The Data City and Open Innovations are working with techUK on the 2024 version of the Local Digital Index. This blog post follows on from our previous blog post, where we discuss how we’re defining digital companies. This blog posts talks about the aims of the index, where it’ll launch and some early findings.

The Local Digital Index is a tool to aid policy makers and a way to see the impact and value of the digital sector for the regional and local economies.

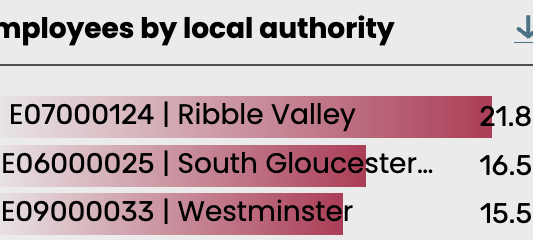

Compared to previous years we’ve expanded the data offering in two main ways. We have included skills demand data from Lightcast. We’ve taken a new approach to defining the digital sector, using The Data City’s Real Time Industrial Classifications (RTICs). This defines the sector using detailed descriptions of what companies do – from their websites – rather than what SIC code they use.

All of this data and more will be publicly accessible on a website. Furthermore, we’re happy to announce that we’ll be working on the index for the next 3 years and we’ll look to add even more datasets and analysis in future years. As part of the longer-term project, Open Innovations and The Data City have invested in data infrastructure, to make the index easier to update.

The index will be launched on the 3rd of December at an in-person event. As well as the web tool, there will be detailed case studies on Glasgow, Manchester and Birmingham.

Paul Connell, from The Data City and Open Innovations will also attend Birmingham tech week and will present some of the early findings.

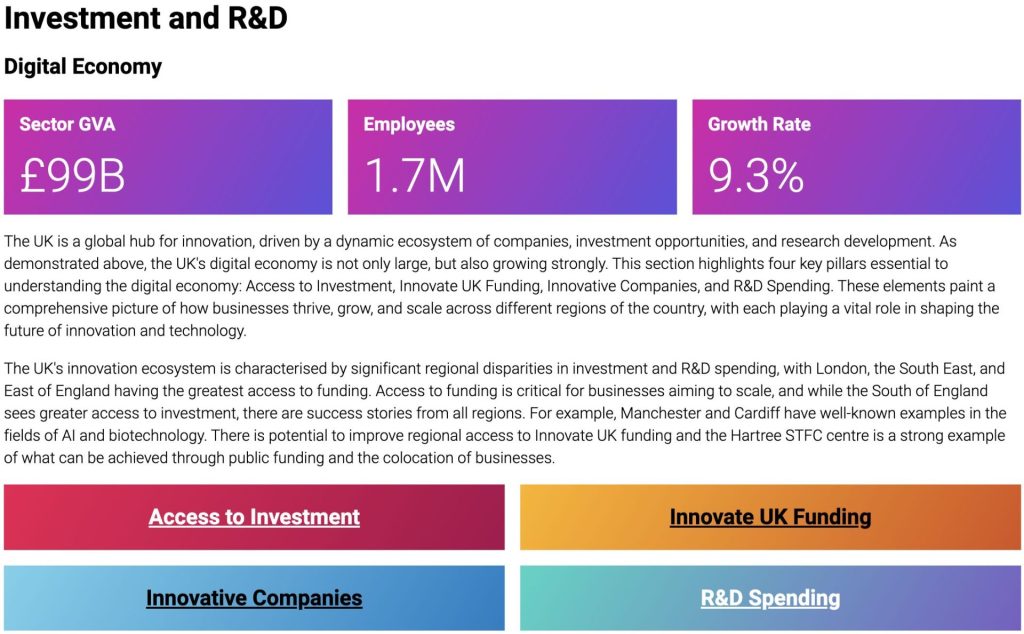

- Regional Disparities: While London and the South East lead in investment, innovation, and R&D, other regions are emerging as significant players, showcasing the UK’s diverse potential in the digital economy.

- Infrastructure as a Foundation: Strong connectivity through broadband and data centres is essential for digital growth, with key hubs in cities like London, Manchester, and Birmingham. However, gaps in rural and less populated areas highlight the need for broader infrastructure investment.

- Innovation Clusters and The Role of R&D: The clustering of innovative companies, particularly in sectors like AI, biotech, and fintech, is transforming both established urban centres and newer regional hotspots, driving economic growth. Consequently, Research and development spending is concentrated in a few regions, but it’s crucial for advancing technologies and industries across the UK, particularly in high-tech and energy-dependent sectors.

- Investment Drives Growth: Access to private investment remains a major factor in business scalability and competitiveness, with certain regions demonstrating how targeted funding can fuel sector-specific growth.

Interested in learning more about our work with techUK? Get in touch with us