We’ve partnered with Tussell and techUK to build the Tech200 – a data-driven view of the UK’s fastest-growing technology suppliers to the public sector, powered by The Data City’s Real-Time Industrial Classifications (RTICs). RTICs classify companies based on what they are doing today, making it easier to spot new and emerging sectors as markets change.

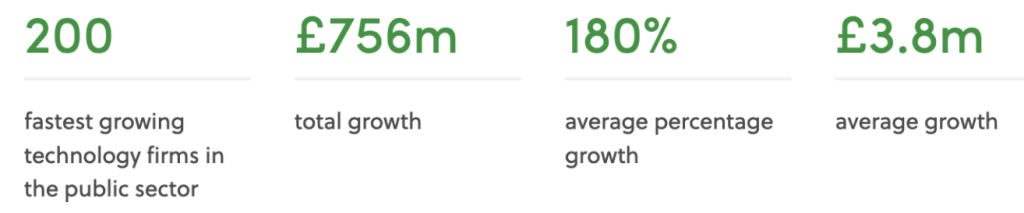

The Tech200 is an annual ranking of the 200 technology suppliers seeing the highest growth in public sector revenue. By combining Tussell’s market intelligence with The Data City’s real-time company classifications, the list shows which suppliers are scaling most rapidly and importantly, what that tells us about how the public sector tech market is evolving.

Together, the companies on the Tech200 show that public sector technology is no longer niche. Instead, it is a high-growth market underpinning the digital infrastructure of public services and one that can now be measured with confidence.

How the Tech200 is calculated

The Tech200 is calculated by Tussell using direct public sector revenue data. It ranks the 200 firms with the highest percentage growth rate between the last two full financial periods (FY23/24 to FY25/26).

Focusing on revenue growth allows us to move beyond reputation or perception and look at which suppliers are winning more work, expanding delivery, and scaling in real public sector environments.

What the data tells us

The 2026 Tech200 highlights several clear patterns in how the public sector tech market is evolving.

Growth is concentrated, not uniform:

A small number of suppliers are scaling extremely quickly, such as SRC UK, which recorded growth of over 1,600%. At the same time, most companies are growing at a steadier pace across the 200 fastest-growing public sector technology firms, which together delivered £756m in total growth, averaging 180% growth and £3.8m per company. This points to a market where breakout success exists but is driven by execution rather than speculation.

SMEs are driving momentum:

Around 60% of the Tech200 are SMEs, underlining the role of specialist and agile suppliers in delivering public sector technology at pace.

The market is predominantly UK-led:

Most high-growth suppliers are UK-based, highlighting the strength of the domestic ecosystem. International firms appear where they bring proven capability, rather than scale alone.

Growth aligns with real public sector pressure points:

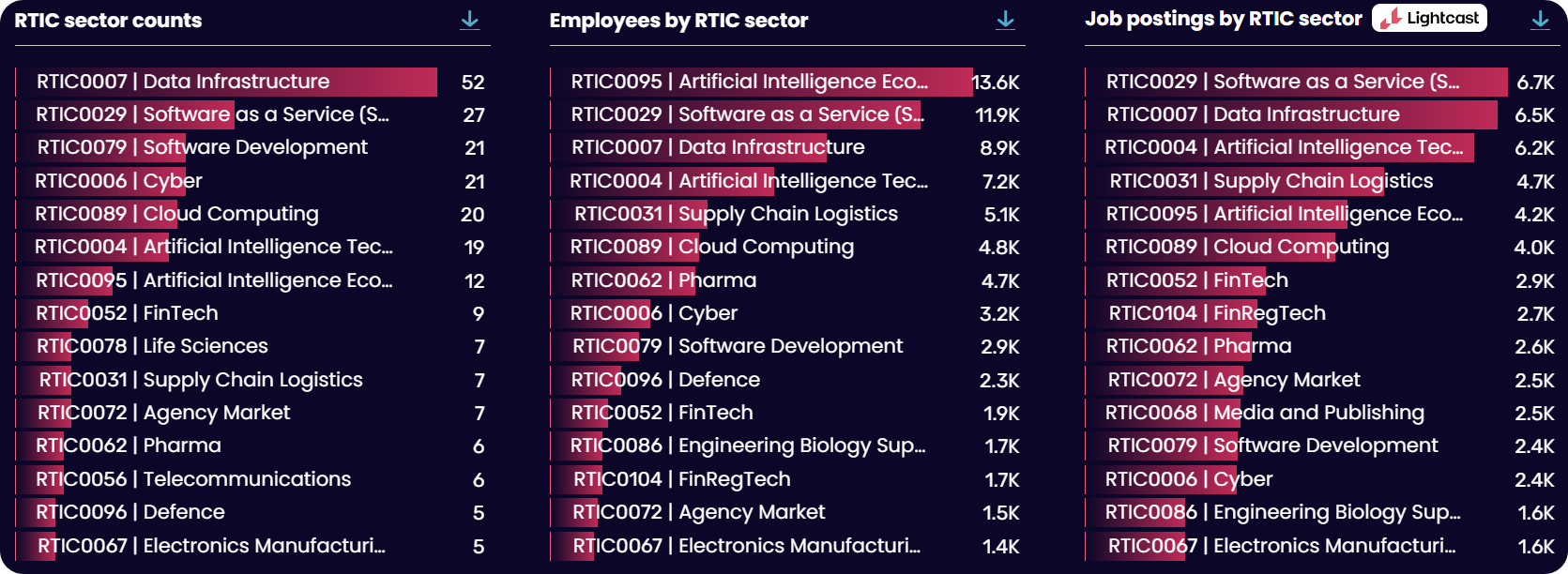

Using our RTICs, we can see the which emerging and frontier sectors public sector are investing in most. The top RTICs companies are classified in are data infrastructure, AI and software.

Why this data matters

For public sector buyers, the Tech200 provides an evidence-based view of suppliers successfully scaling delivery across government.

The Data City’s RTICs are critical to this. Unlike traditional SIC codes, RTICs classify companies based on what they are doing now, making it possible to identify emerging sectors and suppliers as the market changes.

Combined with Tussell’s market intelligence, the Tech200 offers a clearer, more current picture of public sector tech spend and the companies supporting public services.

For customers, this supports better decision-making. Using growth data alongside traditional procurement criteria helps identify suppliers that are not only innovative but credible, stable and equipped to deliver outcomes over time.

Explore the full Tech200

To get a unique perspective on the state of play in the public sector tech market, view the full Tech200 list today 👉 https://bit.ly/4tDnD3x

Want to go deeper? Sign up for a free trial of The Data City and see exactly what companies do, in real time. Build your own sectors. Map emerging markets. Move from “we think” to “we know”. Start your free trial here 👉 https://thedatacity.com/free-trial/