At The Data City, we’ve always known that knowing what a company does is only half the story. Understanding where they do it and in what capacity can be the difference between clear, confident decision-making and skewed, incomplete analysis.

That’s why we’re introducing a new layer of clarity to our data: What companies do, where.

While we’re grateful for the data Companies House collects and encouraged by their new powers, it’s no secret that the UK lags behind international standards in key areas of company data, particularly when it comes to location detail.

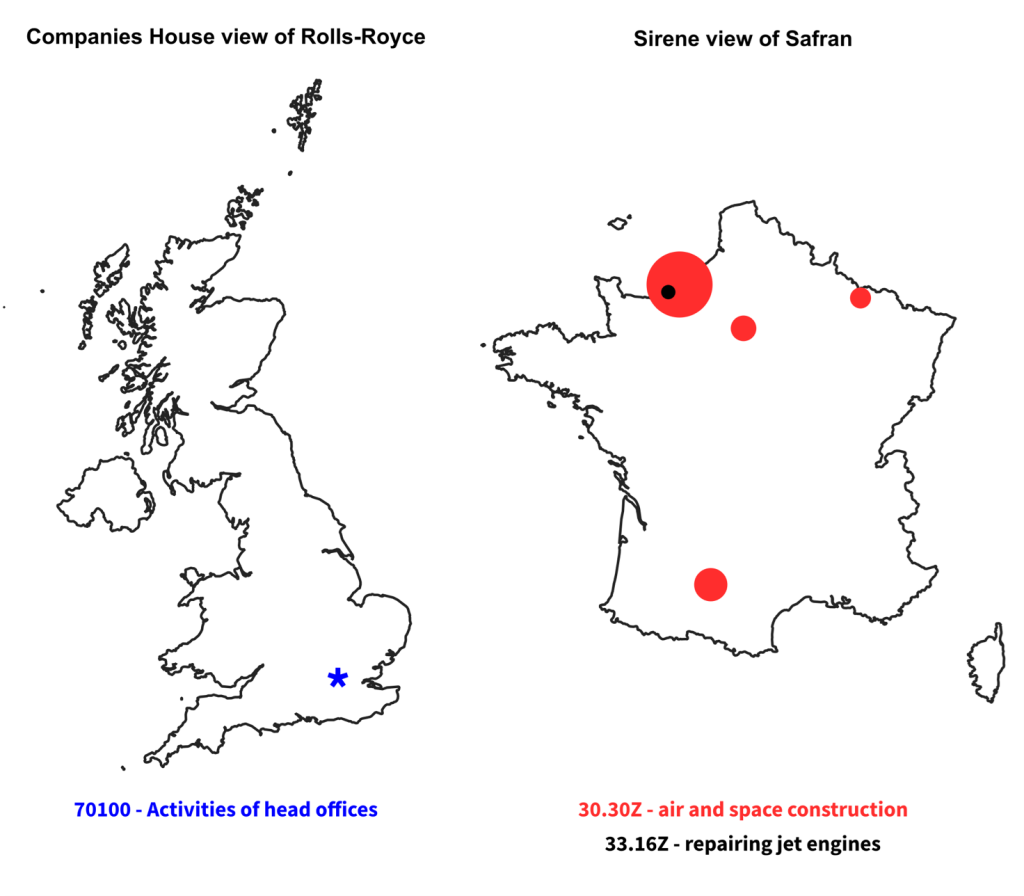

The chart above shows how Companies House compares to the French equivalent, Sirene. There are two main differences:

- UK companies only register a single address with Companies House.

Many companies, especially larger ones, have multiple operating locations. We estimate these operating locations by scraping their websites. Sirene records these locations as standard.

- UK Companies that operate internationally often report their global employee in their annual accounts.

In company accounts filed with Companies House it’s not clear how many employees are based in each region, or whether they’re based in the UK at all. We previously estimated the number of employees by region, by assuming that employees were split equally across operating locations.

In Sirene, information on company locations is provided, alongside an estimate of the number of employees at each location.

The differences set out above create challenges in analysing company data in the UK.

When the ONS and government agencies create Official Statistics, they use datasets such as the Interdepartmental Business Register (IDBR) which estimate how employees are split across the operating locations of companies. But access to these datasets for those outside of government is difficult and comes with heavy restrictions on how the resulting data can be shared.

Introducing what companies do where

Until now we haven’t been able to estimate what companies do where, and in which capacity. With this update, we’re introducing data that answers this question.

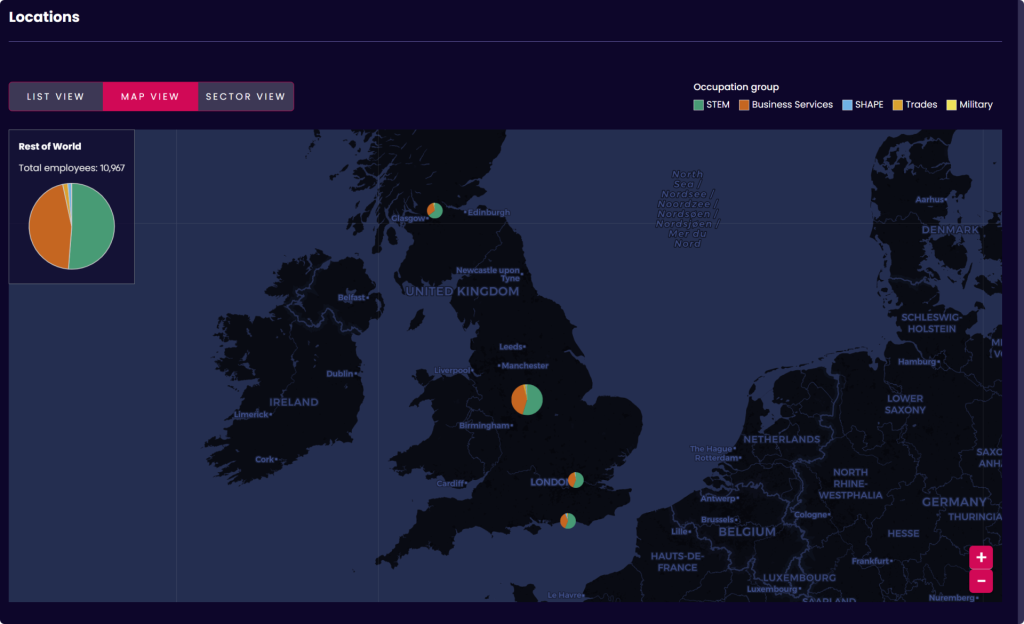

By combining website-derived operating locations with data from Lightcast, our platform now estimates not just where companies are, but what kind of work happens at each site – STEM roles, production, R&D, and more. You’ll now see a more accurate picture of how multinationals like Rolls-Royce, AstraZeneca, and Unilever operate across the UK – and how regional clusters truly function.

This update empowers anyone using our platform to go beyond registered addresses and access real, usable insights about regional economic activity. Whether you’re analysing local labour markets, evaluating sector strengths, or identifying investment opportunities, our data just got smarter, and your decisions just got sharper.

Let’s get into the details…

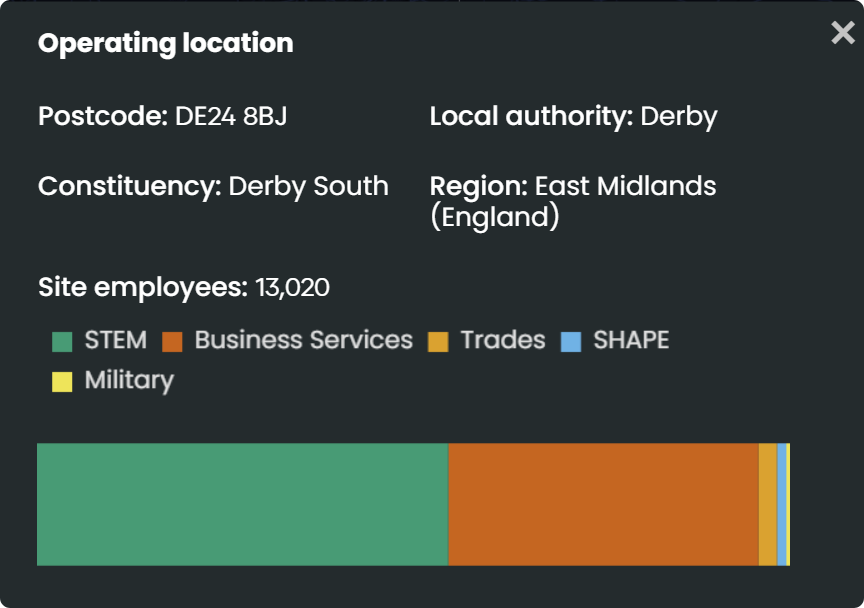

Rolls-Royce are a UK automotive, aerospace, and energy-systems company headquartered in London with a significant presence in Derby. Further sites are picked up in our analysis based on operating locations we find declared on company websites and we are focusing on improving this data.

On Rolls-Royce’s company page in our Industry Engine, we can now see:

- The proportion of their employees in the UK, vs the Rest of the World. This is a huge improvement in our understanding of UK employment of multinational companies.

- For each location, how many employees we expect there to be. For example, while London is their registered headquarters, Derby is by far Rolls-Royce’s biggest site and this is now correctly reflected in our data.

- The types of employment at each location. We can see that STEM activity predominately happens in Derby. In fact, Derby is the predominate home of Rolls-Royce’s global STEM operation. There are estimated to be 7,110 STEM employees in Rolls-Royce’s Derby location. This compares to 5,620 STEM roles in the rest of the World.

Runnymede’s AI Cluster – What this means for your sector analysis

Going back to the challenges we set out comparing Companies House to Sirene, we know that assigning all of a company’s employees to its registered location can be wrong. If this assumption is not manually corrected, it can give a distorted view of the location of economic activity in the UK. Because this challenge stems from a limitation of Companies House data, it is a common problem in many analyses, and across many data providers.

To reduce the impact of this limitation, we previously estimated the number of employees by assuming that employees were split equally across all known operating locations of a business. This was a helpful assumption, and a big improvement on assuming that all employment was at the registered address, but it was not without caveats. Most importantly, for global companies we weren’t able to say how many of the employees they reported in their annual accounts were based in the UK.

Data on what companies do where is helpful for understanding what individual companies do, but it will also help correct regional analysis for sectors across the board.

As an example, let’s look at the small local authority of Runnymede.

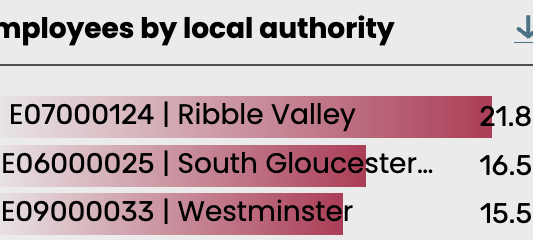

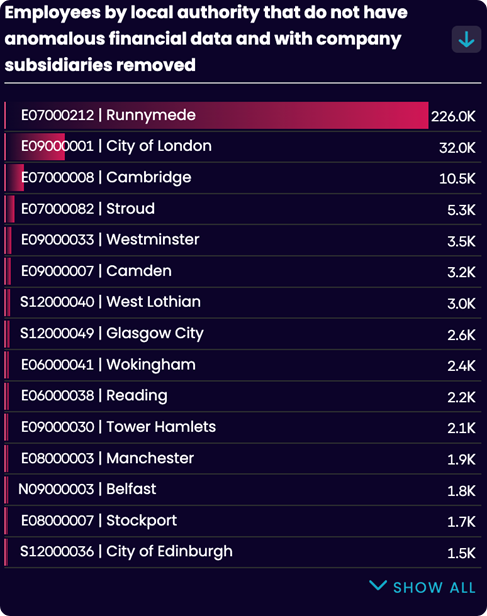

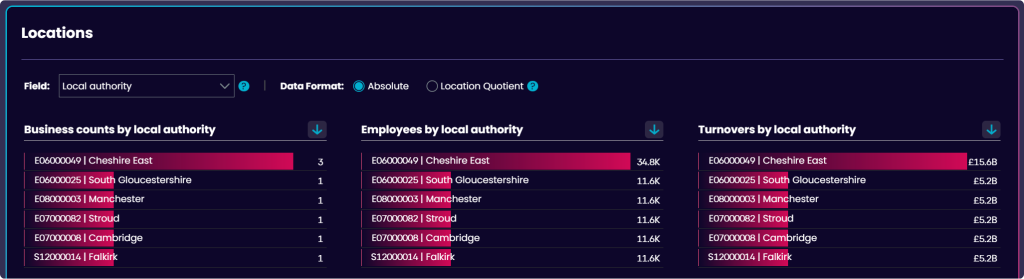

The chart below shows the employees by local authority for our Artificial Intelligence Technologies and Applications RTIC from an older version of our platform. Runnymede has by far the greatest number of employees.

Previously we’ve advised customers to manually sense-check large companies in their analysis and work to remove and amend misleading data. In this case, our users checking which AI companies are in Runnymede would see that there is only one employer.

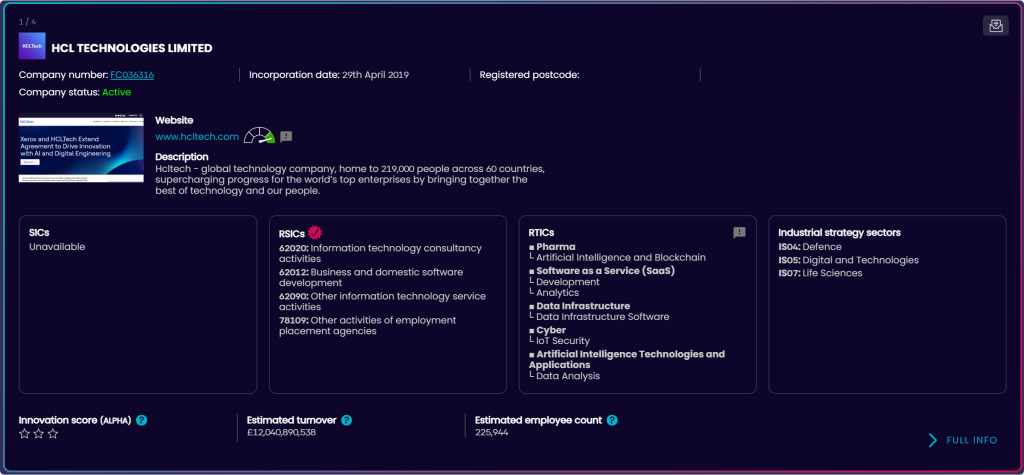

HCL Technologies is a very large multinational registered in Runnymede which reports having 225,000 employees in its annual accounts filed with Companies House. Previously, all 225,000 employees would be assigned to their one location, in Runnymede.

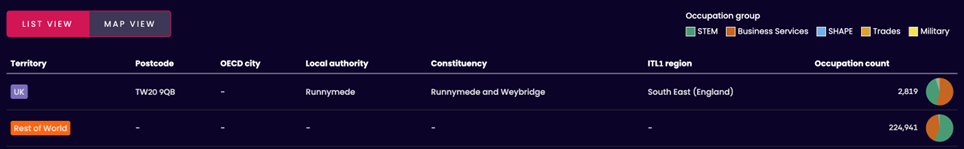

In reality, only 2,800 of HCL’s global employees are based in the UK.

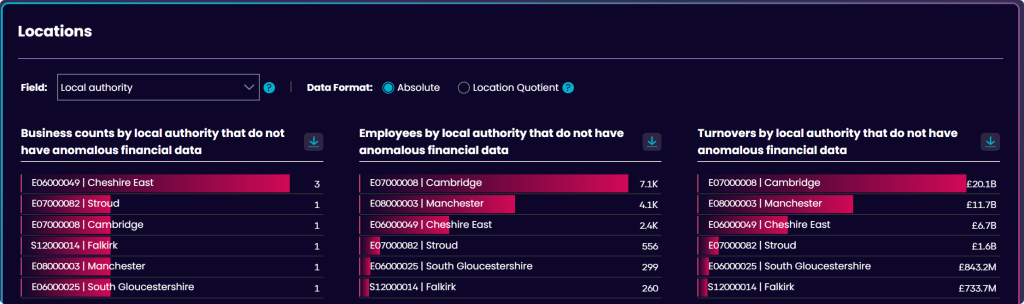

With our new improvements, our regional estimates of employment in the AI sector in the UK are much better.

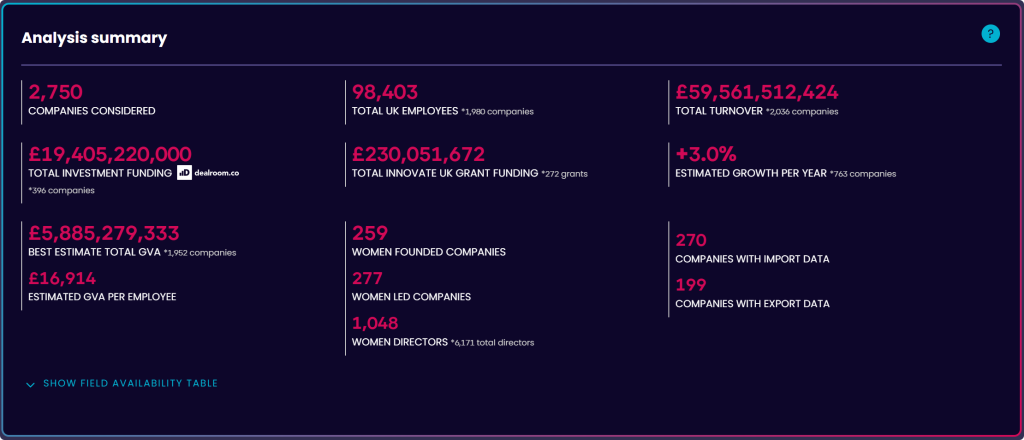

Incorporating the data we have on what companies do where, we get a better understanding of the UK-based impact of the AI sector. Specifically, we estimate there are 98,403 UK employees in the AI sector, compared to 341,000 globally, previously.

How does this work and what are the next steps?

We use data from Lightcast to estimate the distribution of employees regionally and across occupations. This works very well for many companies, as shown in the examples above and hugely improves our employee estimates. This data is already permitting wider use of our data than before by more of our partners, such as the creation of more detailed economic forecasting methods by Oxford Economics.

The data can also have an impact beyond the estimated number of employees by region. The table below shows how we’re thinking of integrating this data further. The update to how we estimate employees is live in the product.

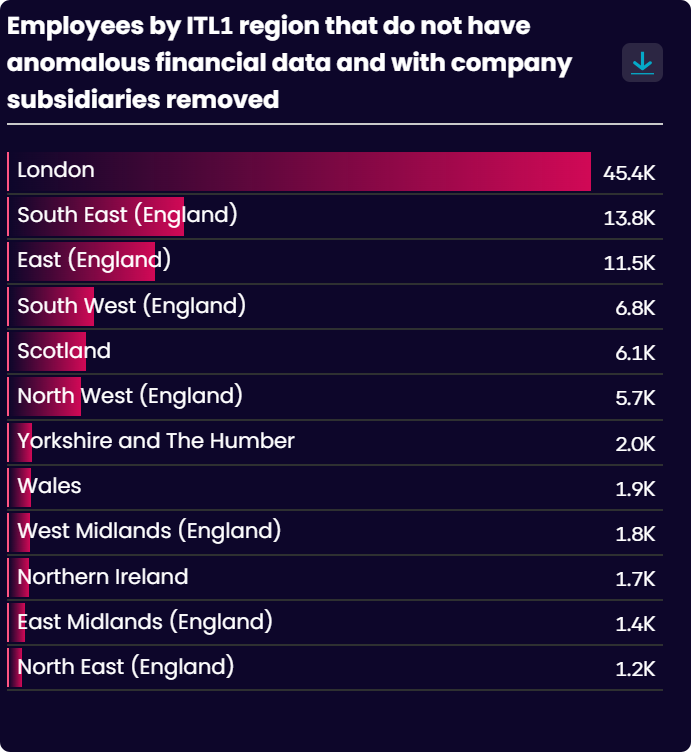

The first change is in a new estimate of total UK Employees in the analyse summary box. The second change will be seen when you analyse employees by location (local authority, constituencies, LEPs, ITL1 and ITL2 regions).

We have applied this data elsewhere in our product, firstly in our GVA estimates and secondly in our estimates of turnover by location. GVA values have been updated and will now be more specific to the UK.

For turnover, we’re using a new method to split turnovers across locations. Before we split turnover equally across each location. Below is an example of what that looks like analysing AstraZeneca.

We now split a company’s declared turnover using the proportion of employees we estimate to be at each location. For AstraZeneca, this means we estimate Cambridge contributes to a greater proportion of employees and turnover than before.

With employees, we’re also now able to say what proportion of employees are based abroad. Unfortunately, we’re not able to do the same with turnover and we acknowledge that we may be allocating foreign turnover to locations in the UK, for companies that report their global turnover in their accounts.

Want to see what companies, do what where?

This update is now live in our platform, ready to support smarter decisions, sharper insights, and stronger strategies. Whether you’re mapping innovation clusters, correcting regional distortions, or just trying to get a clearer view of economic activity, our data now does more of the heavy lifting.

Sign up for a free trial or reach out to the team.

Please note: The data from The Data City is accurate at the time the article was written but may change over time due to the dynamic, real-time nature of our data. For the latest insights, visit our platform.