a slice of the 4,900+ companies in our FinTech RTIC – but they show where the industry’s heading.

What is FinTech?

FinTech blends finance and technology – using tools like AI, blockchain and smart software to transform how financial services are delivered.

In the UK, it covers everything from digital banking and crypto exchanges to regtech, lending platforms and wealth management tools. These innovations are making finance faster, fairer and more accessible.

Familiar names like Monzo, Revolut, Stripe and PayPal have reshaped the consumer experience – but they’re just the tip of the iceberg.

FinTech sector overview

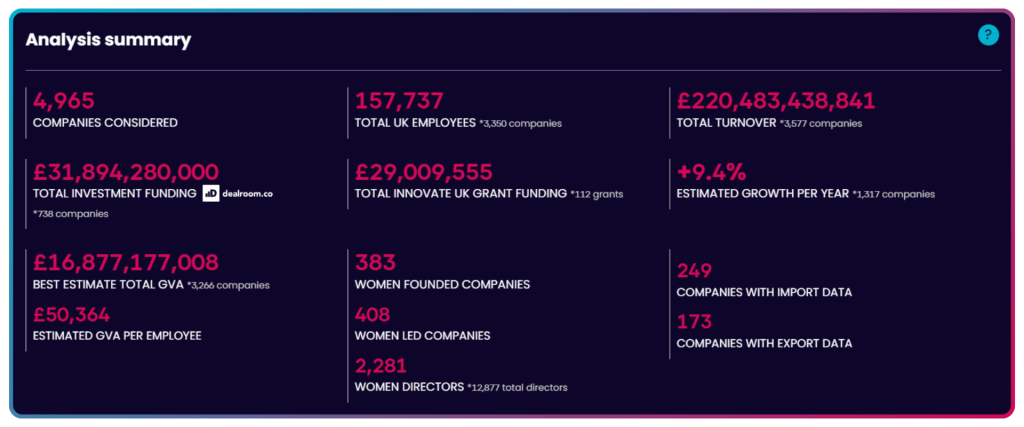

The sector includes around 5,000 UK companies, generating £220.5bn in turnover, contributing £16.9bn in GVA, and attracting £31.9bn in investment. It’s growing at +9.4% annually, with over 157,000 people employed across the country.

While London leads the way – with clusters in the City, Westminster, Camden and Tower Hamlets – FinTech growth is accelerating in Bristol, Manchester, Leeds, Birmingham and Edinburgh, driven by academic links, accelerators and investment.

It’s no surprise financial services was named one of the UK’s eight growth-driving sectors in the UK Industrial Strategy – with FinTech recognised as a key driver. The ambition? To make the UK the world’s most innovative full-service financial centre by 2035.

The problem with FinTech company data

Despite its scale and impact, FinTech is poorly represented in traditional datasets.

The root of the problem? Standard Industrial Classification (SIC) codes.

Still the default method for categorising companies, SIC codes haven’t been meaningfully updated since 2007. That’s years before today’s digital banks, crypto platforms, or open banking providers even existed.

Even the UK Government’s Industrial Strategy acknowledges this in their sector definitions list saying: “FinTech cannot be easily represented by the SIC system.”

That means many high-growth FinTechs are misclassified under vague labels, making it extremely difficult for policymakers, investors or researchers to map the true scale and shape of the sector.

Using our platform, we can see the most popular SIC codes used by FinTech companies in the UK are:

- Financial intermediation not elsewhere classified

- Business and domestic software development

- Other information technology service activities

Not particularly helpful for understanding what these companies actually do.

Where The Data City comes in

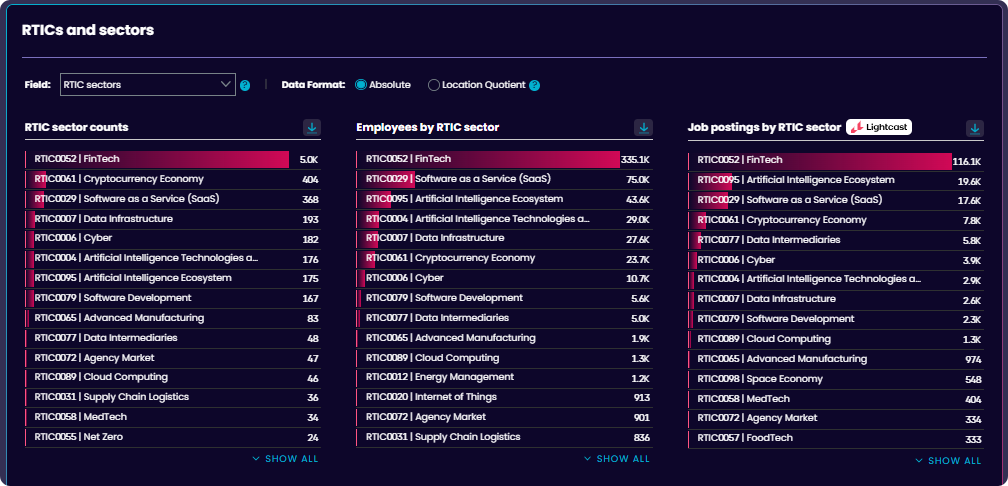

We’ve solved this problem with our Real-Time Industrial Classifications (RTICs) – machine learning-based sector definitions built with input from government and industry.

Our FinTech RTIC includes over 4,900 UK-based companies, classified by what they actually do, not what they selected on a form 15 years ago.

It covers 14 specialist verticals including: Digital Payments, Digital Lending, Regtech, Crypto Asset Exchanges, Wealthtech, Insurtech and more.

These are the companies building the UK’s next-gen financial infrastructure – and we’ve used our platform to surface the fastest-growing among them.

The UK’s fastest growing FinTech companies

Using The Data City’s RTIC dataset, we’ve surfaced seven of the UK’s fastest-growing FinTech companies. For this list, we’ve focused on companies within our FinTech RTIC that have secured at least one round of investment – and ranked them by estimated growth rate.

These are the companies scaling fast, backed by capital and building the future of financial services – from infrastructure and identity to payments and platforms.

Volt

Volt is building the world’s first global real-time payment network – giving businesses the power to send and receive instant account-to-account payments, anywhere in the world.

Founded in 2019, Volt has scaled rapidly. Following seed and Series A rounds in 2020 and 2021, the company grew its team to over 200 employees by 2023 and increased turnover to nearly £13 million – up from £3.8 million the year before.

Our platform estimates Volt’s annual growth rate at +448% – one of the highest in the UK FinTech ecosystem. In 2023, it secured a $60 million Series B to support international expansion and product development across the UK and Europe.

SumSub

A rising force in the RegTech space, SumSub (short for Sum and Substance) provides an all-in-one identity verification and compliance platform – used across FinTech, crypto, trading, and iGaming.

Originally founded in the UK, SumSub has scaled globally, with an R&D hub in Berlin and new offices launched in Miami, Singapore and Dubai throughout 2023 and 2024.

Following a £24.6 million Series B round in 2022, the company posted £44 million turnover in 2023. Based on our platform, SumSub’s estimated annual growth rate is +389% – underlining its strong momentum in one of the fastest-moving corners of FinTech.

MoonPay

Whilst their SIC code classifies them as operating in Information technology consultancy activities, MoonPay are so much more than that.

Classified in both our Cryptocurrency Economy and FinTech RTICs, across a number of verticals, MoonPay offers a faster, simpler way for people to buy and sell popular crypto such as Bitcoin, Ethereum an Solana.

After securing over £471 million in series A funding in 2021 and 2022, MoonPay saw £69 million in turnover in 2023. We estimate them as having a growth rate of +265%.

LHV Bank

LHV Bank is a savings-focused challenger bank delivering specialist services for global FinTechs, UK SMEs, and retail savers. After entering the UK market in 2018, LHV became a fully authorised UK bank in 2023 – marking a major milestone in its expansion.

A subsidiary of LHV Group – a high-growth financial services group based in Estonia – LHV Bank supports over 200 global FinTechs, including Airwallex, Currencycloud, Truelayer and Wise. Through its real-time multi-currency payments, accounts, FX, open banking and indirect scheme access, it helps these firms serve 10 million+ end users across the UK and Europe.

Alongside its business banking services, LHV also offers app-based retail banking and flexible lending for UK businesses. Following a £30 million VC round in 2022, the bank reported £3.1 million in net profit after its first full year – and grew its deposit base by 182% year on year.

With UK offices in London, Manchester, and a development hub in Leeds, our platform estimates LHV’s annual growth rate at +222%, with an estimated employee count of just under 200.

NayaOne

From challenger banks to sandbox-as-a-service, NayaOne helps financial institutions adopt new technology quickly and safely. Its Vendor Discovery Infrastructure (VDI) platform gives banks a single point of access to hundreds of FinTechs, datasets, and a secure Digital Sandbox for real-world testing.

Use cases range from deepfake fraud detection to GenAI applications and automation – all trialled in safe, simulated environments.

With an estimated 40 employees, NayaOne is one of the smaller companies in this list, but also one of the most dynamic. Backed by a series of early VC and Series A rounds, our platform estimates NayaOne’s annual growth rate at +192%.

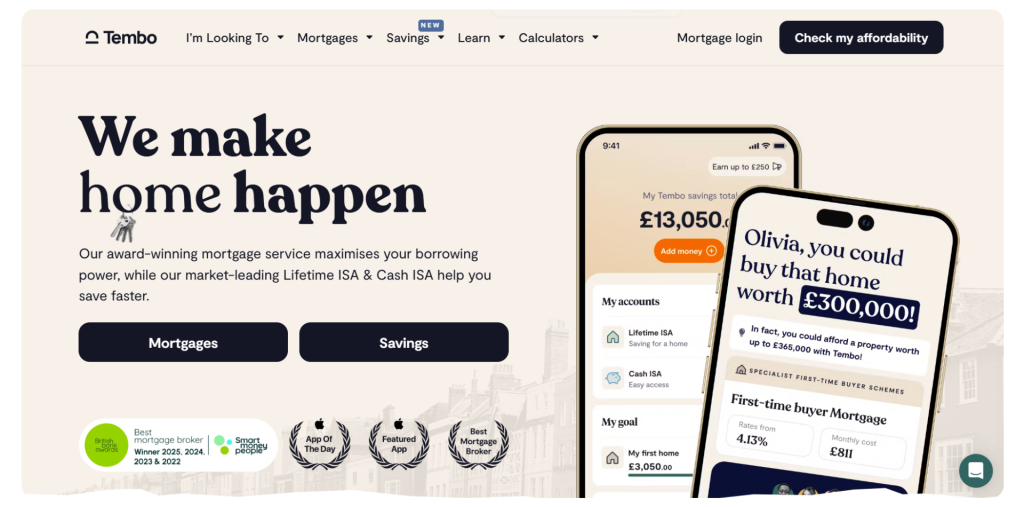

Tembo

Tembo is rethinking how people save and borrow – helping first-time buyers and those facing affordability challenges get on the ladder faster.

Launched in 2020 at the height of the pandemic, Tembo’s platform boosts budgets, increases borrowing power, and gives users access to 20,000+ mortgage products from 100+ lenders. Their tools raise average affordability by £88,000.

Tembo has raised over £21.5 million in funding, including a £14 million Series B in 2024 led by Goodwater Capital. The company is headquartered in London Bridge, but has built a remote-first team working across 20+ locations in the UK.

Despite their innovation, Tembo is still listed under a vague SIC code. ‘Other information technology service activities’.

The default SIC code doesn’t reflect the breadth of Tembo’s work. Alongside their classification in our FinTech RTIC, our AI assigns four more accurate Real-Time SIC Codes (RSICs) to better capture what the company actually does:

- 64999: Financial intermediation not elsewhere classified

- 64922: Activities of mortgage finance companies

- 66220: Activities of insurance agents and brokers

- 66190: Activities auxiliary to financial intermediation n.e.c.

We estimate Tembo are growing at a rate of +189%.

How we estimate growth

We estimate company growth based on reported employee and turnover data from Companies House, via CreditSafe.

When we have three or more years of data, we calculate an average annual growth rate using a curve – this gives a reliable picture, even if some data is missing.

We mainly use employee growth, as it’s reported more often and isn’t affected by inflation.

Find UK FinTech companies with The Data City

From real-time payments and sandbox testing to lending and affordability tools – the UK FinTech sector is growing fast, with a strong mix of scaleups and startups leading the way.

With The Data City, you can explore over 4,900 UK FinTech companies in real time – with accurate classifications, funding data, location mapping and growth insights.

Looking for clarity on the UK’s FinTech sector? Why not sign up for a free trial today and see the data for yourself.

Please note: The data from The Data City is accurate at the time the article was written but may change over time due to the dynamic, real-time nature of our data. For the latest insights, visit our platform.