FinTech continues to redefine how we interact with money. Whether it’s reshaping lending, revolutionising compliance, or unlocking new payment models, the sector is a powerhouse of innovation. Yet, despite its scale, getting a grip on the UK’s FinTech ecosystem hasn’t been simple, until now.

We’ve built the FinTech Real Time Industry Classification (RTIC) to help uncover the companies, people, jobs, and value that make FinTech one of the UK’s biggest emerging sectors.

What is FinTech?

FinTech, short for financial technology, is where finance meets innovation. From digital banks to Insurtech, blockchain startups to AI-driven investment tools, the sector is vast and constantly evolving. Traditional SICs simply don’t keep up.

Our FinTech RTIC is the most detailed, accurate, and dynamic classification of the sector available. We’ve used machine learning, website text analysis, and expert input to define what FinTech actually looks like today from RegTech firms helping with compliance to WealthTech platforms reinventing personal finance.

Why did we build a FinTech RTIC?

FinTech is one of the UK’s strongest economic engines but defining the sector properly has always been a challenge. Existing SIC codes simply aren’t fit for purpose. They don’t account for the complexity, speed, or variety of the businesses that now make up the modern financial landscape.

By using our RTIC methodology, and working with Innovate Finance we’ve been able to go deeper. This RTIC gives analysts, policymakers, and investors a clear, real-time picture of the FinTech landscape – right down to the postcode.

FinTech RTIC Verticals

The FinTech RTIC has 14 verticals which span a wide range of companies delivering software, services, and intelligent technologies that support both financial institutions and personal finance.

Key areas include Digital Payments (1,413 companies) and Digital Lending (985 companies), reflecting strong activity in transaction processing and credit access. Tech for Enterprise (1,947 companies) covers firms building tools for internal banking operations, while Digital Capital Raising (866 companies) supports fundraising through online platforms.

Other significant verticals include WealthTech (659), Crypto Asset Exchange (615), RegTech (576), and Digital Custody (477), which collectively show the sector’s focus on innovation, security, and compliance. Emerging niches such as Digital Identity (442), Alternative Credit Analysis (646), and Insurtech (266) further highlight the shift towards digital-first finance.

Key stats from the FinTech RTIC

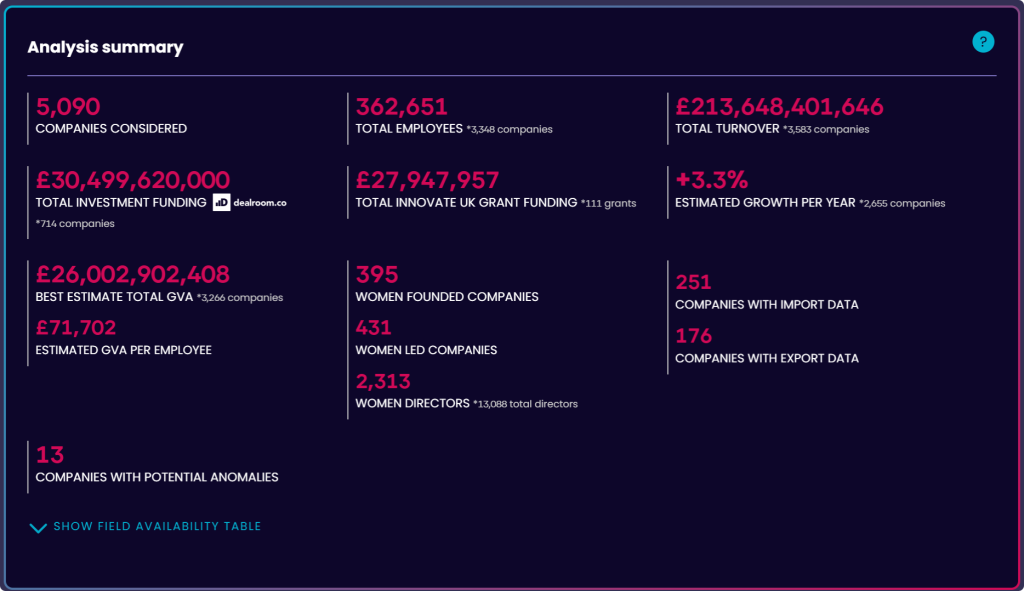

We analysed 5,090 companies to build this classification.

The FinTech sector employs 362,651 people across 3,348 companies and generates a combined turnover of £213.6 billion from 3,583 businesses.

It has attracted £30.5 billion in investment funding across 714 companies and received £27.9 million in Innovate UK grants via 111 awards.

Estimated annual growth is 3.3%, based on 2,655 companies. The sector contributes £26 billion in total GVA, with an estimated GVA per employee of £71,702.

Where are FinTech companies based?

It’s no secret that London is the financial capital of the world. London dominates, with major FinTech hubs in:

- City of London: 1,200 companies / 126,700 employees / £146.2bn turnover

- Westminster: 960 companies / 39,600 employees / £12.6bn turnover

- Tower Hamlets: 439 companies / 37,900 employees / £14.2bn turnover

But activity is growing nationwide, with strong clusters in Bristol, Manchester, Leeds, Birmingham, and Edinburgh.

Jobs, skills, and future outlook

FinTech is a serious employer. Our RTIC links to over 119,000 job postings, with top roles including:

- Programmers & software devs (18.4k)

- Finance analysts (7.2k)

- IT business analysts (4.7k)

- Data analysts (2.7k)

- Cybersecurity professionals (2.1k)

Median salary across FinTech job postings is £43,308 with roles like IT project managers commanding over £69,000.

High growth companies

Volt technologies holdings limited

Volt Technologies Holdings Ltd, founded in 2019, is a UK-headquartered fintech company building real-time payments infrastructure using open banking. Operating globally, Volt enables businesses to accept instant, bank-direct payments from customers, positioning itself as the world’s first real-time payment network.

The company has grown rapidly, with an estimated annual employee growth rate of 448%, classifying it as a large business. Volt has raised around £65.7 million to date, securing investment from Fuel Ventures, EQT Ventures, Augmentum Fintech, and CommerzVentures. Its growth and strategic backing point to strong momentum in a fast-moving payments sector.

Moon Pay (UK)

MoonPay (UK) Ltd is a high-growth FinTech specialising in crypto payments infrastructure. Based in Spitalfields, London, the company has grown rapidly, with an estimated 265% annual increase in headcount, classifying it as a large business though not yet meeting the OECD scaleup criteria. MoonPay has raised over £471 million, including one of the UK’s largest Series A rounds for a crypto firm.

Its UK operations align with regulatory standards, including FCA registration and compliance with anti-money laundering rules like the Travel Rule. While it hasn’t received public grants, MoonPay’s significant private investment and market traction highlight its growing influence in the crypto payments space.

Ready to explore the FinTech sector?

The FinTech RTIC is available now on our platform. You can explore this classification in EXPLORE or use it in ANALYSE for instant insights.

Want to know more or see it in action? Just get in touch with our team and sign up for a free trial.

Please note: The data from The Data City is accurate at the time the article was written but may change over time due to the dynamic, real-time nature of our data. For the latest insights, visit our platform.