In our recent article, 3 Key Facts – What the Data Says About the UK AI Sector, we looked at the big picture: how many AI companies operate in the UK, who owns them and where they are based.

This follow-up takes a closer look at the companies themselves. Not the giants everyone already knows, but the fast-growing UK startups and scaleups that are shaping the future of the sector.

Big players like CoreWeave, Microsoft, OpenAI, NVIDIA, Salesforce and Scale AI are already expanding rapidly in the UK, forming a part of UK Industrial Strategy. But who’s next?

In this piece, we spotlight the next wave of UK-born AI companies – the startups and scaleups building the infrastructure, tools and applications that will shape the country’s AI economy over the next decade.

From photonic chips and predictive analytics to autonomous drones, cultured fat and climate tech, these are the emerging firms defining what’s next for AI in the UK.

First, mapping the UK’s Artificial Intelligence ecosystem

Like many cutting-edge industries, AI is hard to track using traditional data sources. The Standard Industrial Classification (SIC) system – last updated in 2007 – doesn’t include AI as a category. That means there’s no reliable, official way to know: who the UK’s AI companies are, what they do, or how fast they’re growing.

That’s where The Data City comes in.

We use real-time web data and machine learning to classify companies based on what they actually do – not what they ticked on a form at Companies House.

Our database covers over 10 million UK companies and 500+ emerging sectors, including two dedicated Real-Time Industrial Classifications (RTICs) for AI: Artificial Intelligence Ecosystem and Artificial Intelligence Technologies and Applications.

These next generation classifications power national research, regional strategies, inward investment and innovation policy across the UK.

The next wave of AI UK AI companies

Sylvera

- Estimated company growth: +187%

- Location: London

Bringing AI into the fight against climate change, Sylvera uses machine learning and satellite data to analyse carbon offset projects, helping organisations assess their quality and impact. Its tools aim to bring more accuracy and consistency to how carbon credits are measured and verified.

Founded in London in 2020, Sylvera combines AI with geospatial intelligence to assess forests and land use with precision. It’s raised over £74 million to date, including a £24.2 million Series A and a £45 million Series B, backed by investors like Salesforce Ventures, Bain & Company and Insight Partners, alongside Innovate UK grants.

Turnover more than doubled from £1.7 million in 2022 to £3.8 million in 2023. With an estimated growth rate per year of 187 %, Sylvera is now one of Europe’s fastest-growing climate tech companies, and a clear example of how AI is accelerating the path to Net Zero.

TUBR

- Estimated company growth: +145%

- Location: Sheffield

From the more established Sylvera to a micro AI company, TUBR represents the next generation of predictive analytics startups. Based in Sheffield, TUBR is building AI that makes accurate predictions from small, sparse and noisy datasets – ideal for real-world settings where clean, abundant data isn’t an option.

After securing seed funding in 2022 and 2023 from Finance Yorkshire, BlueWing Ventures and others, TUBR continued to gain traction in 2024 with two Innovate UK grants focused on intelligent 5G network control for manufacturing and emissions tracking in urban transport.

It’s not (yet) a household name. But with a 145% estimated growth rate and live R&D partnerships in the UK and Germany, TUBR is a standout example of early-stage AI innovation happening far beyond the usual London hubs.

V7

- Estimated company growth: +141%

- Location: London

Driving growth in the agentic AI space, London-based firm V7 helps organisations automate complex workflows using AI agents. Its platform is already being applied across finance, legal, insurance, real estate and tax – bringing efficiency and scale to traditionally manual processes.

Following a strong seed round in late 2020 worth £7.5m, V7 has continued to scale through multiple rounds of investment – including Innovate UK funding and grants listed on 360 Giving– culminating in a £28m Series A in 2022. In 2024, the launch of V7 Go marked its entry into new markets with simplified deployment of AI agents.

The company’s growth trajectory is striking. Turnover rose from £2.9m in 2022/23 to £4.4m in 2023/24. Headcount tells the same story: from just 6 employees in 2021, V7 had grown to 67 by 2023, with our platform estimating over 150 by the end of 2025.

Interestingly V7’s SIC code is ‘Business and domestic software development’ – not particularly helpful in understanding what they do. In our platform they are much easier to understand: and are classified in our Artificial Intelligence Ecosystem RTIC in our Products and Services verticals, and form part of our Industrial Strategy sectors, in the Digital and Technology IS-8 sector.

Salience Labs

- Estimated company growth: +131%

- Location: Oxford

Salience Labs is taking on one of AI’s toughest challenges: the hardware. Based in Oxford, the company is developing next-generation photonic switches for AI infrastructure – combining breakthroughs in silicon photonics, digital electronics, embedded software and machine learning.

A spinout from the University of Oxford and the University of Münster, Salience Labs sits at the intersection of multiple emerging sectors. On our platform, it’s classified under four RTICs: AI Ecosystem, Photonics, Semiconductors, and Future Telecoms Supply Chains.

Since 2020, the company has raised an estimated £37m in funding – including over £24m through a Series A round in February 2025, and support from Innovate UK and a number of grants listed on 360 Giving. While still small in size, with an estimated 40 employees in 2025, Salience Labs is already building the infrastructure AI will run on.

Eatron

- Estimated company growth: +120%

- Location: Warwick

Proving that AI innovation isn’t confined to London, Eatron is based out of Warwick Innovation Centre with a growing global presence across Europe, the US and Asia. The company develops AI-powered battery optimisation software – improving safety, extending lifespan, and boosting performance for lithium-ion batteries used in automotive, light mobility, off-highway and energy applications.

Eatron has built a strong funding track record across seed, Series A, early VC and grant support, raising over £9 million since 2018. That investment has fuelled rapid growth, with turnover rising to over £4 million in 2023/24 – a 168% increase on the previous year.

Strategically, Eatron bridges three critical RTICs on our platform: AI Ecosystem, Battery Supply Chain and Energy Storage. It’s also mapped to three of the government’s IS-8 sectors, making it one of the clearest examples of AI directly advancing the UK’s Industrial Strategy.

Vizgard

- Estimated company growth: +115%

- Location: London

Another company playing a strategic role in the UK’s industrial future, Vizgard builds advanced AI software for drones, surveillance systems and threat detection platforms – helping manufacturers automate and upgrade their products. It’s a key player across three of our RTICs: AI Ecosystem, Defence, and Robotics & Autonomous Systems.

Founded by Royal Navy veteran Alex Kehoe, Vizgard tackles one of the biggest barriers in real-world AI deployment: open-source models that underperform in complex, mission-critical environments. Its systems are already being deployed in defence, border security and civil resilience projects across the UK.

We estimate the company is growing at over +115% per year, supported by a growing team and a £1.5m seed round closed in early 2025. Like many companies leading UK innovation, its original SIC code – “Other information technology service activities” – gives no useful signal about what it actually does. Thankfully we have RTICs.

Hoxton Farms

- Estimated company growth: +113%

- Location: London

And last – but definitely not least – on our list of next-wave AI companies is Hoxton Farms. A total curveball to end on, Hoxton Farms is the UK’s first cultured-fat plant: a biotech, agriculture and food company using AI to optimise every stage of its production process.

Their advantage is a custom-built AI tool called “Percy.” Trained on over 23 billion data point, the machine learning platform helps them figure out the best mix of nutrients to feed their cells, so they can grow fat more cheaply and efficiently.

Since 2021, the company has raised just under £23m in investment and is growing fast – with an estimated +113% annual growth rate and team size scaling from 4 in 2021 to 41 in 2024. On our platform, Hoxton Farms sits at the intersection of the AI Ecosystem and Engineering Biology Applications RTICs.

They also win brownie points for having one of the best looking websites on this list.

How we built our top AI companies list

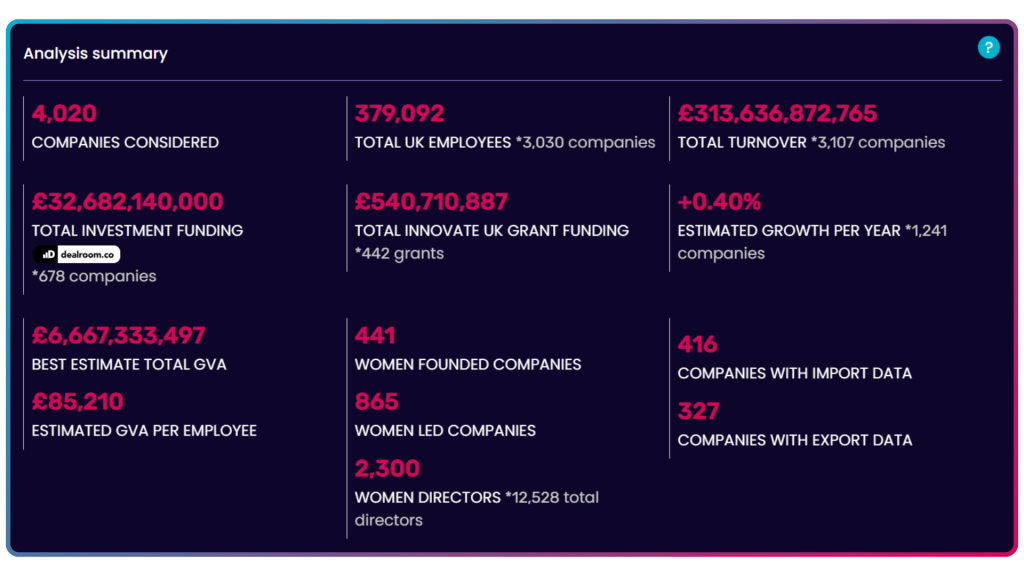

To identify the companies shaping the next phase of UK AI, we turned to our real-time dataset of over 4,000 businesses operating in the sector.

We focused on companies with strong growth potential, early-stage traction and UK ownership:

- Classified in one or both AI RTICs

- Micro or small in size (based on headcount and turnover)

- At least one funding round via Dealroom or Innovate UK

- Excluded companies known to be ultimately foreign-owned

- ‘Active’ company status

- Ranked by estimated growth rate

We believe this gives us a list of genuinely home-grown emerging companies in the UK with the potential to shape the UK’s AI economy over the next five years.

What’s next for AI?

This is just a handful of companies we’ve picking from our platform. In a few minutes using our range of filters, we developed the companies and insights you see above you.

With our real-time data and RTICs, we’re able to track the sector as it evolves. If you want to find out more about the growth of AI companies in the UK both at a macro and company-level, and see the biggest players in the market, our platform can help.

Interested in how the AI sector is evolving and what the data tell us about AI in the UK, read our blog; 3 key facts – what the data says about the UK AI sector.

Want to try the data for yourself? Please sign up for a free trial today. For everything else, please get in touch.

Please note: The data from The Data City is accurate at the time the article was written but may change over time due to the dynamic, real-time nature of our data. For the latest insights, visit our platform.