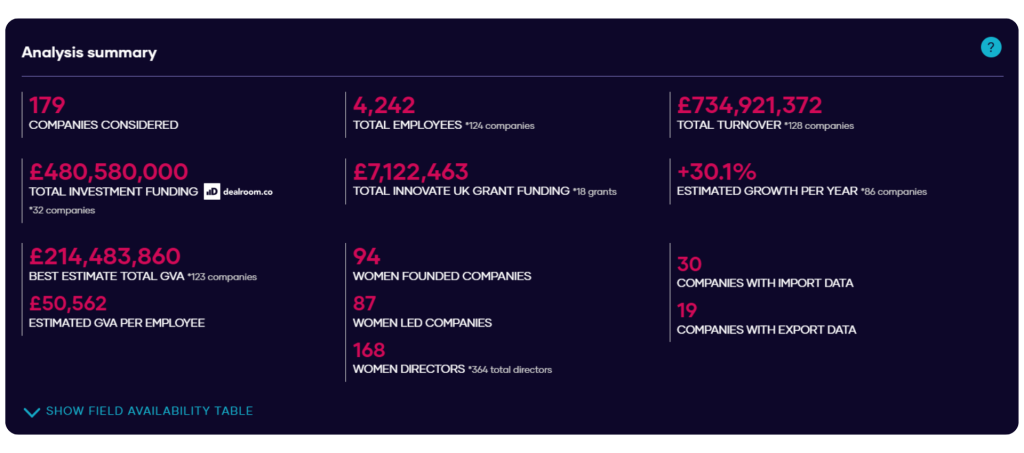

The FemTech sector is booming, with over £480 million in investment funding and growing at a rate of 30%, but you wouldn’t know it by looking at traditional industry classifications.

Outdated SIC codes have kept these businesses hidden for too long, failing to reflect the rapid growth and investment pouring into women’s health innovation.

At The Data City, we’re changing that. Our FemTech Real-Time Industrial Classification (RTIC) provides an up-to-date view of this fast-growing industry, breaking it down into four key verticals:

- Breast Health – Companies developing tools and wearables for monitoring breast health, including early detection devices. (4 companies mapped)

- Menopause – Companies creating platforms, wearables, hormone replacement therapies, and digital resources to support menopause. (82 companies mapped)

- Menstrual Health – Companies developing period tracking apps, pain management devices (CBD, wearables, patches), and sustainable menstrual products. (63 companies mapped)

- Reproductive, Pregnancy & Postpartum Health – Companies providing fertility tracking, pregnancy care, and reproductive health solutions. (38 companies mapped)

Using our real-time industry classification, we’ve identified some of the UK’s fastest-growing FemTech companies, businesses breaking barriers in fertility, menopause, pregnancy, and general wellness.

SIC Codes are failing FemTech

Despite being high-growth, innovative companies, the businesses driving FemTech are still classified under outdated and vague SIC codes.

The companies in this blog are assigned the following SIC codes:

- 58190 – Other publishing activities

- 63110 – Data processing, hosting and related activities

- 63120 – Web portals

- 96040 – Physical well-being activities

- 86900 – Other human health activities (used multiple times)

- 82990 – Other business support service activities n.e.c.

None of these codes accurately describe what these businesses do. They fail to capture the real innovation happening in hormone health, fertility tracking, menopause support, and sustainable menstrual products.

This lack of precise classification suppresses visibility, investment, and policy support, meaning key decision-makers don’t have the right data to support FemTech’s rapid growth. That’s exactly why The Data City’s RTICs exist.

High-growth UK FemTech companies

Using The Data City platform of over 5 million UK companies, we’re taking a closer look at the UK FemTech industry and the companies within it using our RTICs and platform.

We’ve used our industry filters and growth measures to pinpoint some of the fastest growing and most interesting companies in the FemTech space.

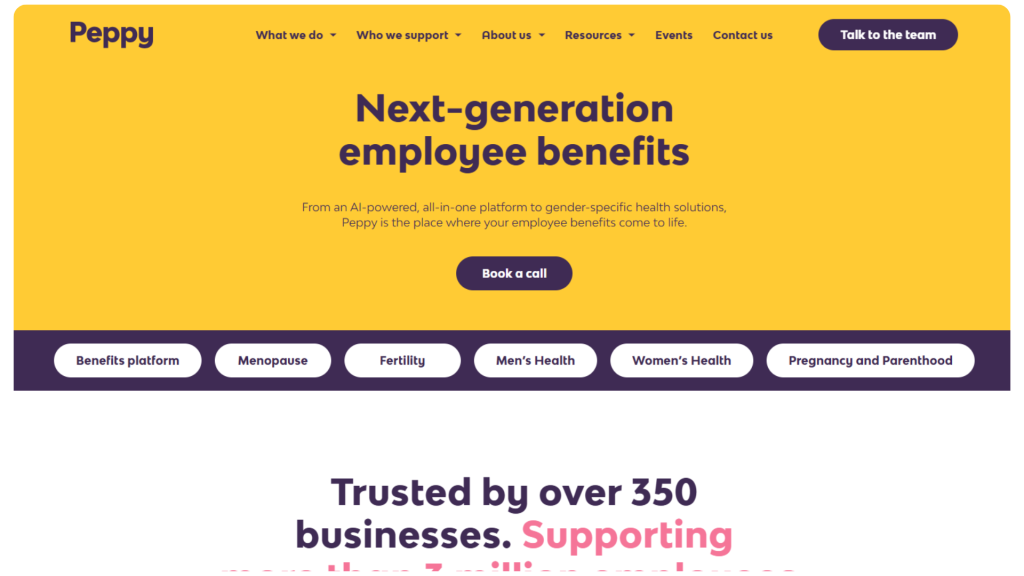

Peppy

RTIC – FemTech: Menopause

Founded in 2018, Peppy has become one of the UK’s fastest-growing FemTech companies, with an estimated growth rate of +282% per year.

Peppy is helping reshape the landscape of women’s health in the workplace, ensuring employees have access to specialist menopause, fertility, and postpartum support. Peppy provides employee benefits from an AI-powered, all-in-one platform for gender-specific health solutions.

Whilst being founded in the UK, Peppy secured funding in 2023 to expand in the US, with a $45 million Series B led by AlbionVC.

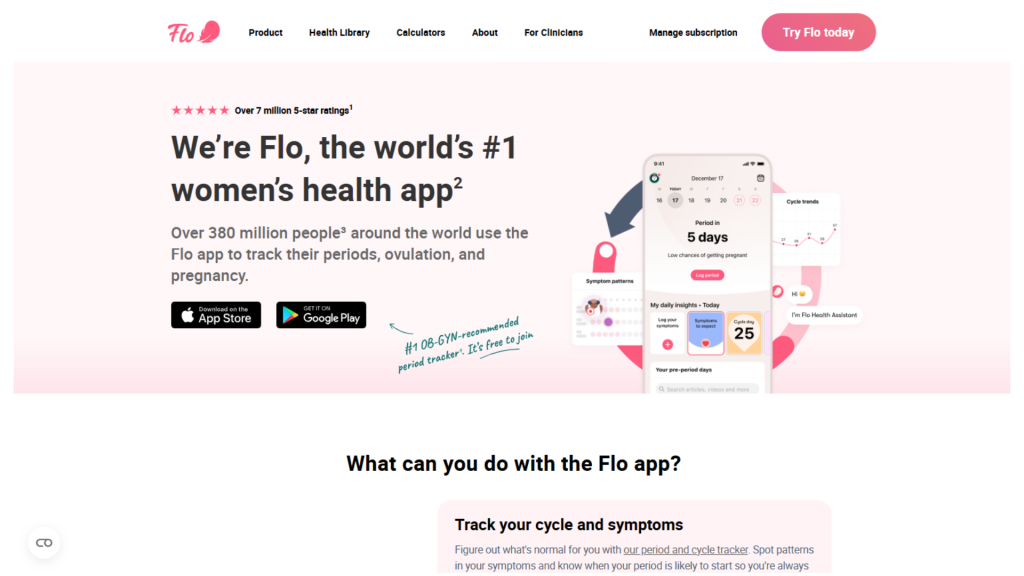

Flo Health

RTIC – FemTech: Menstrual Health, Reproductive, Pregnancy & Postpartum Health

Flo Health, incorporated in September 2020, has become one of the most widely used menstrual and ovulation tracking apps in the world – with over 380 million people using their app (according to their website). With an estimated growth rate of +268% per year and an estimated 938 employees, Flo has positioned itself at the forefront of tech-driven women’s health technology.

Headquartered in London, Flo has raised an impressive £214.4M in funding (according to our Dealroom data) with a Series C round of £157.82M in 2024 from General Atlantic. The app’s AI-powered insights and symptom tracking help users take control of their reproductive health, bridging the gap between data-driven wellness and medical support.

Hertility Health

RTIC – FemTech: Reproductive, Pregnancy & Postpartum Health

Founded in 2019, Hertility Health is redefining reproductive healthcare with its at-home hormone and fertility testing. With an estimated 108 employees, Hertility is addressing a critical gap in the healthcare system, allowing women to assess their reproductive health without the long wait times of traditional medical services.

With an estimated growth rate of +162% per year, Hertility has secured £4.2M seed funding in 202 from Venrex, LocalGlobe, and Evelyn Bourke. They also received angel funding in October 2024. As fertility awareness grows, Hertility is making diagnostics more accessible, giving women the power to take control of their reproductive future.

Fertifa

FemTech: Reproductive, Pregnancy & Postpartum Health

Fertifa, a women-founded business, is leading the charge in workplace fertility benefits, ensuring companies can support their employees with fertility treatments, consultations, and menopause care. With an estimated growth rate of +117% per year, Fertifa has expanded to an estimated 46 employees and continues to push for better reproductive healthcare in corporate settings.

The company has secured £6M in total funding, with investors including Passion Capital, Speedinvest, and Notion Capital. As more businesses recognise the importance of fertility support, Fertifa is helping shape the future of employer-backed healthcare solutions.

Stella

FemTech: Menopause

Stella is a digital clinic providing personalised treatment and support for perimenopause and menopause. Through online assessments and the Stella app, users receive tailored care plans designed to manage their symptoms effectively.

Founded in April 2020, this women-led company has an estimated growth rate of +106% per year and now employs an estimated 42 people.

Based in London, Stella – the first product from Vira Health – has raised £10.81M in funding in total, with securing series A investment from Opteum Ventures and Octopus Ventures in March 2022 for £8.9 million. The company has also received significant Innovate UK grants, supporting its efforts to integrate HRT prescribing decision tools into primary care workflows.

With menopause care still underfunded and underrepresented, Stella and Vira Health are at the forefront of bridging the gap between traditional medicine and digital health innovation.

How we estimate growth

At The Data City, we estimate company growth using real-time data from Creditsafe and Companies House. Since financial reporting lags behind reality, we use historical employee and turnover data to calculate annual growth rates, applying our own exponential growth models to fill in gaps.

These estimates update monthly, ensuring we provide the most accurate, up-to-date insights on high-growth companies.

Want to see how our model works? Read our blog on company growth.

What’s next for FemTech?

With an estimated 30% annual growth rate, FemTech isn’t slowing down. But to unlock its full potential, it needs:

- More funding to scale women-led innovation

- Better representation in economic and policy decisions

- Stronger visibility in industry classifications (goodbye, outdated SIC codes)

At The Data City, we’re committed to tracking and refining the FemTech sector in real-time, ensuring that investors, businesses, and policymakers have access to the most up-to-date insights.

This is our first iteration of our FemTech RTIC. If you’d like to help refine and perfect our map of the industry, please do get in touch.

Want to explore FemTech in more detail?

Interested in finding out more about the UK’s thriving FemTech industry? Make sure you download our free RTIC Snapshot report today.

You can also read more about the development of our RTIC in our launch blog.

And if you want to get hands on with the data for yourself, be sure to sign up for a free trial of The Data City platform.