In 2022, the OLS reported that there were 1084 sites associated with the core Biopharmaceutical industry across the UK1. Using these same industry definitions The Data City has found over 1400 companies that are active today in Biopharmaceutical, specialising in R&D and manufacturing of 6 verticals: therapeutic proteins, antibodies, blood and tissue products, advanced medical therapy products, vaccines small molecules.

These companies make up our Real-Time Industry Classification (RTIC), a list informed by web scraped data and updated through our machine learning training set.

Understanding each vertical within this RTIC and the companies that illustrate them first requires an overview of where they are based and how this relates back to 2022’s findings.

What is Biopharmaceutical?

The biopharmaceutical industry is a sector of the life sciences focused on developing medical treatments using biological processes and living organisms, rather than traditional chemical synthesis. It includes therapies like therapeutic proteins, monoclonal antibodies, vaccines, gene and cell therapies, and advanced small molecule drugs.

These treatments are used to address complex conditions such as cancer, autoimmune diseases and rare genetic disorders. Unlike conventional pharma, biopharma is highly research-driven and innovation-led, relying on advanced manufacturing techniques and strong ties to academic and clinical research.

Spacial insights

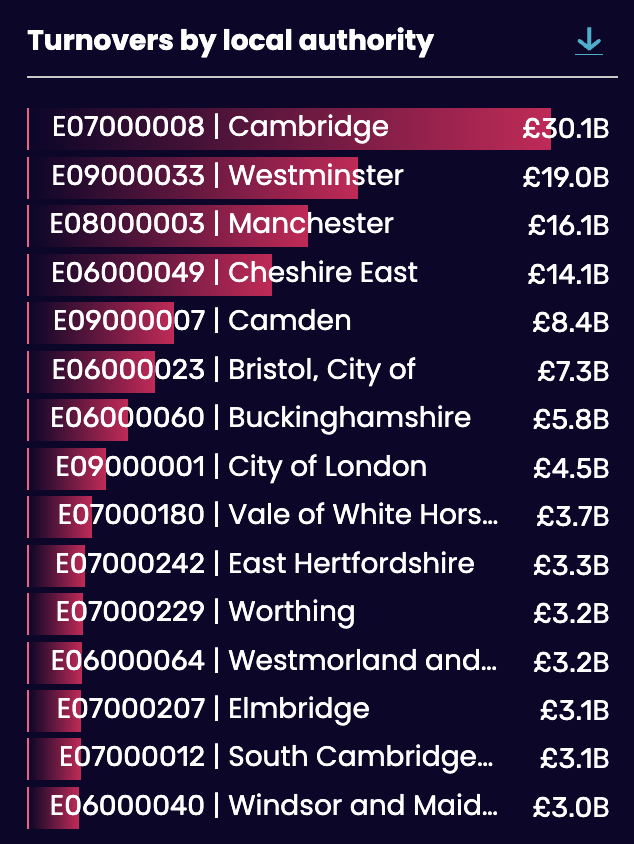

With a dense clustering of businesses around London and Cambridge, the South East is still the region with the highest turnover, the latter still remaining in the highest performing local authorities. Whilst regionally still second to the East and South East, as was the same in 2022, standout local authorities in the North West are competitively performing in the Biopharmaceutical industry.

Cheshire and Manchester contributed the 3rd and 4th highest turnover by local authority, and the companies active here are both on the cutting edge of innovation and responsible for driving the industrial growth nationwide.

With offices in Macclesfield, Cambridge and London, AstraZeneca’s UK subsidiary has the highest turnover by year and is joined in the North West region by other high performing multinationals such as Novartis and Chiesi.

South Eastern industrial power can also be defined by its high performing multinationals, with examples being Amgen’s presence in Cambridge, GSK’s Headquarters in London, Pfizer’s headquarters in Surrey and such as Oxford Biomedical and Vertex contributing to Oxford’s regional importance.

Outside of the multinationals that also define importance in the South East, the North West’s success can be understood through the growth of smaller companies pushing the boundaries across all five of the verticals that define the industry. With strong funding from Innovate UK, these are companies carving new frontiers in the UK’s Biopharmaceutical industry.

Companies carving new frontiers in the UK’s Biopharmaceutical Industry

Daresbury Proteins Ltd – Therapeutic Proteins

Daresbury Proteins focuses on producing high-value therapeutic proteins, including recombinant and blood factor-based biologics. A key innovation lies in their ability to create stable mammalian cell lines —engineered cells that can continually grow and reliably produce complex proteins that bacteria or yeast often cannot. To ensure consistency, they also generate master cell stocks, frozen reserves of these engineered cells that serve as a standardised ‘starting point’ for large-scale protein production. Combined, these tools allow Daresbury to rapidly and reliably manufacture the protein reagents and biologics that advanced therapies rely upon.

Based at Sci-Tech Daresbury in Warrington and a recent recipient of Innovate UK grant funding, the company is firmly embedded in one of the UK’s leading science and innovation campuses.

Thermo Fisher – Antibodies

Thermo Fisher excels in antibodies, offering over 250,000 validated options for research and diagnostics. Their GeneArt platform allows researchers to design antibody genes precisely, including modifying regions to improve binding to a target antigen. Not only does this speed up the early stages of antibody discovery, where multiple variants need to be tested, but their platform technology can optimise the DNA sequence for the host system; ensuring that this antibody is efficiently produced in cells and able to be harvested.

By speeding up antibody design and optimisation, GeneArt is pioneering the time it takes to develop new medicines, ensuring patients with diseases like cancer or autoimmune disorders can get effective treatment quicker.

Thermo Fisher Scientific also has major operations in Runcorn, Cheshire, and the company has received Innovate UK funding in the last three years.

Orbsen Therapeutics – Blood and Tissue

Orbsen Therapeutics develops living stromal cell therapies (ORBCEL-M™ from bone marrow and ORBCEL-C™ from umbilical cord tissue) to help the body repair itself. Delivered via intravenous infusion, these cells are in trials such as NEPHSTROM, which aims to slow or reverse kidney damage in diabetic patients, and REALIST, which is testing their potential to treat acute respiratory distress syndrome (ARDS), a life-threatening lung condition.

Though based in Ireland, Orbsen’s presence in Cheshire connects them with Manchester’s research ecosystem and they received Innovate UK funding for the application of their technology in Birmingham.

Infex Therapeutics – Advanced Medical Therapy Products

Infex Therapeutics develops small molecule therapies to combat critical infections, focusing on bacteria that are increasingly resistant to antibiotics. Small molecule products remain one of the largest verticals in the RTIC and involve the creation of chemically manufactured compounds that can block or switch biological processes beneath the cellular level. To illustrate, a pipeline product they are producing is MET-X, a small molecule that attacks the specific enzymes found in Gram-negative bacteria that protects them against antibodies. Where traditional treatments would otherwise fail, Infex’s precision small molecules represent a new strategy to outsmart some of the toughest pathogens in modern medicine.

They are based in Cheshire’s Alderley Park: the UK’s largest single-site life sciences campus, home to over 250 science and technology companies. As a national hub for Biopharmaceutical innovation, it provides the facilities, investment, and collaborative ecosystem needed to accelerate drug discovery and development.

TheraCryf – Small Molecules

TheraCryf innovates in low-molecular-weight drugs that can cross cell membranes to reach intracellular targets. Their lead candidate, SFX-01, is a stabilized form of sulforaphane, a natural compound found in broccoli that is known to activate cellular defence pathways. They target Nrf2 which can induce antioxidant and anti-inflammatory gene transcription, helping cells resist stress and damage. By stabilizing this otherwise fragile molecule, TheraCryf has turned a dietary chemical into a reliable therapy for hard-to-treat cancers such as glioblastoma.

As a spin-out from the University of Oxford, now based at Alderley Park, TheraCryf illustrates the strength of the UK’s academic-to-industry pipeline. These kinds of spin-outs transform world-class university research into therapies with real patient impact, while contributing to the UK’s position as a leading global hub for Biopharmaceutical innovation.

CSL Seqirus – Vaccines

CSL Seqirus, part of the global biotech leader CSL, runs the UK’s largest influenza vaccine manufacturing facility in Speke, Liverpool. Producing more than 50 million flu doses each year, they are on the frontline of pandemic preparedness. Capable of scaling for responding to pandemic threats, their Liverpool site anchors the region as a growing life sciences hub.

New companies

Where the sector wide view conducted by OLS in 2022 was extensive, others have since been identified by The Data City as companies contributing to Biopharmaceutical’s regional hotspots.

TrophiCell

Born out of the University of Liverpool, TrophiCell is a spin-out advancing a new generation of stem cell therapies. TrophiCell focuses on ‘trophic repair’, harnessing the natural ability of mesenchymal stem cells (MSCs) to secrete factors that reduce inflammation and promote tissue repair. With a patented production method, the company can reliably generate cell-based treatments for chronic diseases such as osteoarthritis and liver disease.

Galytx

This University of Liverpool spin-out is developing galectin-3–targeted therapies, or therapies that inhibit this carbohydrate-binding protein that is associated with tumour growth, tissue scarring, and chronic inflammation. Backed by Liverpool’s Enterprise Investment Fund, Galytx has already licensed these therapies for use in treating atopic dermatitis.

Other notable companies

BlackfinBio

This University of Sheffield spin-out is developing AAV gene therapies for ultra-rare childhood neurological diseases. Building on decades of expertise at the Sheffield Institute for Translational Neuroscience, the company is advancing BFB-101 for Hereditary Spastic Paraplegia Type 47 (SPG47), with FDA designations secured and a first-in-human trial planned.

CoED Biosciences

This Bristol based biotech start-up is transforming adoptive cell therapy (a treatment that uses a patient’s own immune cells to fight disease) with its patented CoED platform. This one-step system can separate, prepare, and grow immune cells without the usual complex equipment, bringing the entire workflow into a single, more efficient unit.

Explore the Biopharmaceutical RTIC and see the full map of innovation in real-time.

The Biopharmaceutical industry isn’t just a cluster of multinational giants. It’s a living, evolving ecosystem – powered by the kinds of companies you’ve just read about. From stem cell spinouts in Liverpool to global vaccine production in Speke.

But these stories are only a small part of the bigger picture. Our Biopharmaceutical RTIC goes beyond headlines, uncovering every business that’s shaping the future of advanced medical therapy, antibody development, vaccine innovation and more. If you’re planning investments, designing policy, or simply want a clearer view of the UK’s biopharma landscape – this is where you start.