New technologies are reshaping many traditional sectors. This is the case for healthcare and medical devices, which have experienced critical changes during the last years. New technologies are changing the ways we diagnose, treat and monitor illnesses. Therefore, we built our MedTech RTIC, targeting UK companies providing proprietary technologies and new medical devices. We found 988 UK companies pushing for the modernisation of medical practice, with an aggregated net worth value of £24.8bn and employing more than 65,000 people.

A taxonomy for MedTech

We followed a technology approach to create our MedTech taxonomy, outlining the emergent technologies applied to medical devices. This approach not only help us to identify relevant companies, but also let us know which are the most relevant technologies.

- Advanced materials: these are the companies applying advanced materials to new medical devices. We identified 220 companies in this space.

- Artificial Intelligence: in this group, we target companies applying artificial intelligence and proprietary algorithms to healthcare tools. We found 245 companies.

- Imaging: in this category, we aggregate the companies that are using new technologies to create and/or analyse medical images. We captured 139 companies.

- Internet of Medical Things: here we address companies making possible for health devices to share real-time data. We found 176 companies.

- Photonics: this segment targets companies using photons (light) in medical devices. We found 139 companies.

- Robotics and Automation: these companies are using developments in robotics and automation in medical devices. We captures 163 companies.

- XReality: these companies are applying virtual, augmented or mixed reality technologies to healthcare, often for educational and training purposes. We identified 37 companies.

A relational view of MedTech

We have prepared a chord diagram that visualises the relationships among taxonomy groups. You can hover over the chords to see the numbers of companies shared by different segments.

The diagram informs that the relationships across taxonomy groups are not large. The most relevant are AI-Robotics and Automation (27 companies), Advanced Materials-IoMT (26 companies) and AI-Photonics (24). Hence, we can conclude that artificial intelligence is key for both Robotics and Automation and Photonics medical devices, while Advanced Materials are central for the Internet of Medical Things. This is because Advanced Materials have been key in the development of wearables, sensors and monitoring devices sharing patients’ real-time data. We can see this relationship with our Wearables and Quantified Self RTIC, since we find 42 MedTech companies also present in this space.

The language of MedTech

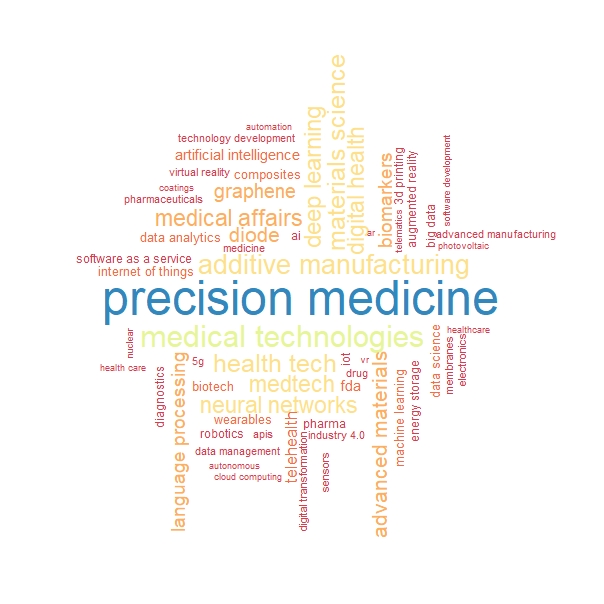

Our platform is able to extract complementary insights from website text too. One of our newest features is Sector Keywords Enrichment: we are able to identify sector-specific keywords, and quantify how likely are companies to use them in comparison to the average UK company. Hence, these keywords provide meaningful information about sectors’ specialised practices. Below we have prepared a wordcloud illustrating MedTech’s specialised language.

Thanks to our platform, we know that MedTech companies are a 4,356% more likely to use the expression “precision medicine” in their website text than the average UK company, a 2,517% more likely to use “medical technologies” and a 2,0717% to use “additive manufacturing”. Besides, the sector close engages with several terms related to AI, like deep learning, neural networks and language processing. Ultimately, we see a prevalence of advanced materials keywords, such as graphene or composites. Therefore, our Sector Keywords Enrichment proves very useful to further understand the specialised practices of companies captured in an RTIC.

MedTech’s geography: a Local Authority view

We believe it is important to know the geographical distribution of industrial sectors to find clusters or hidden patterns. For this reason, we have prepared an interactive choropleth map that displays the number of MedTech companies found within the boundaries of UK’s local authorities.

The map shows that there is a concentration of MedTech companies in central London local authorities, as we have seen with other emergent economies. However, we can see that MedTech companies are also prevalent in South Cambridgeshire, Vale of White Horse or Sheffield. These kinds of insight are crucial for public sector planning, as far as they provide a view of the relative strength of regions.

Wrapping up MedTech

During the last year and a half we have learnt how important it is to understand developments in healthcare and know the medical capabilities of each region. This is why we concluded that looking into the MedTech sector in the UK is a much needed task. The result is a dataset that allows us to understand the size of the sector, its financial performance and specific details about MedTech’s practices and geography. Nonetheless, we want encourage experts and the public and private sectors to work with us to create more information about the healthcare revolution in the UK.