Recently the FT ran a piece looking at the space sector in Glasgow, highlighting the nanosatellites being built in the city and what this means for Scotland’s push to grow the space sector more generally.

The piece was really interesting. But what it lacked as a comparison with other parts of the UK to understand if there is anything going on in both Glasgow and wider Scotland over and above other parts of the UK. Fortunately The Data City’s data is able to see if Scotland is about to go into orbit.

Scotland is a home to the UK space industry

Looking at our Space Economy RTIC shows where the space industry is based in the UK. And both Glasgow and wider Scotland are doing well.

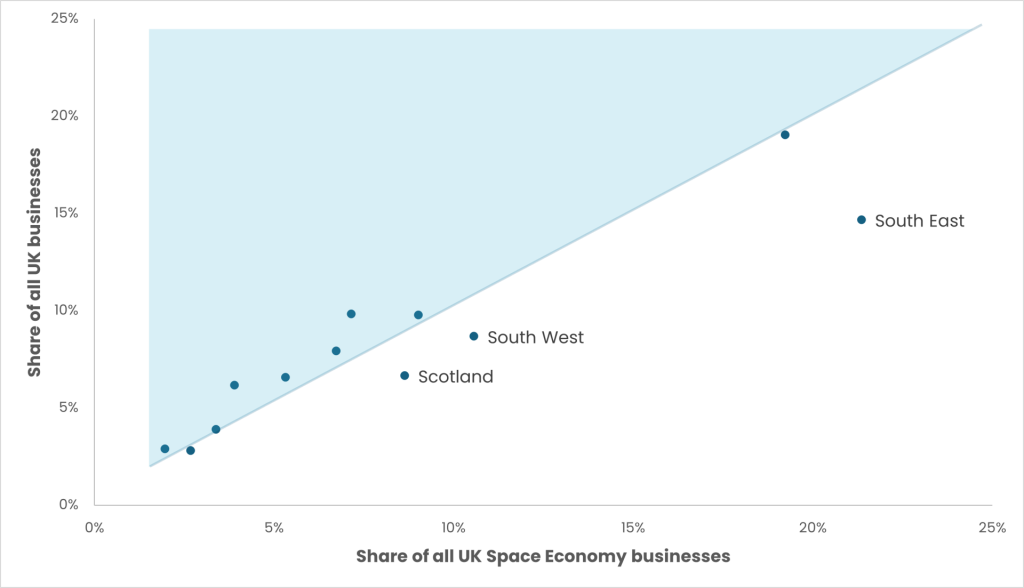

At the level of nations and regions, Scotland is one of three areas that has a disproportionate number of businesses in this area. It is home to 6.7% of all UK businesses, but 8.6% of the UK space businesses. But by far and away the biggest out performer is the South East of England. It is home to 14.7% of all businesses. but 21.4% of space businesses (see Figure 1.)

Figure 1: Scotland and the South West outperform, but the South East really excels.

Edinburgh does even better than Glasgow

The performance of cities reflects this regional picture. In terms of ‘overperformance’, Glasgow makes the top five cities in the UK. Its 59 companies in Space Economy account for 1.9% of all of the sector, and is higher than its 1.2% share of all UK businesses. But Edinburgh does even better. Home to 72 Space Economy businesses, it accounts for 2.3% of the sector (well above its 0.6% share of all businesses). Bristol, Aldershot and Cambridge make up the rest of the top 5 (see Figure 2).

Figure 2: The top performing cities reflect regional performance

| # | City | Share of the UK’s Space Economy businesses | Share of all UK businesses | Difference (percentage points) |

|---|---|---|---|---|

| 1 | Edinburgh | 2.3% | 0.7% | 1.6 |

| 2 | Bristol | 2.3% | 1.1% | 1.2 |

| 3 | Aldershot | 1.3% | 0.3% | 1.0 |

| 4 | Cambridge | 0.9% | 0.2% | 0.7 |

| 5 | Glasgow | 1.9% | 1.2% | 0.7 |

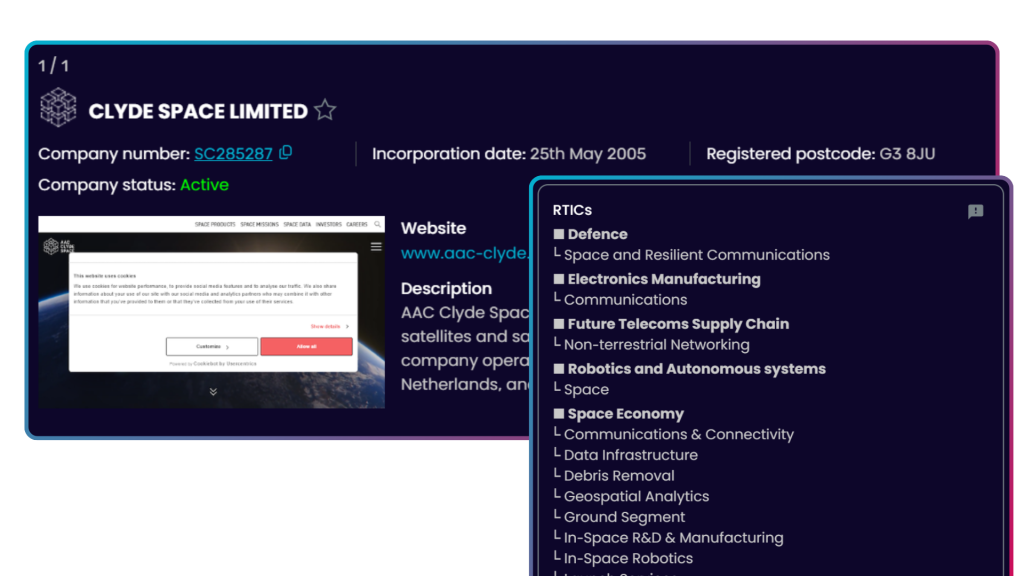

The FT article centres in on AAC Clyde Space, a company that employs 93 people according to its last accounts. The Standard Industrial Classification (SIC) code does assign it to spacecraft production. But as both the FT article and our Real-Time Industrial Classifications (RTICs) show, this only scrapes the surface of the innovative things they do (see Figure 3).

Figure 3: AAC Clyde Space do a whole range of space-related activities

The most impressive performance of all, though, does not go to an urban local authority. The Vale of White Horse in Oxfordshire has close to 80 businesses operating in Space Economy – 2.4% of the sector. Many of them are based on its Harwell Science and Innovation Campus.

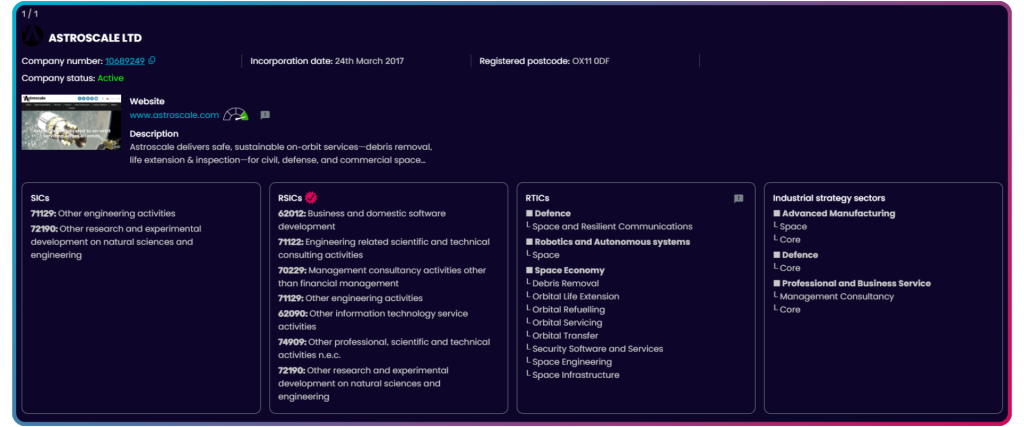

An example is Astroscale, which provides a number of services to satellites while they are in orbit (see Figure 4). Not that you’d know it from its SIC code.

Figure 4: Astroscale provide services that are out of this world

Scotland has got cause for optimism

While it’s not uncommon for the sector goals of places to feel more like pipe dreams than achievable goals, the data shows that Scotland has got a lead in the Space Economy. Scotland is certainly one of the leading parts of the UK, but it still has much work to do if it is to catch up with the South East of England.

For more insights into the UK’s space economy and what companies do, sign up for a free trial of our Industry Engine platform today.