SIC codes are finally being updated but it comes with its own problems – There’s an elephant in the room!

They asked users of SIC to consider which international classification framework the UK should adopt and to what level. And to consider how different options could impact current users of the classification framework.

At The Data City, we welcome this discussion. It’s an important step forward, and we’re fully engaged in supporting the transition with both of our real-time classifications, RTICs and RSICs.

The Context: Goodbye 2007, Hello 2026?

The current Standard Industrial Classification (SIC) system was last updated in 2007. That was before the iPhone. Before deep tech. Before ClimateTech, FinTech, Quantum, synthetic biology or AI.

Between October 2023 and January 2024, the Office for National Statistics (ONS) consulted users on the future of the UK Standard Industrial Classification (SIC) following updates to international frameworks ISIC and NACE and the UK’s departure from the EU.

Respondents, including government departments, businesses, and trade bodies, were asked which classification framework the UK should follow, how closely it should align, and whether to retain the five-digit subclass level.

We know that SIC 2007 has long been unfit for purpose, failing to capture high-growth, modern industries, or keep up with how real businesses actually describe themselves. Despite its flaws, it remains embedded in everything from investment decisions to policy modelling, from GVA calculations to Companies House filings.

The consultation on SIC 2026 is a recognition that the world has moved on and that the UK’s official industrial classification system needs to do the same.

What’s changing?

Put simply: SIC 2026 is a refresh of the official way the UK classifies companies by what they do. It’s a chance to modernise sector definitions, improve comparability across global systems, and (hopefully) make the UK’s economic data more useful.

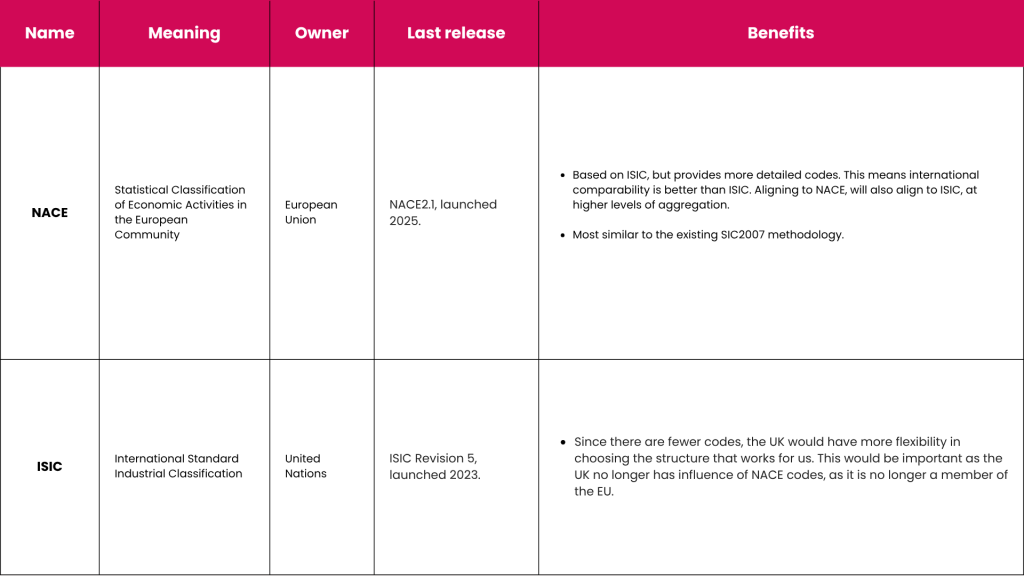

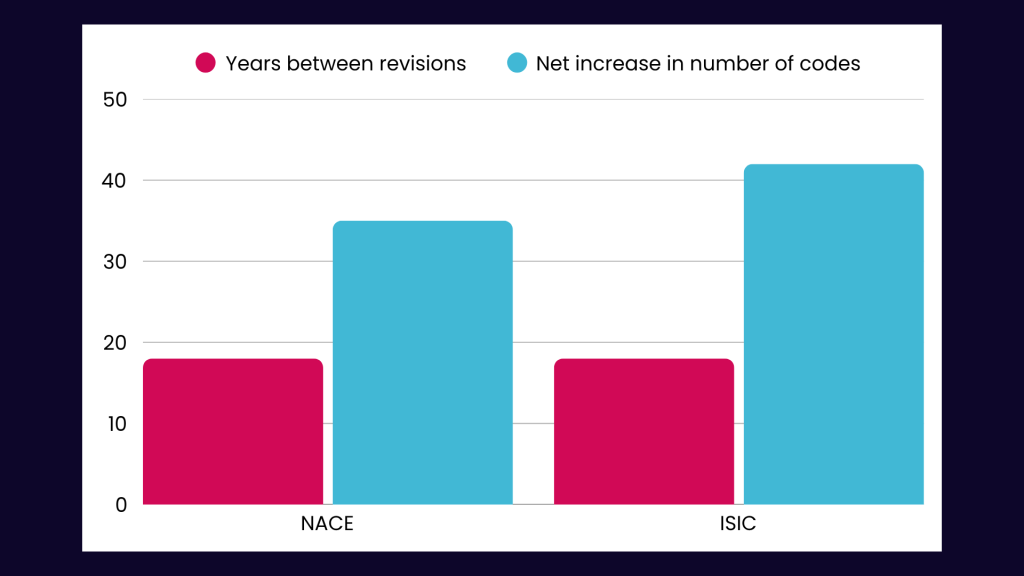

Revising SIC follows updates to other industrial classifications, namely those in the table below. SIC 2026 will be a combination of the latest versions of NACE, ISIC, and our own input.

Real Example:

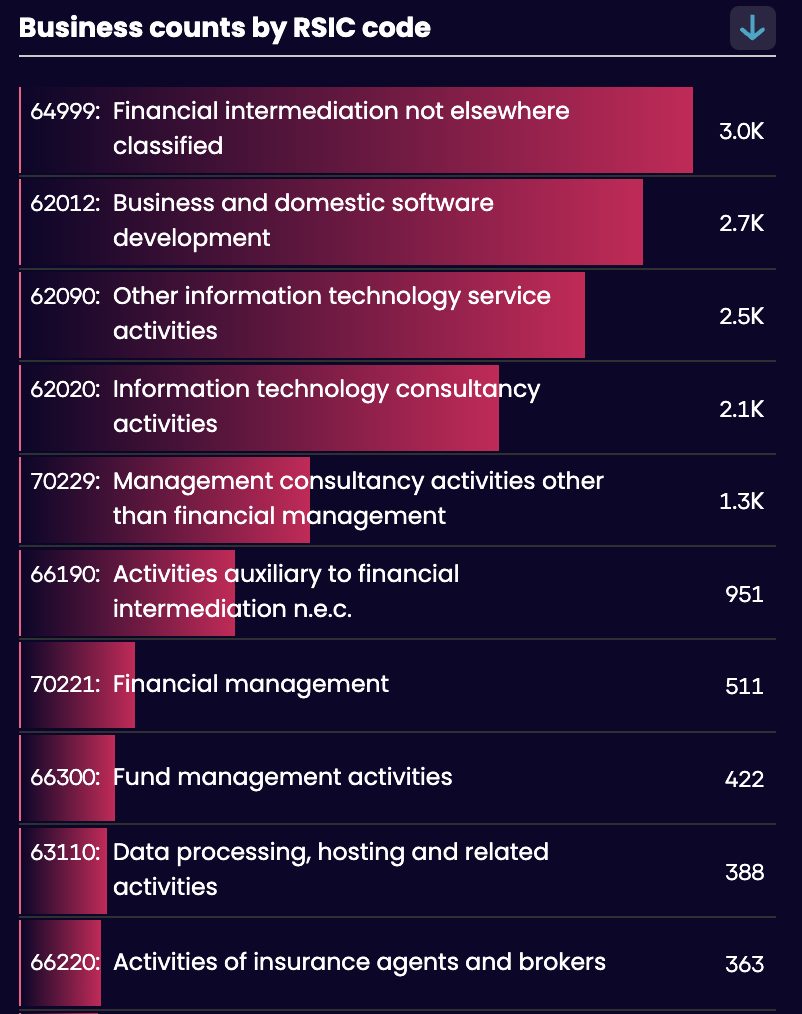

Under SIC 2007, there’s no code for “FinTech” a £10bn+ sector in the UK and a sector that is a combination of both digital and financial services. It gets lumped under outdated banking or software categories, as is shown in the chart below.

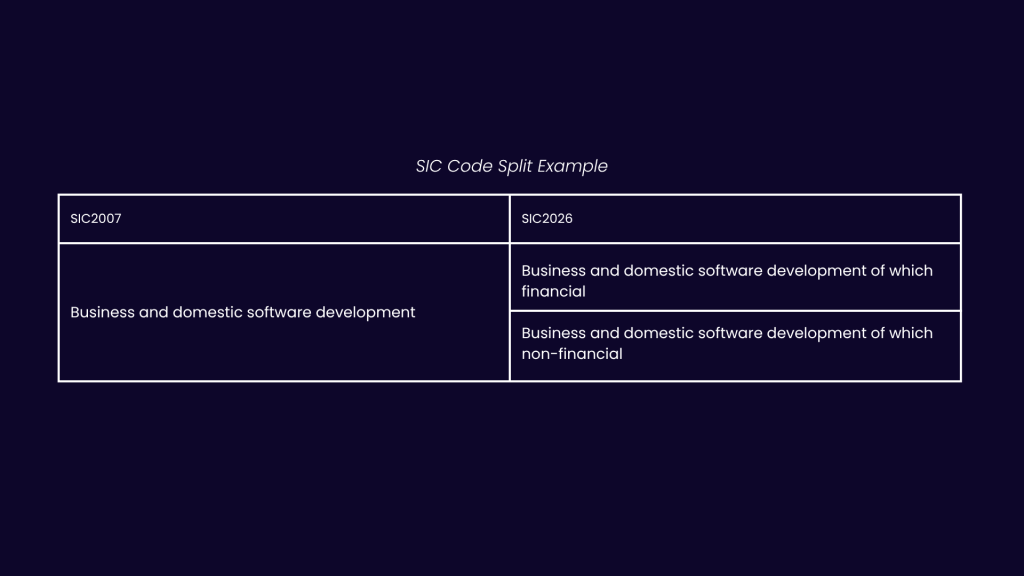

To maintain comparability with international standards, SIC 2026 will be limited to a varying extent in its flexibility. Aligning to NACE, the most detailed standard will limit the flexibility the most. Creating new sections, to better classify sectors like FinTech is unlikely to be possible without breaking the link back to the international standards. As the ONS mention, the changes are likely to focus on the splitting of existing codes. An illustration of how this could work is shown below.

What does this mean for FinTech? It’s not certain that sectors like FinTech will be well represented in SIC 2026. Maintaining comparability, and splitting existing codes, will mean that, if represented, FinTech will be presented in a fragmented view.

We’re also able to look at how other countries have handled recent updates to their industrial classifications. Switzerland has already rolled out their equivalent to SIC 2026, called NOGA 2025. The refreshed version did not include a code for Financial Technology companies:

“No new groups and classes have been created for the classification of activities carried out by financial technology companies (Fintechs) that are using digital techniques to provide, improve or increase access to financial services. Such activities are integrated in the existing structure of NOGA [2008], since these are not viewed as new activities, but rather as existing activities being carried out via a new modality”

SIC 2026 will provide welcomed granularity for existing sectors, but it will be more challenging for it to represent entirely new sectors, especially ones that are applications of multiple traditional sectors.

What happens next?

The ONS are engaging with businesses, trade bodies and other users of SIC. They hope to release a final version of SIC 2026 by March 2026. When SIC 2026 launches, it’ll have benefits for the public and ONS users, and for Companies House.

For the public & ONS users

Better sector definitions should mean more accurate statistics, policies and decisions. That’s vital for everyone – from civil servants to academics to investors trying to understand where growth is really happening.

For Companies House

Every UK business must select a SIC code when they incorporate. SIC 2026 will shape how companies are described legally – which affects everything from funding to tax reliefs to procurement eligibility.

How the Data City will help the transition – eating the elephant whole

This is the elephant in the room, most companies won’t update their SIC codes even if new, more accurate ones are introduced. As it stands, around 2.9% of businesses update their SIC code each year. With 4.5m incorporated and active businesses, changes introduced in SIC 2026 will take a while to be adopted.

So, even if a FinTech-specific SIC code is released in 2026, we know from experience that the 5,000+ Fintech’s operating in the UK today won’t suddenly update their records on Companies House. In reality, most won’t touch them at all. This means it will be hard to get a timely picture of newly created sectors. If the expectation is that having launched a FinTech SIC code means that it will then be possible to answer the question “how many FinTechs are there incorporated in the UK” then prepare for disappointment, on day one of release the answer will be zero..

RTICs exist for emerging sectors – sectors that combine and apply technologies used in other sectors in new ways, as FinTech does with financial and digital services.

RSICs exist for correcting SIC codes and hold the answer to understanding new sectors added as part of SIC 2026. Our Real-Time Standard Industrial Classifications (RSICs) use website text and machine learning to classify what companies actually do.

We’re the only company that can apply the new 2026 SIC codes retrospectively. We can find the companies operating in the new SIC codes, even if many companies fail to update their SIC codes, bringing clarity to sector mapping, policy development and investment planning.

SIC may be getting an update. But The Data City already has the upgrade and the elephant is looking edible!

Start a free trial of The Data City platform to explore your sectors using RTICs and RSICs. If you’re thinking about how to align your organisation with the future of industrial classification, we’re here to help.

Let’s build a smarter classification system, one that reflects the economy we’re in, not the one we used to be in.