Real-time company classification for Insurance & InsurTech

The Data City helps insurers assess and underwrite with confidence. We provide real-time classification and firmographic data on over 9 million UK companies, replacing outdated SIC codes with AI-powered insights built for risk.

Trusted by leading policymakers, financial institutions & organisations

Broken business data is costing you

Outdated SIC codes and vague broker descriptions make it harder to price risk, quote quickly and protect margin.

The Data City gives insurers real-time classifications at the point of submission – reducing manual checks, improving accuracy and speeding up decisions.

Instant classification

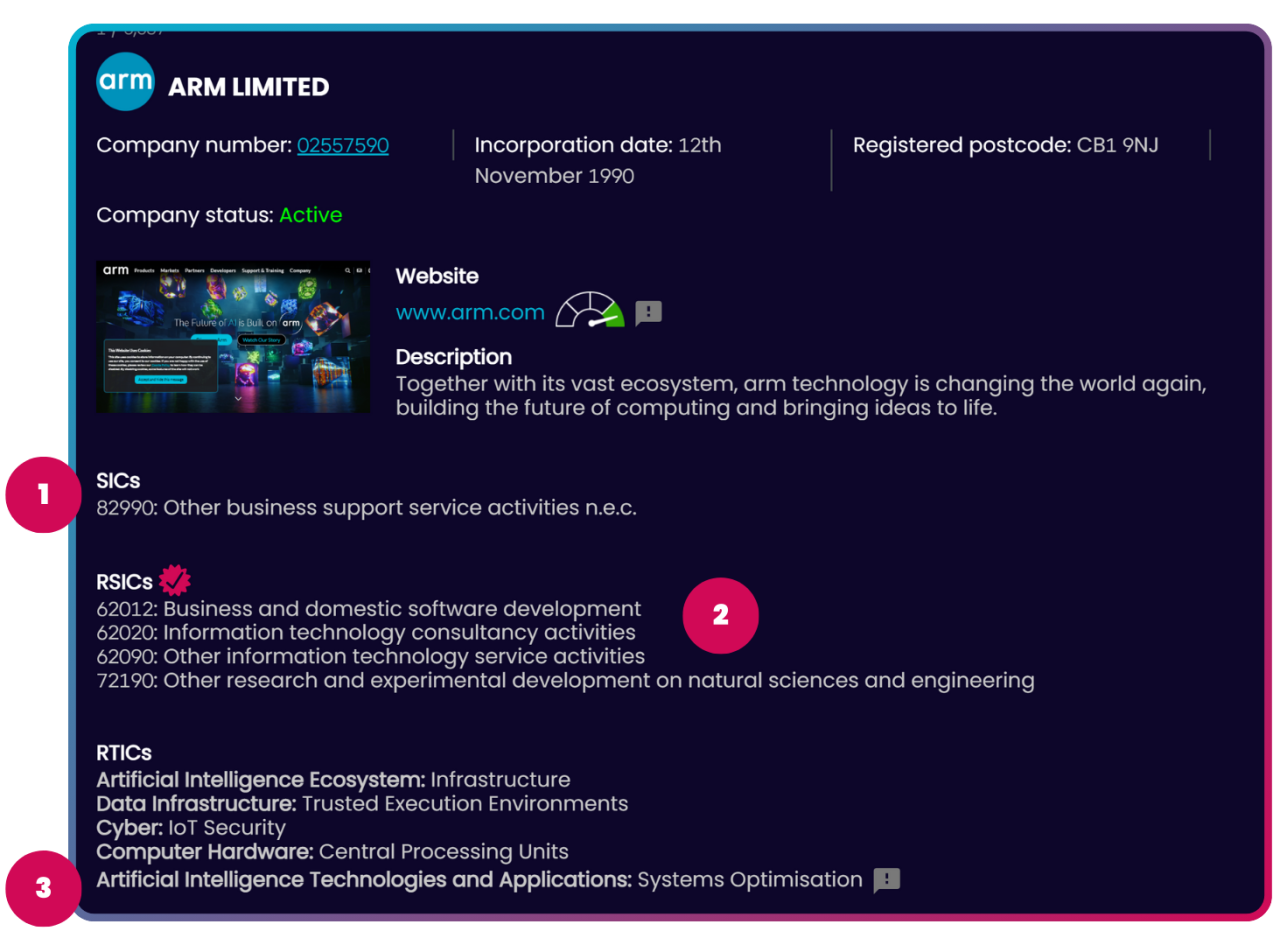

Underwriting and onboarding rely on knowing what a business actually does. But SIC codes are vague, outdated, and often wrong. The Data City’s Instant Classification tool gives insurers and InsurTechs real-time clarity on companies and sole trader.

Enter a company website, number or description and instantly receive accurate sector classifications, corrected SIC codes and similar company suggestions. It gives risk teams the clarity they need to move faster, make better decisions, and assess businesses with confidence.

Understand the sectors that matter

Traditional data misses the sectors that matter most. Our Real-Time Industrial Classifications (RTICs) go beyond SIC, covering 500+ high-growth and emerging sectors like FinTech, AI and Net Zero.

Built using machine learning, website data and expert input, RTICs give you company-level and sector-wide insights, accessible via our Industry Engine platform or API.

You can also define your own sectors with us. We’ll help you build and publish new RTICs that reflect how the economy actually works.

Find more of your ideal customers

With The Data City’s Industry Engine platform, you can search, filter and profile over 9 million UK companies, enriched with real-time data to help you find the right prospects, faster.

See detailed firmographics, ownership, growth signals and classifications – from turnover and headcount to funding, director networks and RTICs.

Filter by size, region, sector or growth signals, then export lists for CRM enrichment, pipeline building or portfolio reviews.

Working with us

Platform

Subscribe to our Industry Engine SaaS platform to explore and classify companies in real time. Add seats for team members – perfect for analysts, strategists and compliance teams who need clarity fast.

API & bulk data

Plug our data into your world. Integrate our API and classification tools directly into your onboarding, compliance, or risk workflows. Also available as a bulk data file for enrichment and offline analysis.

Data services

When you need bespoke support. Work with our team of data and development experts to build custom classifications, design tailored datasets or build bespoke tools.

What makes us different?

We’re not just fixing SIC codes, we’re replacing them. Only The Data City combines real-time data, machine learning, and expert validation to deliver business classifications that you can trust.

- Companies House SIC codes – 30%+ error rate, vague, inaccurate, not compliant.

- AI-assigned SIC codes – accurate, compliant.

- Real-Time Industrial Classifications – built for modern sectors, useful, compliant.

Frequently asked questions

- Does The Data City offer a Free Trial?

-

Yes. You can try our platform for free to explore how our classification data fits into your workflow and supports your customers. Sign up for a free trial to get started.

- What’s wrong with SIC codes?

-

SIC codes (Standard Industrial Classification codes) are used to describe what businesses do. They’re embedded in risk models, compliance checks, and onboarding workflows.

But there’s a problem. They’re broken.

Last updated in 2007, SIC codes can’t keep up with the pace of modern business. They’re often vague, self-selected by companies at registration, and overused in generic categories like “Other services.” Today, over 1.4 million UK companies are misclassified. That creates risk, slows down onboarding, and leads to compliance issues.

Real-Time SIC Codes (RSICs) and Real-Time Industry Classifications (RTICs) from The Data City fix this.

RSICs provide real-time, AI-powered classification within the SIC framework—clean, accurate and automated. RTICs go further, defining modern industries like FinTech, AI, and Advanced Manufacturing. Together, they give your platform the precision SIC codes were meant to deliver.

- What are RTICs?

-

RTICs (Real-Time Industrial Classifications) are dynamic, expert-led industry definitions designed to track modern and emerging sectors like AI, Net Zero, and FinTech. They help platforms understand where companies sit in the economy, beyond legacy categories.

- What are RSICs and how do they differ from traditional SIC codes?

-

Real-Time SIC Codes (RSICs) use AI to update business classifications. Unlike traditional SIC codes, which can be outdated and inaccurate, RSICs ensure businesses are correctly classified based on real-time information, providing more accurate and relevant data for those using the SIC Code system.

Our AI analyses companies and assigns them the most relevant classifications from the current SIC Code system, avoiding issues with catch-all ‘other classifications’ that don’t accurately describe a companies activities.

- How does The Data City compare to other similar products on the market?

-

The Data City isn’t just another data provider; we’re redefining how industries are classified and understood.

Our mission is to build the new standard industrial classification system, liberating our clients from outdated SIC codes and enabling them to discover and invest in industries addressing the world’s key challenges and opportunities.

Unlike others who rely on outdated data, limited databases, and buzzwords, we offer a real-time view of companies in the UK and beyond.

Our Real-Time Industrial Classifications (RTICs) set us apart. Developed in partnership with the UK government and leading academics, our platform features over 400 bespoke RTICs, providing unparalleled insight into emerging sectors.

With the ability to build custom classifications using our machine learning technology, our innovative approach to developing alongside our customers and partners, and our comprehensive dataset, you’ve only just scratched the surface of how we compare to ‘similar’ products on the market.

Ready to reduce your cost of risk?

Join the insurers and reinsurers using real-time company data to drive better risk decisions.