The UK’s Industrial Strategy is back in the spotlight.

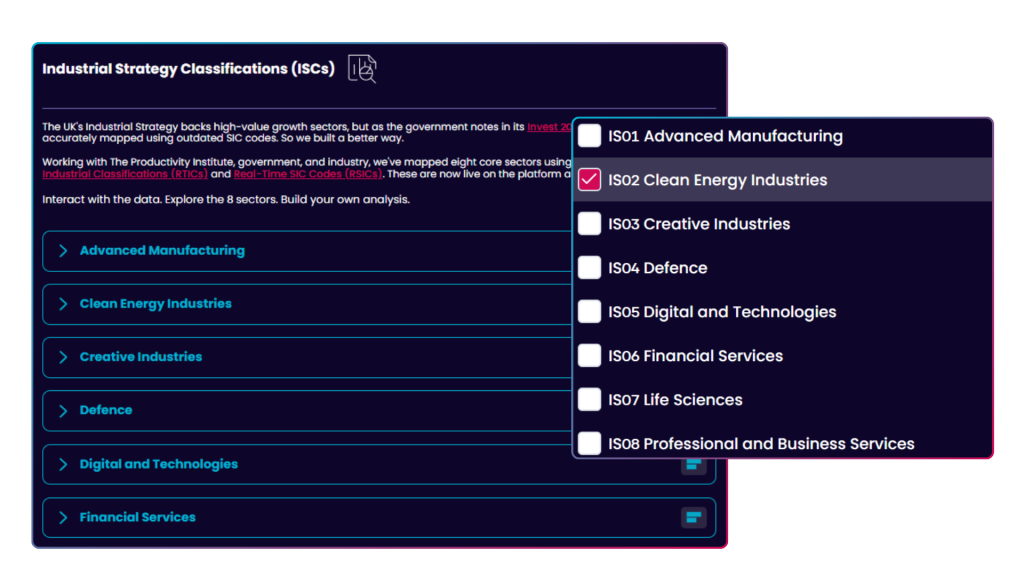

With the release of the new Industrial Strategy on Monday 23rd June, the government has renewed its focus on the eight priority sectors set to shape the UK’s future. Known as the IS-8, these sectors are positioned to unlock productivity, accelerate innovation, and drive long-term economic growth.

The Data City has been closely involved in shaping the evidence base behind this strategy.

Our work powers the Innovation Clusters Map, developed in partnership with the Department for Science, Innovation & Technology (DSIT) and Cambridge Econometrics, which is cited in the Industrial Strategy Technical Annex as part of the government’s approach to identifying and prioritising high-growth city regions and clusters.

A close collaborator and user of our data Centre for Cities is also referenced throughout the annex for their insights on place, agglomeration, and spatial productivity.

But with issues in how we map and understand key UK sectors – and the frontier economy in particular – still affecting research, policy and action, the need for a shared, modern classification system has never been clearer.

The Industrial Strategy (IS-8) sectors

Since the publication of the green paper, there’s been speculation about whether the original list of eight growth-driving sectors would evolve. The new strategy confirms the government is sticking with its original focus – with individual sector plans published for each. These sectors are:

- Advanced Manufacturing

- Creative Industries

- Digital and Technology

- Life Sciences

- Financial Services

- Clean Energy Industries

- Professional and Business Services

- Defence

These categories will shape everything from local industrial strategies to R&D funding and devolution deals. But turning strategic intent into meaningful action requires clarity, and traditional classifications like SIC simply aren’t built for that.

Defining growth-driving sectors

On 23rd June, the Department for Business and Trade (DBT) published a Sector Definitions List for the IS-8. It maps SIC codes to each sector and flags areas where no suitable code exists.

It’s a welcome step, but it also exposes just how limited SIC is. DBT acknowledges that key frontier industries like heat pumps, nuclear fission, complex weapons, and sustainable finance don’t map cleanly to any part of the SIC system. They’re either spread across multiple classifications or not represented at all.

That leaves a gap. And it’s already sparking a scramble.

Across the UK, different places, departments and organisations are now rushing to define these sectors themselves.

Without coordination, this risks creating a fog of confusion- where no two maps match, comparisons become impossible, and every place ends up “world-leading” in everything.

The cost of misalignment is high. But the opportunity? Even higher.

How we’re providing clarity

We’ve acted fast, because delivering clarity is what we do best.

The government’s definitions provide a foundation. But for those working in industrial strategy – whether in national policy, local government, research or economic development – you need more than a list of SIC codes. You need something usable, accurate and live.

In the next few weeks, we’re delivering just that:

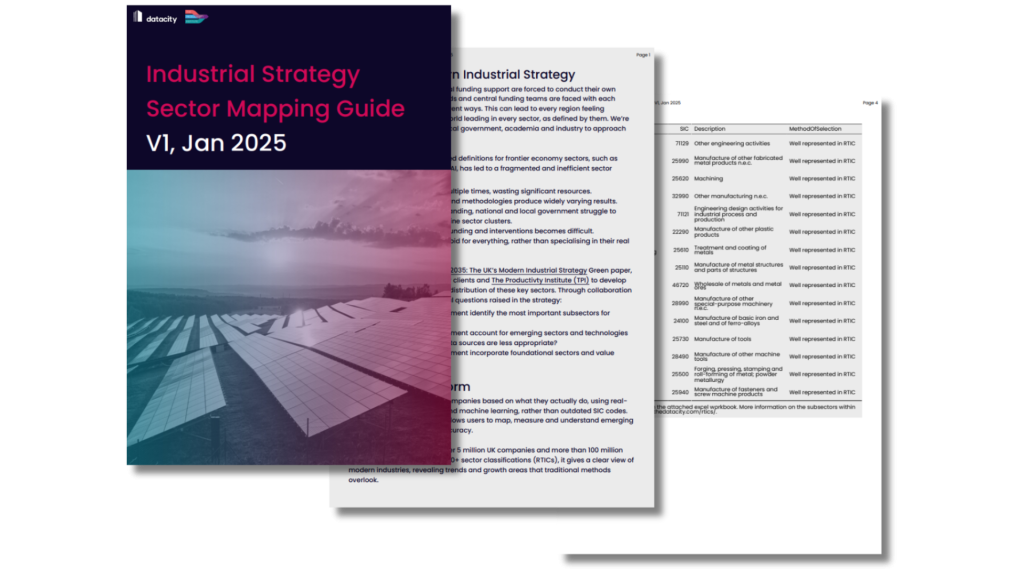

- V4 of our Mapping Guide – We’re updating our Industrial Strategy Mapping Guide to align our Real-Time Industrial Classifications (RTICs) and Real-Time SIC Codes (RSICs) classifications directly with DBT’s IS-8 sector definitions.

- Platform updates – These changes will be live in our June platform release, so users can instantly explore and analyse the data.

- New RTICs – We’re working with key partners to build RTICs for frontier sectors that SIC and DBT can’t capture – ensuring they’re visible, mappable and measurable.

Industrial Strategy Mapping Guide V4

Since its first release, our Industrial Strategy Mapping Guide has helped organisations across the UK make sense of sectoral data.

V4 builds on that foundation – providing deeper coverage and stronger alignment with government strategy.

We plan on publishing the full mapping guide in the following weeks, but in the meantime here’s a look at what’s changing:

| IS-8 Sector | What’s changing in V4 |

| Advanced Manufacturing | Added AgriTech and Battery Supply Chain RTICs and 83 RSICs. The Data City are currently building two new verticals to the Advanced Manufacturing RTIC: Aerospace and Automotive. |

| Clean Energy Industries | Removed Battery Supply Chain RTIC. The Data City are currently building two new verticals to add to the Net Zero RTIC within this growth sector: Heat Pumps and Nuclear Fission |

| Defence | Added 4 additional RSICs. |

| Financial Services | Added 11 additional RSICs. The Data City are currently building a new vertical to add to the FinTech RTIC: Sustainable Finance |

| Life Sciences | Removed Engineering Biology Applications, Engineering Biology Supply Chain, and AgriTech RTICs. Added 4 RSICs. |

| Digital and Technology | Removed AgriTech RTIC.. Added Semiconductors RTIC. |

| Professional Business Services | Removed Business Support Services RTIC. Added 54 RSICs. |

| Creative Industries | Removed all RTICs as the sector is sufficiently capturing using RSICs. |

One industrial strategy. One shared map.

The Data City was built for exactly this moment.

Our mission is to build the new global industrial classification system – and we’re already doing the work. Of the five frontier sectors that DBT couldn’t classify using SIC, we’ve already mapped two in partnership with the defence association. The remaining three will be completed by the end of July.

There’s no need for 50 different definitions from 50 different places. We can and should work from a shared base – saving time, reducing duplication, and enabling meaningful comparison across the UK.

On Thursday 26th June, we’re hosting our next Industrial Strategy Summit. We’ll share our latest work, hear from our community, and open up the conversation asking:

How do we ensure one strategy leads to one evidence base? And how can open data power the success of UK Plc?

Couldn’t get a ticket? No problem. We’ll be publishing key insights from the day, along with new data and updates over the coming weeks.

Want to cut through the fog and bring clarity to the Industrial Strategy? Stay in touch, or sign up for a free trial and see the data for yourself.