PropTech is one of the most exciting parts of the modern UK economy. It’s where real estate, data, software and automation collide. It covers everything from AI driven valuation tools to energy optimisation systems inside smart buildings. If it touches how we build, operate, manage, or invest in property, it sits somewhere inside this sector.

Why does it matter? Because the built environment drives productivity, net zero progress, housing affordability, and the UK’s ability to attract investment. PropTech is where many of the solutions to these challenges are being built. The sector is expanding fast, and until now it has been difficult to see it clearly. Traditional SIC codes bury it under labels like “management consultancy” or “other service activities”, obscuring the real story.

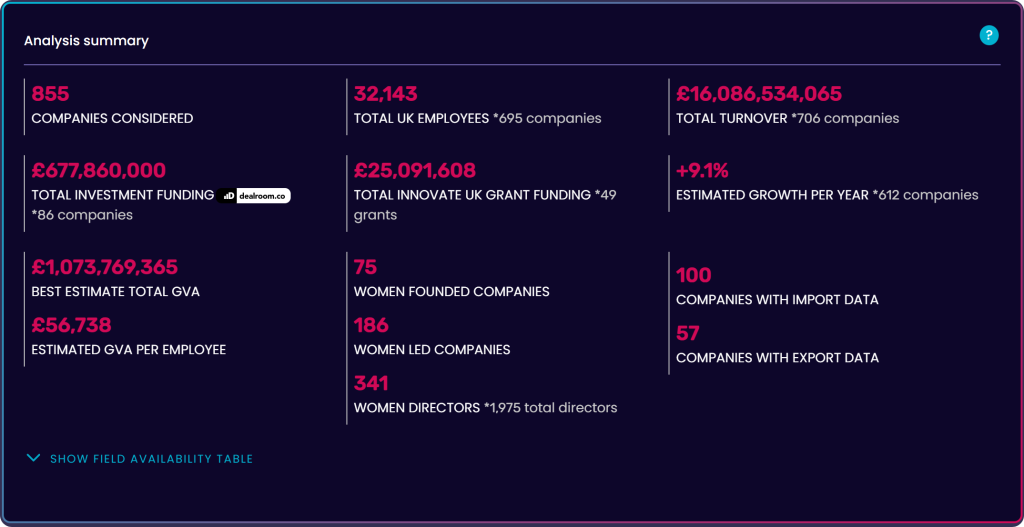

At The Data City, we classify companies in real time using website text and machine learning. Our Real Time Industrial Classifications (RTICs) give a clear picture of what PropTech looks like today, not what it looked like in 2007.

We’ve recently launched our ALPHA PropTech RTIC, which maps the UK’s PropTech landscape. You can learn more about what an ALPHA RTIC is in our blog to Introducing alpha RTICs

Let’s bring the fog down and show you the sector as it really is.

The PropTech RTIC: four core verticals

We classify the sector into four key verticals:

- Construction and development – Tech that supports planning, design and delivery of real estate and infrastructure.

- Property management and leasing – Software and platforms that streamline buying, selling, letting and property operations.

- Real estate investment tech – Tools for analysing property markets, valuing assets and supporting investment decisions.

- Smart buildings and IoT – Connected systems that enhance sustainability, energy efficiency and occupant experience.

Now the scene is set, let’s look at the companies reshaping the sector.

The top 10 fastest growing PropTech companies in the UK

Method: companies with more than 5 employees, growing above 20 percent per year, filtered using the PropTech RTIC in the Industry Engine.

1. ABEC

- Estimated growth rate: +215% per year

- Estimated turnover: £8.4m

- Location: Bracknell

ABEC is a major player in smart buildings. Their BMS and EPMS technologies sit inside complex commercial environments. They appear in SIC as ‘other construction installation’, which significantly under-represents the sophistication of their work.

Registered in Cheltenham, ABEC are an OECD start up with an estimated employee count of 98. Abec undertakes major projects, engaging during the construction or refurbishment phases of a building’s life to install a new bms service.

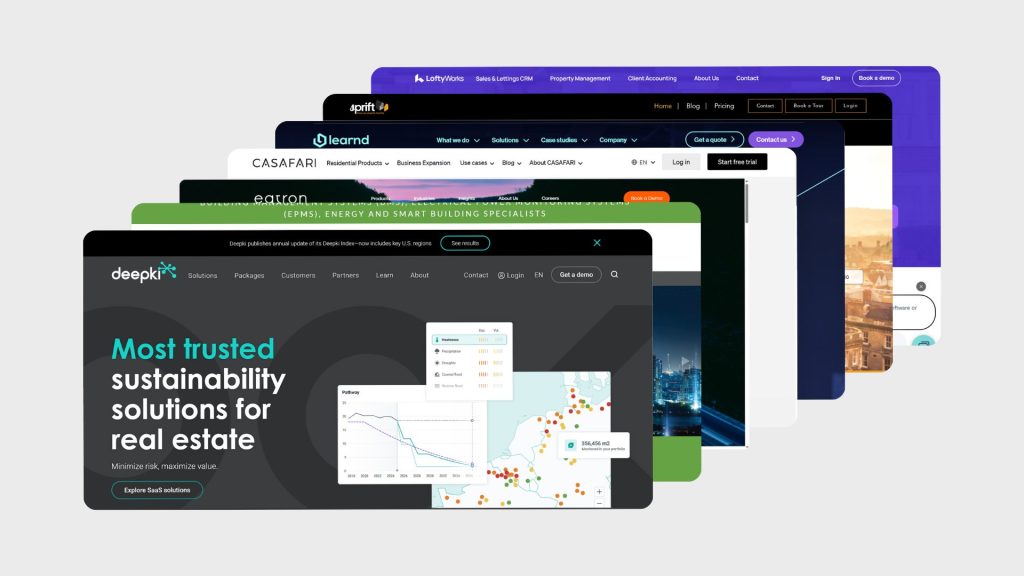

2. Deepki

- Estimated growth rate: +172% per year

- Estimated turnover: £6.5m

- Estimated total funding: £111,590,000

Deepki helps real estate owners track emissions and hit sustainability targets. Founded in 2020, in the last three years they have received an estimated £111,590,000 in funding. On our platform, they’re classified under two RTICs: ESG and PropTech.

3. Casafari

- Estimated growth rate: +151% per year

- Estimated turnover: £9.4m

- Location: Camden, London

Casafari runs one of Europe’s largest property data platforms. It aggregates property listings from over 30,000 portals and agency websites, offering professionals access to the largest and cleanest real estate database in the regions that it operates in.

They have an estimated growth per year of +151% and an estimated turnover of £9.4 million. On our platform they’re classified in two RTICs, PropTech and Software as a Service (SaaS).

4. PropertyLoop

- Estimated growth rate: +142%

- Estimated turnover: £1.2m

- Location: Enfield, London

An online lettings and management platform with a strong London presence. SIC places them as “real estate agencies”, missing their automation and digital services.

Incorporated in October 2019, PropertyLoop is a UK-based online estate agency that connects landlords with tenants through a streamlined digital platform.

They have a best estimate growth percentage per year of +142% and an estimated employee count of 25.

5. BG Energy Solutions

- Growth rate: +118% per year

- Estimated turnover: £15.1m

- Funding: Acquired by Learnd in 2024

Part of the wider Learnd group, they specialise in energy optimisation inside commercial buildings. Their SIC code lands in generic “electrical installation”, hiding their IoT work.

Their platform integrates data from various systems to provide real-time insights, remote monitoring, and support, enabling clients to cut costs, boost uptime, and progress towards net zero goals.

They have a best estimate growth percentage per year of +118% and an estimated turnover of £15.1 million.

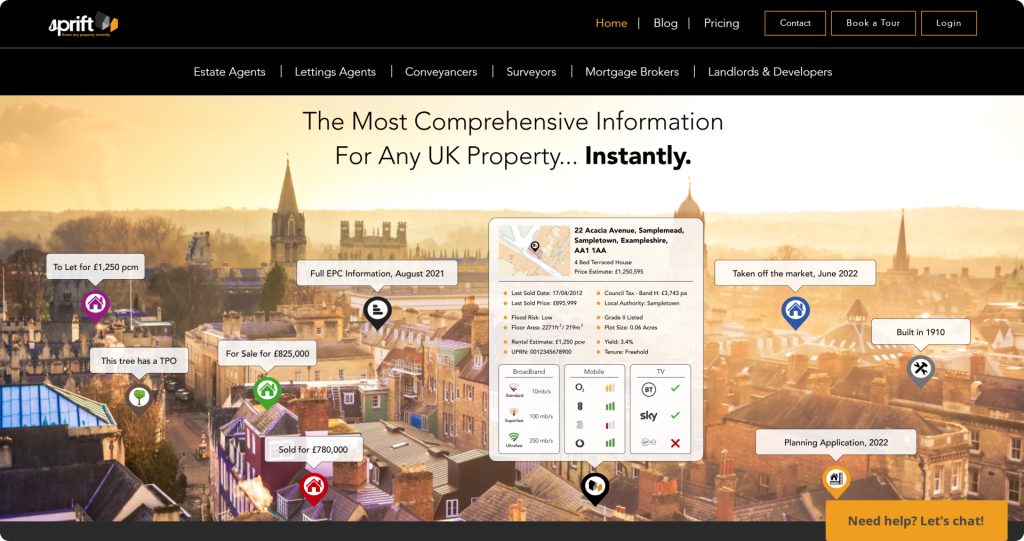

6. Sprift

- Growth rate: +109 percent per year

- Estimated turnover: £4.8m

- Estimated employees: 44

Sprift’s platform covers more than 29.5 million UK properties. They offer estate agents, conveyancers, and other professionals comprehensive reports, EPC (Energy Performance Certificate – from A-G ratings, indicating how energy efficient a building is) ratings, and market insights to streamline transactions, save on research time, and improve client engagement through interactive dashboards and white-labelled content.

Based in Hackney, they have a best estimate growth percentage per year of +109% and have an estimated 44 employees.

7. Hubexo

- Estimated total funding: £31.8m

- Estimated employees: 220

- Location: Newcastle Upon Tyne

Known for NBS Source and NBS Chorus, this team helps construction professionals specify products. SIC places them under “architectural activities” even though they operate as a digital specification SaaS platform.

A women-led business, Hubexo north uk limited also known as NBS are based in Newcastle Upon Tyne. Their platform helps architects, engineers, and construction professionals find and specify building products they need more effectively. Their tools, NBS Source and NBS Chorus, make it simple to search for products, write specifications, and collaborate on projects.

8. AIRC Digital

A micro business working at the frontier of Scan to BIM automation. Their SIC entry as “architectural activities” undervalues the role they play in construction digitisation.

- Estimated growth rate: +100% per year

- Estimated turnover: £103.6k

- Registered location: London, UK

Airc.digital is a micro technology company specialising in Building Information Modelling (BIM) and digital solutions for the architecture, engineering, construction, and operations (AECO) industry. Their services streamline the Scan-to-BIM process, notably through their SnapTwin platform, which converts point cloud data into IFC models, helping clients save time, reduce costs, and improve collaboration across projects.

Although a micro company they have a best estimate growth percentage per year of +100%.

9. LoftyWorks

A property management platform that handles CRM, lettings and payments in one place.

- Estimated growth rate: +92.2% per year

- Estimated turnover: £1.3m

- Funding: Acquisition by Chime in September 2022

A property management platform that handles CRM, lettings and payments in one place.

Based in Horsham, LoftyWorks is a property management platform designed for estate agents, offering an all-in-one solution to streamline operations from lead generation to rent collection. It features tools for sales CRM, lettings, website creation, secure payment processing, and AI-powered automation. They have an estimated growth percentage per year of +92.2%.

10. Built AI Inc

- Estimated total funding: £2m

- RTIC vertical: Real estate investment tech

- Location: Westminster, UK

Built AI provides automated investment modelling and deal screening for real estate. Their SIC code appears as “business consultancy”, a classic example of where SIC obscures emerging industries.

Their platform automates financial modelling, deal screening, and market analysis, enabling faster and more accurate decision-making.

What this tells us about the UK PropTech sector

This ranking makes one thing clear. PropTech is no longer just a support function. It is a high growth, high skill, high complexity part of the UK economy, with clusters in:

- London

- The Northeast

- Sheffield

- The Southeast

The sector includes everything from low carbon retrofitting to AI powered valuations. Yet SIC codes hide most of it. PropTech companies commonly sit in unrelated SIC labels including:

- Management consultancy

- Electrical installation

- Other information service activities

- Activities of head offices

- Architectural activities

This is why accurate, real time classification matters. You cannot build policy, investment strategies or innovation support on broken foundations.

Looking ahead

PropTech is evolving at speed. Energy optimisation, automation, IoT integration and AI driven investment insight are becoming standard. The companies above prove that the next generation of the built environment is already here.

At The Data City, our ALPHA PropTech RTIC gives you a real-time, accurate view of this transformation as it happens.

Want to explore PropTech in real time?

With The Data City, you can see every company, every vertical and every growth signal inside the sector. Funding, geography, employment, SIC mismatches and more.

Sign up for a free trial and see the data for yourself.

Please note: The data from The Data City is accurate at the time the article was written but may change over time due to the dynamic, real-time nature of our data. For the latest insights, visit our platform.