Update: This blog has been updated to reflect additional features added in our December 2025 release.

We’re updating how financial outliers are handled on the platform

Outliers can affect how you analyse companies and sectors. For the last 2 years we’ve been flagging identified outliers, but we’re changing how we do this.

We’ve written in the past about how financial outliers occur and the work that we’ve been doing to handle them and improve your analysis.

Previously we’d allow you to exclude companies that have outliers in their data. But in some cases, it’s hard to analyse a sector without that company being included. Say, for example, you wanted to analyse the defence sector, you typically would want to include BAE Systems. They are a large employer and a significant contributor to the UK’s defence sector.

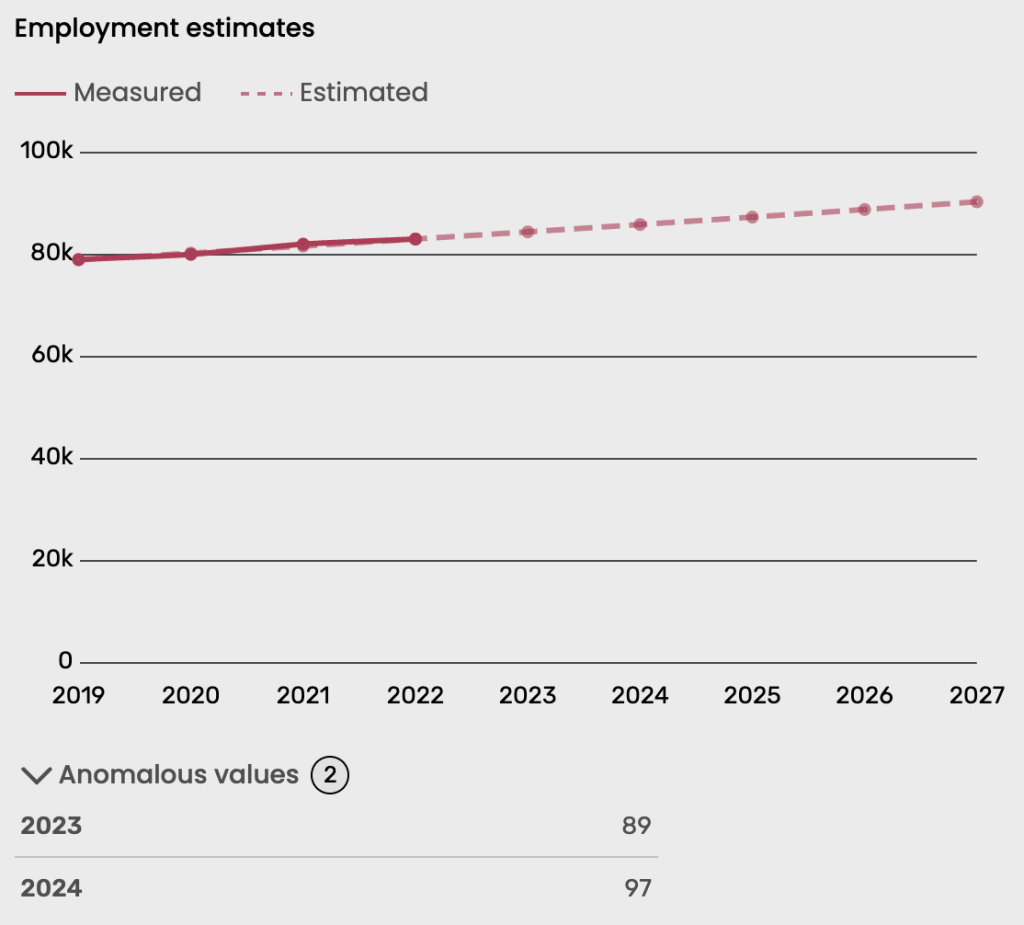

Below is a screenshot of BAE’s accounts, on our platform and you can see we have recognised that the last two years of BAE accounts are anomalies. However, it’s not easy to simply remove the company from analysis of the defence sector.

So we’ve changed how we use the outliers data. We now remove outliers before creating estimates. This means that you no longer have to decide whether a company should be included or excluded, based on outliers in its data. The chart below shows the effect of this change.

By removing the bad data, we can still produce an accurate estimate of how the company is performing. In the case of BAE systems, we now estimate they have 83,000 employees, meaning they can be kept in your analysis.

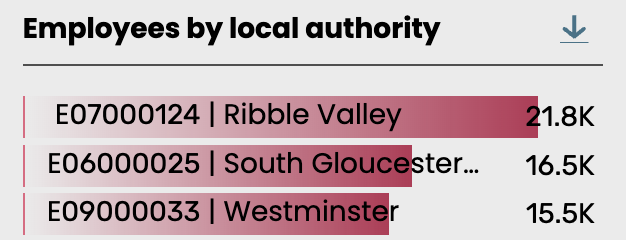

These changes filter up to sector analysis and will be particularly important for location-based analysis. This can be seen below. Ribble Valley was previously underestimated because of the outliers in BAE’s accounts.

16/12/2025 Update

We can now apply the same process to our turnover projections. Before our outlier model would tell us when something was wrong, but it now tells us whether it’s employees or turnover that is wrong.

How do you find this data?

This change is automatically applied for all companies.

For now, we’re leaving the old filters live on the platform. You can still inspect or exclude outliers, but the data should be better by default.

We’re working over the next couple of releases to improve our outlier data further and to make analysis easier and more accurate.

What’s next?

We’ve improved the model used to identify outliers and the outputs of this will go live in our December release. Keeping this model up to date with examples means that we can be on top of identifying anomalies in companies’ accounts.

Whilst we’re making these changes, some of the old filters will remain, but over time, we’ll move to outliers being removed from our estimates by default.

We’re looking into whether it’s possible to identify the reason accounts are anomalies – for example, is it the turnover value, is it the employee value, or is it something else? We also plan to look at whether group accounts can explain some of the anomalies we see.