The Creative Industries have been measured using SIC codes since 1998, giving policymakers a long-term view of sector growth. But this stability comes at a cost. SICs were built for a different era they miss key areas like gaming, overlook creative roles embedded across sectors, and rely on self-selected, often vague codes. As creativity increasingly overlaps with technology, traditional classifications can’t keep up, distorting the real picture of the modern creative economy.

That’s where The Data City steps in. Our Real-Time Industrial Classifications (RTICs) and Real-Time SICs (RSICs) reveal a clearer, more accurate view of the sector. When we apply the government’s creative definition but correct misclassified companies with RSICs, the story changes. And when we go further by using RTICs to surface new subsectors like CreaTech – we expose the frontier of the creative economy that standard datasets miss.

This frontier lens is particularly important because the Creative Industries are one of the UK’s eight Government-designated frontier sectors (IS-8) – areas expected to drive the next wave of economic growth and innovation. Yet the data used to understand them still relies on frameworks that haven’t been updated since 2007. Without real-time industrial intelligence, policymakers and investors risk making decisions with an incomplete or outdated picture.

This blog spotlights the IS-8 Creative Industry – what the official definition says, where it falls short, and how our real-time data reveals a more accurate picture of the companies driving the sector today.

Sector summary

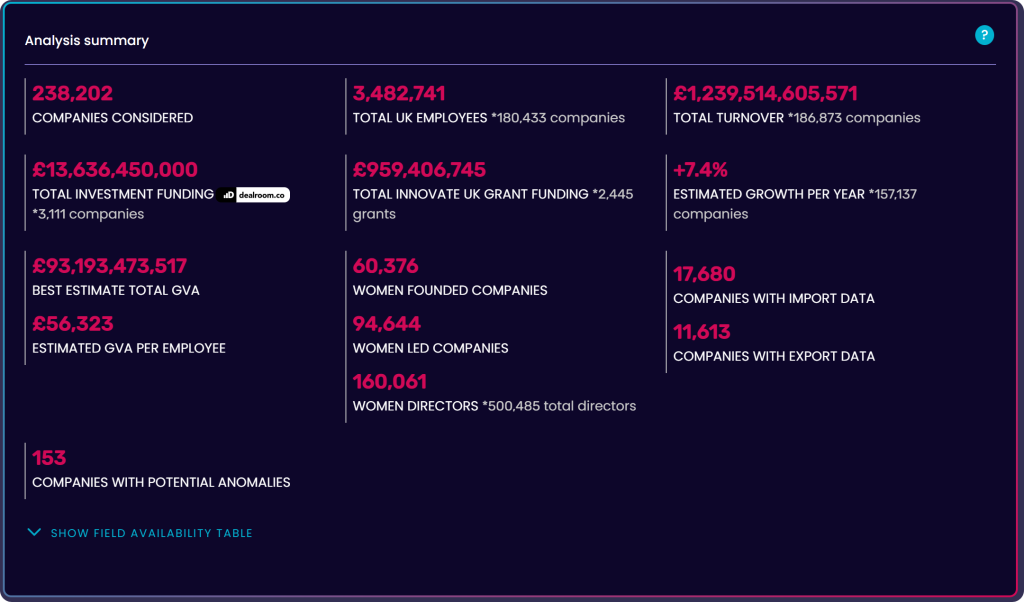

To look at this sector in more detail, we’ve used our own sector mapping of the IS-8 and applied some exclusion filters so we’re only looking at UK owned companies, that have a website match. Based on analysis of 238,202 companies, the IS-8 Creative Industries emerge as a large, economically significant, and fast-growing frontier sector. Here’s the headline picture:

The IS-8 Creative Industries represent one of the UK’s most dynamic and economically significant frontier sectors.

Based on a dataset of more than 238,000 companies, the sector generates extraordinary economic value, with £1.24 trillion in total turnover and an estimated £93.2 billion in GVA.

Productivity looks strong too, with each employee contributing an estimated £56,323 – reflecting the sector’s knowledge-intensive, high-skill foundation. The Creative Industries continue to expand at pace, with an estimated 7.4% annual growth rate, reinforcing why government has designated them as one of the eight frontier sectors expected to drive future economic competitiveness.

Within this sector, crossover with digital and media RTICs is a defining feature: the top three RTICs are Digital Creative Industries (17K companies), Agency Market (12.8K), and Media and Publishing (5.4K) – highlighting how creativity and technology increasingly operate hand in hand.

Location

When it comes to location, Westminster tops the list with 16.8K businesses, followed by Camden with 13K, making central London a major hub for business activity. Other London boroughs like Islington (8.3K), Hackney (8K), and the City of London (5.2K) also feature prominently, highlighting the capital’s dominance. Outside of London, Birmingham (5.8K) and Manchester (5.4K) lead, followed closely by Leeds, Edinburgh, and Bristol, each with over 4K businesses.

Employment

Employment within the IS-8 Creative Industries is substantial, encompassing 3.48 million jobs across the UK.

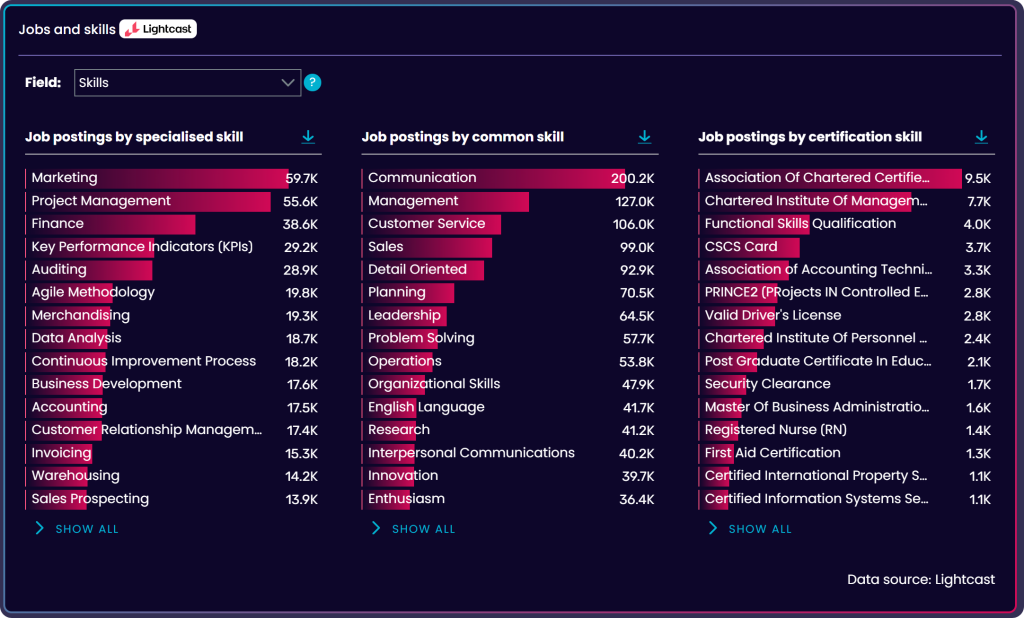

This makes the sector not only economically powerful but also socially significant, supporting millions of workers across fields such as design, media, advertising, film, architecture, digital content, and more. The sector’s reach extends well beyond traditional creative roles, with creative skills embedded across every corner of the economy.

Some of the most wanted skills in this sector are Marketing, Project Management and Finance.

Investment

Investment and innovation are central to the sector’s frontier status.

Companies in this space have attracted £13.64 billion in private funding, alongside £959 million in Innovate UK grant funding, reflecting strong public and private confidence in creative R&D. High-growth subsectors – particularly where technology and creativity intersect – benefit the most, signalling the expanding importance of CreaTech, gaming, digital media, and creative SaaS to the UK’s innovation landscape.

Women founded companies

The sector shows comparatively strong representation of women: over 60,000 women-founded companies, 94,000 women-led companies, and more than 160,000 women directors, making creativity one of the more inclusive parts of the UK economy – even though further progress is still needed.

Together, these figures reveal a sector that is large-scale, fast-growing, internationally connected, and innovation-led. The IS-8 Creative Industries not only reflect the UK’s cultural strengths but also its future economic potential – making accurate, real-time data essential for understanding and supporting the companies driving this frontier sector forward. Now let’s dig a little deeper into some of the highest growing micro companies that are also women-founded.

Women founded, high growth micro companies’ spotlight

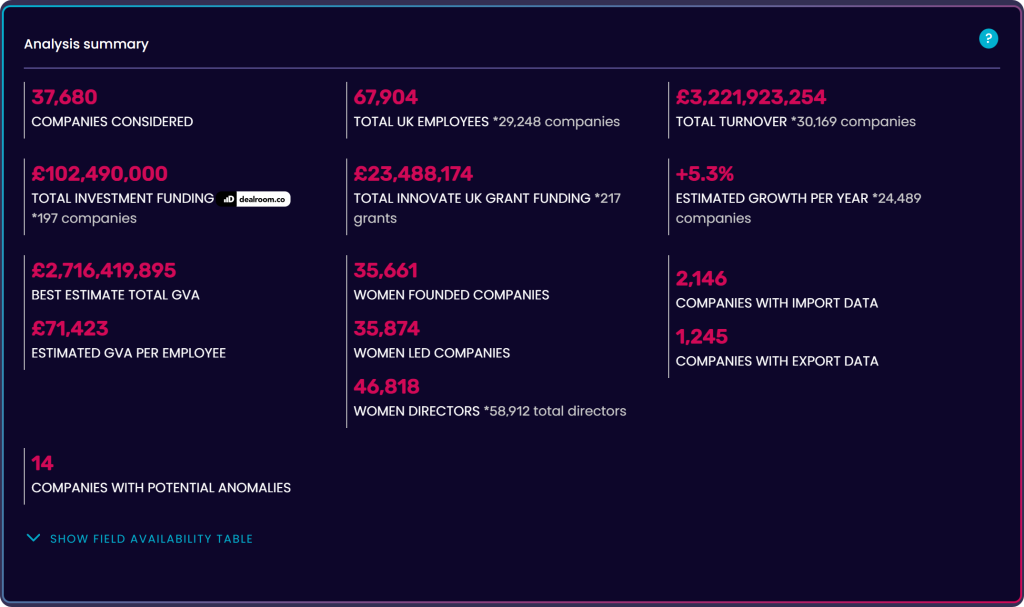

This dataset was found by using our skills and inclusion filter and selecting ‘Only women-founded’ companies and using the growth filters to find micro companies. There are 37,680 women-founded micro companies in the creative sector, revealing a rich and high-growth part of the economy.

Collectively, these businesses employ 67,904 people and generate £3.2 billion in turnover across just over 30,000 companies. The estimated GVA per employee is £71,423, with a total GVA of more than £2.7 billion. Funding is strong: £102.5 million in investment funding has been raised by 197 companies, while £23.5 million in Innovate UK grants has supported 217 projects.

Klowt

- Estimated growth rate: +232% per year

- Estimated turnover: £955k

- Location: Hackney

Founded by Ms Amelia Sordell in 2020, Klowt is a personal branding agency that helps founders and business leaders build strong, authentic brands online, particularly on LinkedIn

They work closely with founders, CEOs, and thought leaders, offering end-to-end support from brand positioning and content creation to strategy execution. From our platform we can see they employ an estimated 28 people and while there SIC codes are accurate, we have also placed them in our Agency RTIC: Branding.

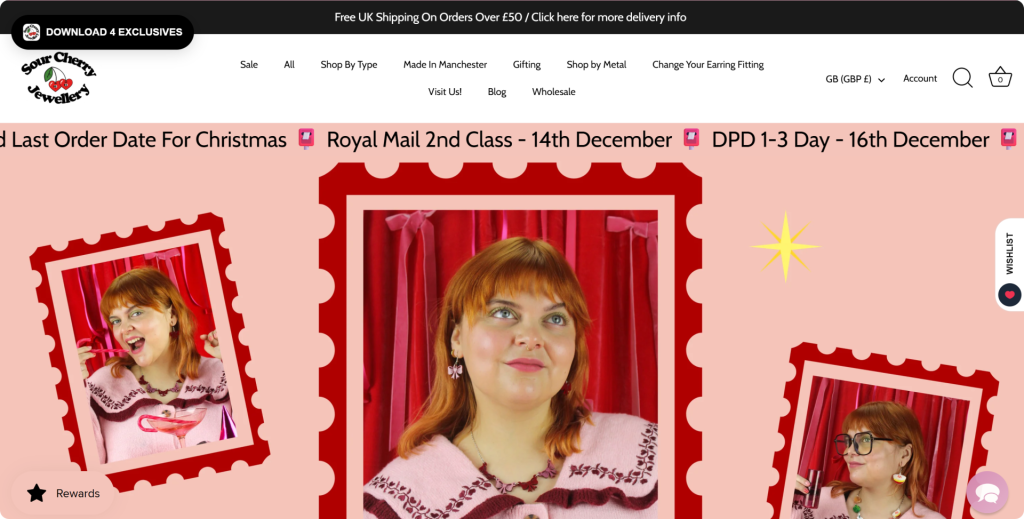

Sour Cherry

- Estimated growth rate: +73% per year

- Estimated turnover: £980k

- Location: Manchester

Founded by Miss Kayleigh Walker in 2009, Sour Cherry is an independent UK jewellery brand. Starting from a garage, it has grown into a small creative company with around 20 staff and two physical shops in Manchester’s Afflecks and the Leeds Corn Exchange. They employ an estimated 45 people. Their SIC code puts them in ‘32130: Manufacture of imitation jewellery and related articles’ but using our RSIC we’ve placed them in 6 SIC codes we think are better suited and they are:

- 47770: Retail sale of watches and jewellery in specialised stores

- 32120: Manufacture of jewellery and related articles

- 47910: Retail sale via mail order houses or via Internet

- 47190: Other retail sale in non-specialised stores

- 46480: Wholesale of watches and jewellery

- 47710: Retail sale of clothing in specialised stores

- 46900: Non-specialised wholesale trade

- 47990: Other retail sale not in stores, stalls or markets

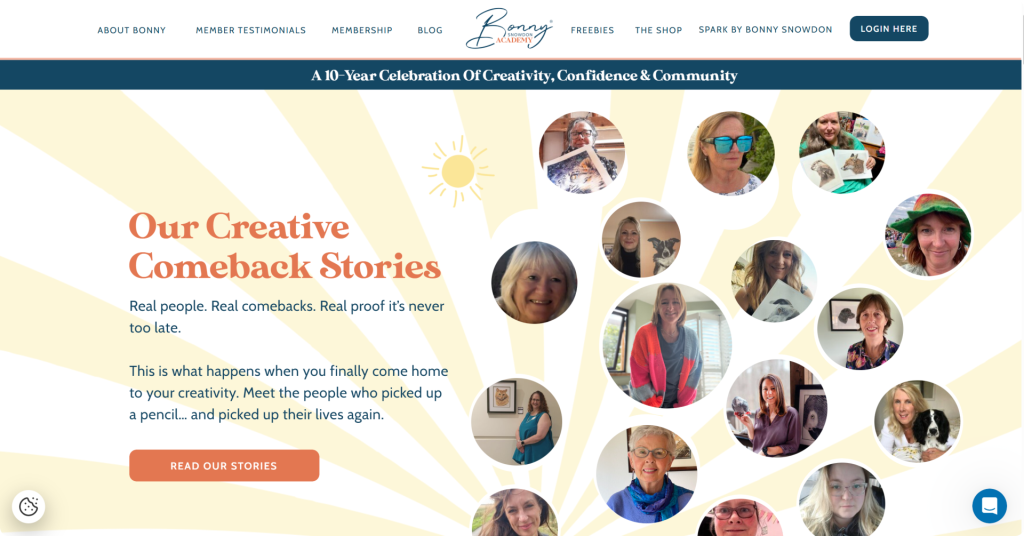

Bonny Snowdon Academy

- Estimated growth rate: +73% per year

- Estimated turnover: £158k

- Location: London

Bonny Snowdon Academy is an online art-teaching platform, run by the artist Bonny Snowdon, that helps people learn realistic coloured-pencil drawing – especially portraits, animals and other detailed subjects.

After rediscovering drawing later in life, Bonny turned her passion into a full-time teaching career and now offers structured courses, video tutorials, downloadable guides and a supportive membership community (called “Ignite”) aimed at everyone from complete beginners to experienced artists.

Their SIC code is ‘85590: Other education n.e.c.’ but our RSICs place them in the following SIC codes

- 90030: Artistic creation

- 85590: Other education n.e.c.

- 90040: Operation of arts facilities

- 85520: Cultural education

- 85600: Educational support services

- 90010: Performing arts

The Creative Industries are larger, faster-moving, and more diverse than traditional data shows

By combining government definitions with real-time data, we can surface the emerging subsectors, high-growth micro companies, and founders who are reshaping the UK’s creative economy from the ground up. The stories of companies like Klowt, Sour Cherry, and Bonny Snowdon Academy show the breadth of innovation happening at the frontier – from digital branding to handmade retail to creator-led education.

As policymakers and investors increasingly look to the Creative Industries as a driver of national growth, the quality of the data underpinning their decisions matters more than ever. Real-time classifications give us the clarity required to understand where potential is building, who is leading it, and how the sector is evolving in real time. And this is just the start.

Want to see more of how we define and measure the IS-8 sectors?

Download our latest IS-8 report which shows exactly how we’ve mapped each Industrial Strategy sector – using real-time data, not outdated classifications.

Curious to see the data for yourself?

Explore how real-time sector mapping works – and why SIC is no longer enough.