With the increasing media attention on cryptocurrency, many news outlets are forecasting a rise in crypto adoption by 2026. This is supported by a recent Statista report (Statista, 2025), the number of UK adult cryptocurrency users is expected to reach 42% by 2026, up from 40% in 2025. This anticipated growth represents a shift towards mainstream acceptance and is driving developments across the crypto ecosystem, creating exciting opportunities that crypto enthusiasts and investors will want to follow closely.

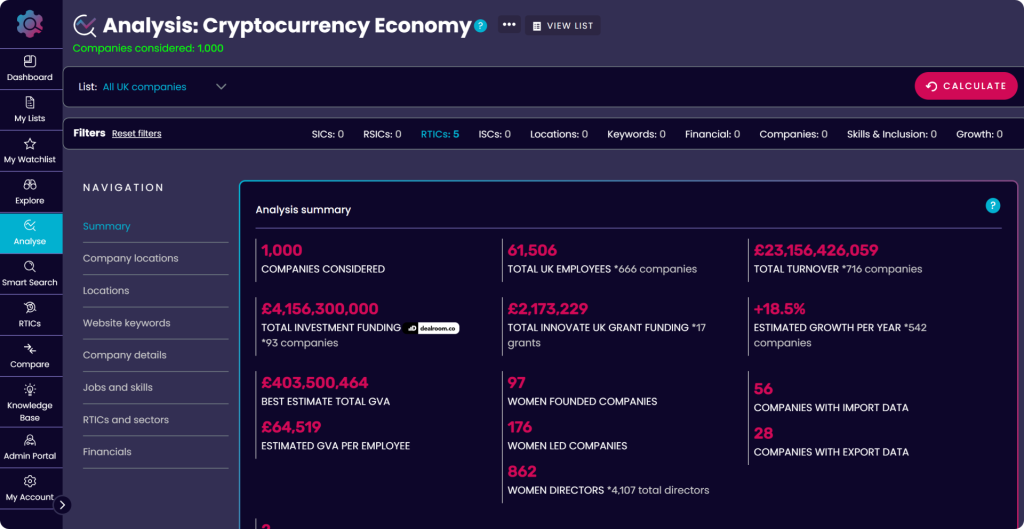

However, given the innovative nature of the sector, the government’s categorisation of companies’ activities using SIC codes cannot, on its own, map the cryptocurrency sector. That’s why, at The Data City, we’ve developed Real-Time Industry Classifications (RTICs) to enable new sectors to be mapped and to give people the data they need. RTICs use machine learning to deliver more accurate, timely insights into emerging industries, enabling a more comprehensive understanding of dynamic markets like cryptocurrency.

Based on our data, here is a non-exhaustive list of companies deeply involved in the cryptocurrency ecosystem that have promising futures in 2026.

Criteria: A weighted scoring system

You might be wondering how these companies were selected from the thousands in the cryptocurrency ecosystem. To create the top 10, I looked at four key factors: Turnover, Growth, Innovation Score, and Data quality.

Each company was scored on these factors, and the combined scores helped us rank them from highest to lowest. This way, the companies at the top represent a balance of strong performance, rapid growth, innovation, and solid data.

If you want, you can also explore the complete list yourself using the ‘sort by’ dropdowns, which let you rank companies based on whichever factors are most important to you.

The Top 10

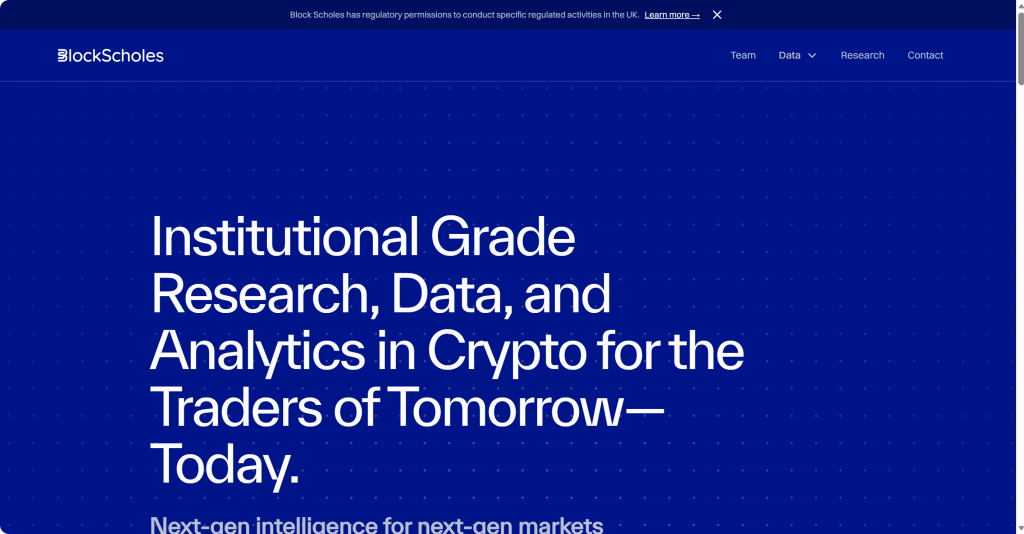

1. Block Scholes

Block Scholes describes itself as an institutional-grade research, data, and analytics firm specialising in crypto for the ‘traders of tomorrow’. Block Scholes helps large investors and companies accurately measure and interpret developments in the crypto markets, particularly crypto derivatives (financial contracts that derive their value from cryptocurrencies, allowing investors to bid on price changes).

Block Scholes is experiencing impressive growth, with our data showing its best-estimate annual growth rate at 124%. This remarkable number highlights a strong demand for its crypto market analytics services. To put this into context, the industry’s average growth rate is approximately 11%, as you can see, Block Scholes stands out significantly. Additionally, this puts it at the 12th-fastest-growing company in the cryptocurrency economy, according to the Real-Time Industrial Classification.

Block Scholes stands out from others in the field by offering in-depth, intelligent data on crypto markets, revealing insights into advanced trading tools such as options and futures. They follow the official FCA rules in the UK, which helps them earn their clients’ trust, essential when money is involved. Additionally, they offer an all-in-one service that combines data, analysis tools, research, and reports, eliminating the need for investors to visit multiple companies for their needs.

Given its rapid growth, strong regulatory standing, and professional-grade analytics, Block Scholes is a company to watch in 2026!

2. XRPayNet

Incorporated in 2021, XRPayNet enables businesses to convert consumer crypto payments into their preferred, more traditional currency. XRPayNet does this through a mobile app and a card—a feature that distinguishes them from other providers. In fact, consumers spent $2.5 billion on prepaid crypto cards in just three months from the end of 2021 to the start of 2022, highlighting the growing adoption of such payment solutions (Visa, 2022).

XRPayNet has an estimated annual turnover of approximately £77,659. While this may appear modest, it is a relatively young company and demonstrates early-stage growth. XRPayNet addresses a significant issue within the crypto community: although 300 million people hold cryptocurrencies, very few companies (less than 0.001%) accept them for transactions due to their potential volatility. These users are seeking a company to bridge this gap—and that is precisely what XRPayNet offers.

XRPayNet is part of the XRP Ledger, which focuses on a sustainable future by being as eco-friendly as possible. This aligns with Xrpaynet’s values and our data, which state that the estimated greenhouse gas emissions are 0.183 tonnes of CO2 equivalent per year, significantly lower than those of many other companies mentioned in this blog. With its innovative, future-thinking approach, XRPayNet is one to watch in 2026.

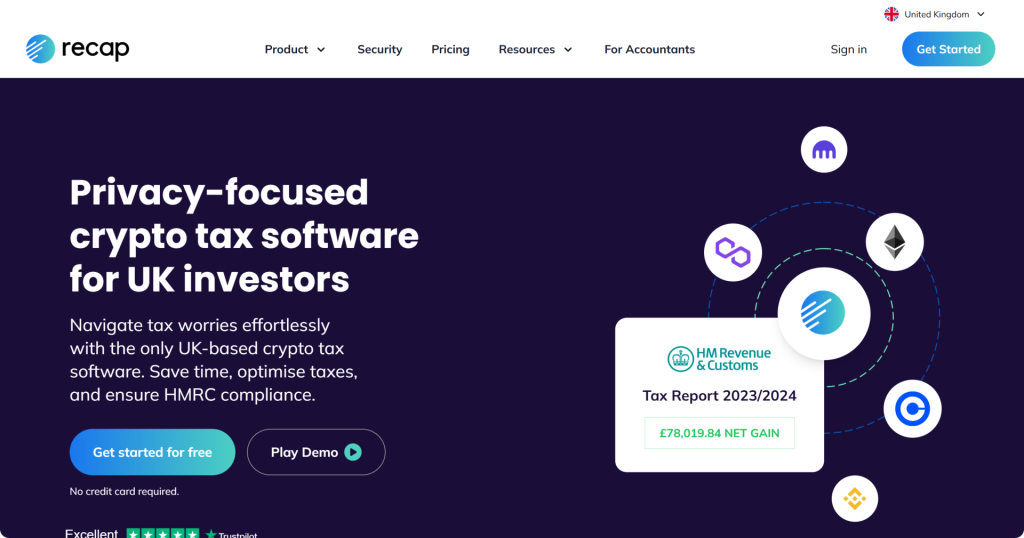

3. Recap

Incorporated in 2018, Recap is a UK-based privacy-focused crypto tax software company designed to simplify tax compliance for cryptocurrency investors. The platform was built to address a growing problem: as more people diversify into digital assets, tracking and reporting crypto transactions for HMRC becomes complex and time-consuming. Recap bridges this gap by providing a secure, user-friendly system that automates tax calculations, aggregates data across exchanges, and ensures users remain compliant with UK tax regulations.

According to our data Recap has an estimated turnover of over £240,000 and an annual growth rate of 6.9%. The platform integrates directly with major exchanges and wallets, automatically importing transaction data to maintain an accurate and real-time record of users’ holdings. It’s built-in crypto tax calculator allows users to calculate capital gains, income, and disposals with minimal effort. In addition, Recap offers end-to-end encryption, ensuring that sensitive financial information remains private even from the company itself.

As the UK tightens its cryptocurrency tax reporting requirements (GOV.UK, 2025) and more investors enter the market, tools that simplify compliance while protecting user data will become increasingly valuable. Recap is positioned to capture this growing demand and is one to watch in 2026.

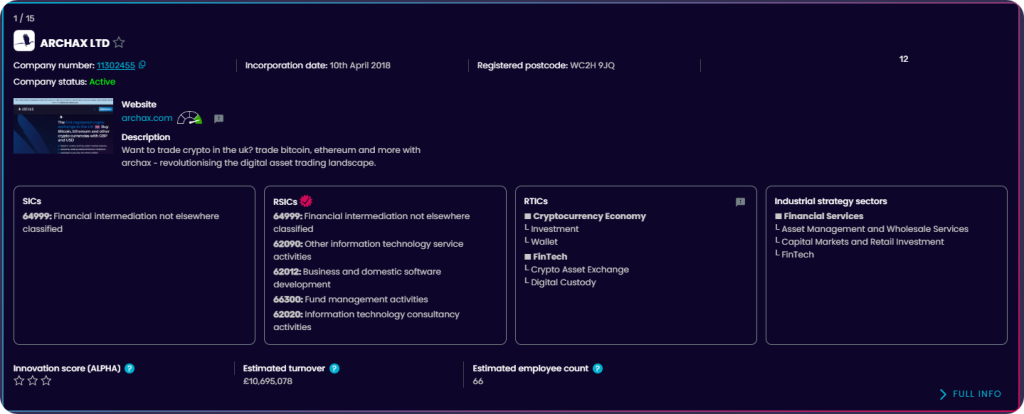

4. Archax

Archax is a London-based platform that enables professional investors to trade and manage digital versions of real-world assets, such as bonds and funds. It combines three key services: a digital securities exchange (a marketplace for buying and selling tokenised assets), a brokerage (helping investors execute trades), and a custodian (keeping digital assets safe and secure). Archax also enables companies to issue tokenised assets and raise capital in a fully regulated environment.

Our data shows Archax has an estimated turnover of £10,695,078 and a best-estimate annual growth rate of 57%. This puts it ahead of many peers in the UK crypto space and shows growing demand for regulated digital asset services.

Archax stands out because it combines trading, custody, and asset issuance on one regulated platform, making it easy and safe for investors and companies to participate in the digital asset market. Assets listed on Archax can generally be traded and settled faster than traditional securities. This seamless integration illustrates the efficiency Archax offers. With UK crypto regulations becoming clearer and tokenised assets gaining popularity, Archax is a company to watch in 2026.

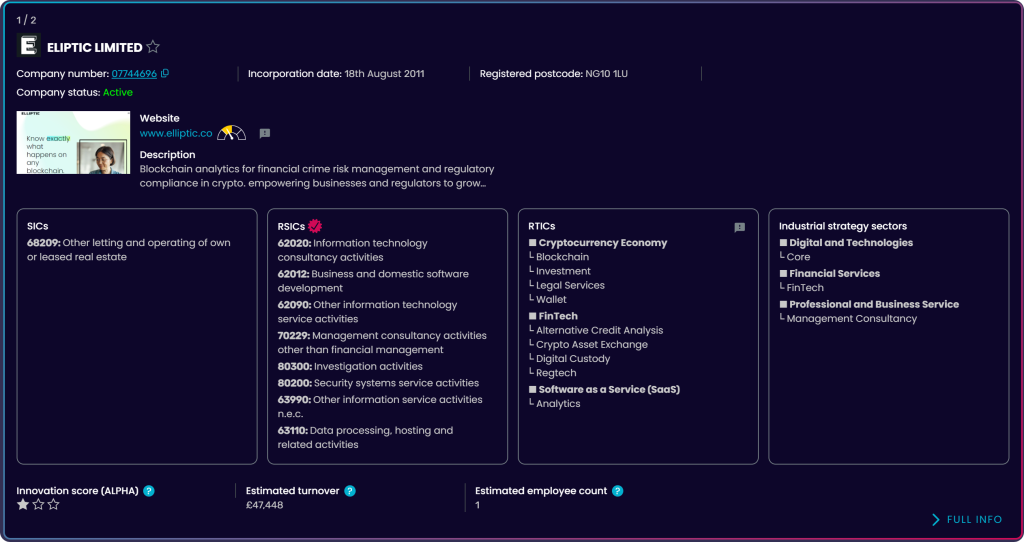

5. Elliptic

Based in London, Elliptic provides precise and comprehensive blockchain analytics for cryptocurrency compliance and forensic investigations. Established in 2013, Elliptic was among the pioneers in developing anti-money laundering and sanctions compliance solutions specifically tailored for cryptocurrency environments.

Since then, our shows shows the company has an estimated turnover of over £31 million and a projected growth rate of 20% per year. Having initially received support from Innovate UK funding grants and now establishing itself as a global company, the company has proven its capacity to innovate and grow successfully.

Elliptic distinguishes itself in the fast-changing blockchain and crypto industry by specialising in providing forensic investigators and financial regulators with access to its data. Its platform features user-friendly analytical tools, such as the ‘enforcement-grade toolkit,’ designed to speed up crypto investigations. As a result, wherever crypto is involved, demand for their services will persist.

With its proven track record, cutting-edge analytics, and ongoing global expansion, Elliptic remains a leading company to watch in crypto forensics through 2026.

6. Wintermute

Wintermute, incorporated in 2017 and based in London, is a global algorithmic trading firm and market maker specialising in digital assets. Put simply, Wintermute uses computer programs and mathematical models to automatically execute financial trades, providing liquidity to financial markets by being ready to buy and sell digital assets at any time.

Our data shows: an estimated turnover of over £119 million and a growing team of around 180 experts, the company is expanding at a rate of around 82% per year. Backed by more than £18 million in funding, Wintermute is clearly recognised by investors for its impact and potential in the digital asset market.

Wintermute stands out for its smart technology, rapid growth, and experience in digital assets. They have recently expanded into the U.S. market with the opening of their New York headquarters. (Newswire, 2025) and are actively engaging with regulators on digital asset policies (SEC, 2025). With these initiatives and a strong track record, Wintermute is a company to watch in 2026.

7. StrikeX

StrikeX, incorporated on 16th September 2021 and headquartered in London, is a modern financial platform which uses blockchain technology to make digital finance more accessible and flexible. The platform combines traditional, centralised services, like those from banks and exchanges, with decentralised, blockchain-based options. These let users trade and manage assets directly, without intermediaries. By merging both approaches, StrikeX aims to simplify investing, trading, and asset management.

The company has an estimated turnover of £215,484 and is supported by a passionate team of 8, including technologists, stock traders, and front-end developers. While still a small team, this tight-knit group enables rapid innovation and close collaboration, allowing StrikeX to efficiently develop its platform, experiment with new features, and respond quickly to changes in the crypto and financial markets. The turnover indicates that StrikeX has already begun generating revenue while maintaining lean operations, demonstrating both market traction and disciplined execution in its early growth stage.

StrikeX is a project to watch in 2026 because of its innovative approach to the crypto ecosystem. As well as offering both centralised and decentralised services, the platform focuses on tokenising real-world assets, allowing users to trade fractions of stocks, commodities, and other tangible assets on the blockchain —a feature attractive to many crypto enthusiasts.

8. Applied Blockchain

Applied Blockchain is a development studio specialising in creating blockchain solutions such as cryptocurrency wallets, supply chain tracking systems, and secure data-sharing solutions for large organisations. Founded in London in 2015, Applied Blockchain has produced over 150 projects for clients such as Shell, Barclays, and the United Nations.

Applied Blockchain has an estimated turnover of over £800,000, with a best-estimate annual growth rate of approximately 2.5%. In 2023, the company secured an estimated £2,000,000 in funding, supporting its continued expansion and the development of innovative blockchain solutions.

With a proven history of high-profile clients and recent funding to support growth, the company is strategically positioned to benefit from the expanding crypto ecosystem. As blockchain adoption accelerates and digital assets become more mainstream, Applied Blockchain’s expertise in creating scalable, secure, and user-friendly crypto solutions makes it a company to watch in 2026 and beyond.

9. NFT TECH

Incorporated in 2021 and headquartered on the outskirts of London, NFT TECH is dedicated to bringing Web3 the decentralisation of the internet into the mainstream by investing in innovative projects and infrastructure. Web3 is characterised by shifting control from major platforms like Google and Amazon to individual users who gain ownership of their data, identity, and digital assets. NFT TECH also aims to promote Decentralised Physical Infrastructure Networks (DePINs), systems in which physical infrastructure (e.g., routers or energy grids) is owned and operated by a distributed group of individuals rather than a single organisation. Users contribute resources (e.g., hardware or bandwidth) and are rewarded with digital tokens.

The company has brought in about £87,000, showing it can get results with just a small, focused team of two. As more companies explore crypto, NFTs and digital assets, NFT TECH is in the perfect position to support interesting and innovative projects which turn emerging Web3 ideas into scalable, revenue-generating realities.

Their strategy of backing early-stage infrastructure and venture projects in this space sets them apart from firms simply chasing digital assets. For anyone keen to watch a Web3 company bridging digital tokenisation and tangible infrastructure, NFT TECH is one to keep on the radar heading into 2026.

10. DIGTL

DIGTL is a global financial technology company that connects investors with investment opportunities, such as tokenised crypto mining operations through digital securities exchanges. It enables companies to raise capital by listing their assets digitally, making the process faster, more cost-effective, and accessible to a broader range of investors.

DIGTL stands out among cryptocurrency companies by fully tokenising assets, allowing fractional ownership and global accessibility for both investors and companies. Its strong focus on regulatory compliance ensures secure, legal, and scalable investment opportunities. At the same time, its end-to-end services, combined with advanced blockchain technology, make investing more efficient and transparent than with most competitors, making it a company to watch in 2026.

Interested in learning more?

The UK cryptocurrency ecosystem continues to grow, and the companies featured in this list demonstrate a range of approaches, from trading platforms and blockchain development to compliance tools and Web3 infrastructure. Each has shown measurable progress, whether through funding, turnover, or product innovation, making them notable players to watch heading into 2026.

To get a more in-depth look at this sector, sign up for a free trial and gain insight into the trends, technologies, and services shaping the UK crypto market.