In 2022, experts at the Satellite Applications Catapult (the Catapult) collaborated with The Data City to understand key emergent markets in the Space sector.

This collaboration led to the building of a comprehensive Space RTIC which identifies 22 different verticals within the Space ecosystem. The RTICs help in understanding sector growth as well as the impact of the Space sector on other sectors.

The Standard Industrial Classification system (SIC) has failed to capture these key emerging sectors in appropriate detail. This makes it difficult to accurately track the growth and impact of the Space sector. The Catapult aims to promote space and satellite enabled technologies to address challenges across non-space markets. To support this objective, the Catapult identified three emerging sectors (Autonomy & Robotics, In-orbit Servicing and Manufacturing (IOSM), and Space Energy) in the Space ecosystem that will likely become crucial players in the industry’s future. Innovative technologies and industry expansion make these sectors important for the future of Space exploration and utilisation.

Supervised Machine Learning

The Catapult adapted its comprehensive taxonomy for a supervised machine learning algorithm to group similar companies based on language. Experts carefully reviewed each list, removing outliers and false positives, resulting in the identification of organisations for emerging sectors. Unlike SIC, the RTIC system undergoes expert review to ensure accurate representation of the sector, with feedback consolidated and published after a quality assurance process.

Deep dive into the data

Autonomy & Robotics

These organisations create and utilise robots and automation to perform tasks that would typically need human interaction. Their offerings include 3D sensing, robotic arms, and AI systems. Advancements can boost efficiency, save money, and increase productivity across various industries, all of which could then apply to the Space domain.

This sector has 994 companies working in various areas such as Robotic Mobility, Robotic Integration, Reasoning and Acting, Sensing & Perception, and Robotic Manipulation. The sector is growing at 6.2% per year, and around 60% of companies are startups growing at 13.6% per year, highlighting the sector’s startup nature.

Below we can see the top level statistics of the Autonomy & Robotics sector:

In Orbit Servicing and Manufacturing (IOSM)

These organisations are involved in manufacturing and building structures and products in Space rather than on earth. Due to the expansion of the Space industry, Space Debris has emerged as a significant challenge for Space missions. This has prompted the establishment and management of an In-orbit Servicing and Manufacturing industry that can promote Space sustainability.

There are 1494 companies with potential links to the IOSM sector, growing at a rate of 2.4%¹ per year. The IOSM sector has been classified further into 8 categories known as Assembly, Debris, Inspection, Refuelling, Servicing, Hardware, Manufacturing, and Software.

¹2.4% differs from what you will see on the platform. 2.4% is the more accurate growth rate of the industry after removing GKN Limited from the analysis; the way their employee counts were reported skewed the top level growth rate value to be inaccurate. It is important that we retain GKN Limited for non-growth-related analysis as they represent a significant and important part of the sector.

Below are the top level statistics of the In-Orbit Servicing and Manufacturing sector including GKN Limited:

Space Energy

Space Energy organisations are involved in the research, development, and commercialisation of technologies and systems that can generate, transmit, and store energy in Space. These organisations will be instrumental in the creation of renewable energy sources outside of our atmosphere, playing a pivotal role in the economic growth of the energy sector.

There are 1148 companies with the potential to operate across Ground Segment, Power Core, Operations Management, Reflector, and Space Infrastructure.

Below are the top level statistics of the Space Energy sector including GKN Limited (top level growth rate has been removed as the inclusion of GKN Limited provides results that do not represent the sector as a whole):

Growth and Investment

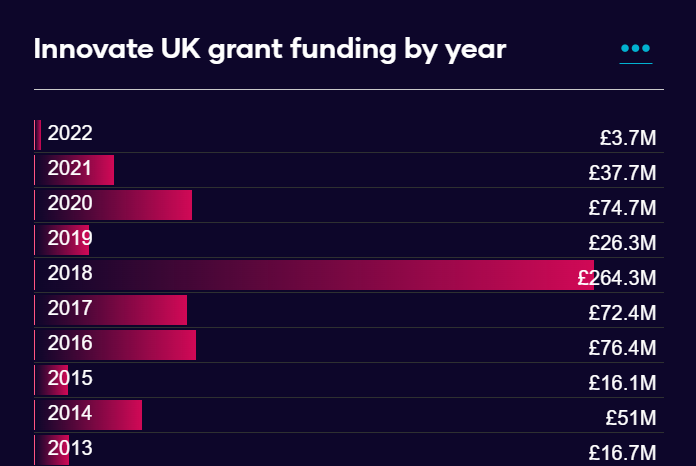

These 3 sectors are key in achieving the UK government’s space sustainability goals, having received a total of £5.93 billion in funding, based on Dealroom data, both from private investments and grants. Of the 293 organisation that has received Innovate UK grant funding across all three sectors, 126 are startups and 140 are established companies. These grant recipients have grown at a higher rate of 4.7% per year. In 2018, these sectors received the largest grant funding of £283 million. The Companies that have received the highest grant funding include:

- The Manufacturing technology centre (384.96 million)

- GKN Aerospace (118.14 million)

- National Physical Laboratory (40.2 million)

The investment figures indicate that these sectors have immense potential in supporting sustainable Space exploration technologies. The advent of autonomous systems and robotics in Space-related industries has created new opportunities for exploration, manufacturing, and energy generation, resulting in a surge in investment and funding in these areas.

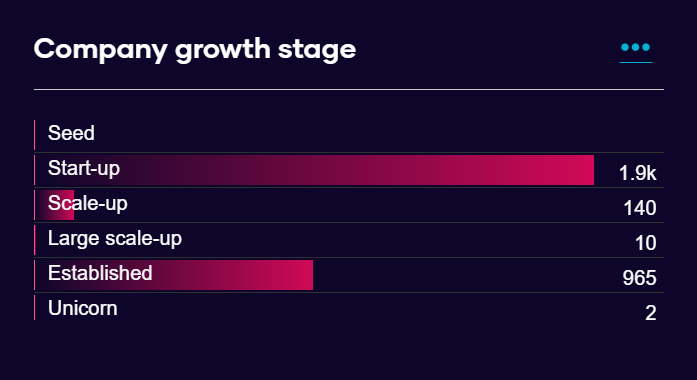

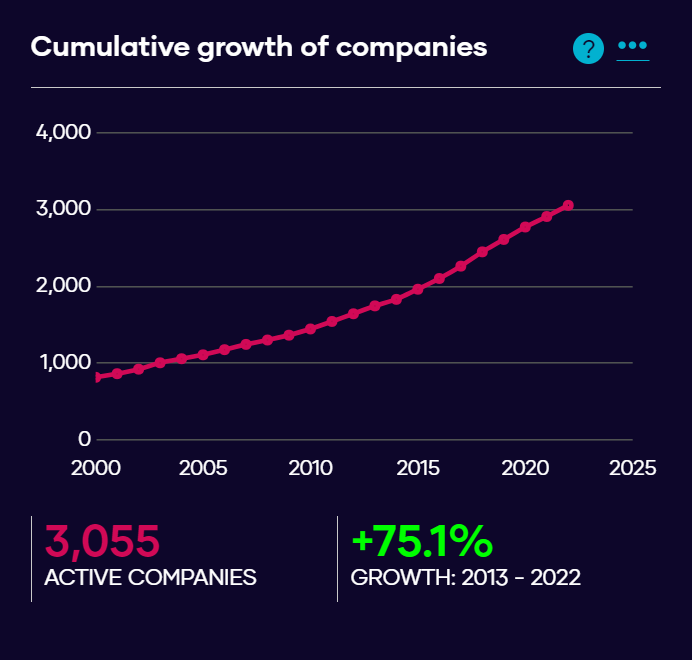

Over the past eight years, the cumulative growth rate of companies in these sectors has risen by 75.1%. The data reveals that most companies are still in the start-up (1.9K) and seed stages, with a smaller proportion attaining scale-up and larger scale-up status. The presence of two unicorns (start-up companies valued at £1bn or more) implies that this sector has significant potential for growth and investment.

Common language patterns

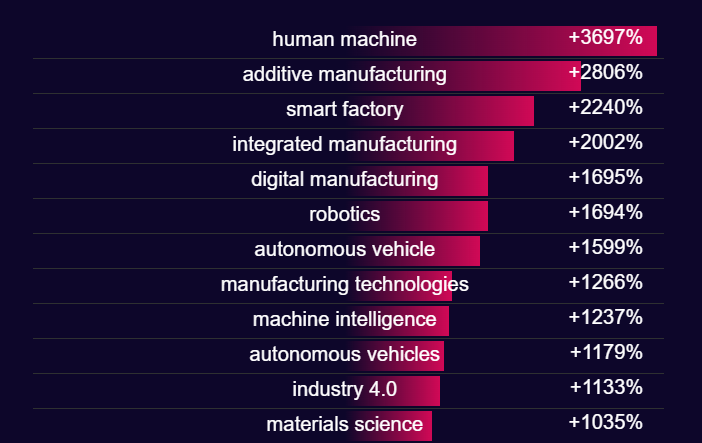

Our machine learning algorithm identifies and groups companies by their language patterns, which is crucial in detecting emerging sectors. Recognising common narratives in these sectors allows investors to make informed decisions, stay ahead of trends, and identify knowledge gaps that drive innovation and growth.

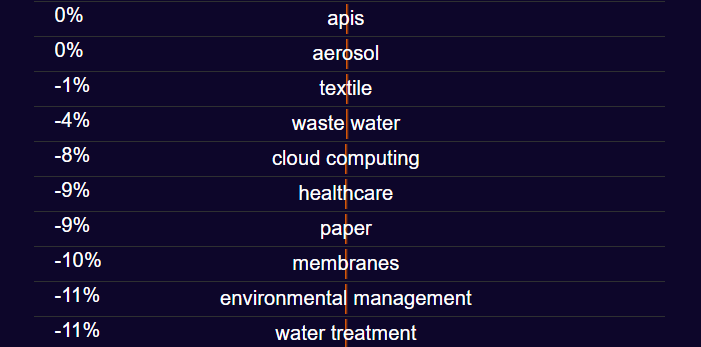

The prominent use of “advanced manufacturing” keywords in the Space sector indicates a focus on improving efficiency, quality, and cost-effectiveness through technologies such as “additive”, “digital” manufacturing, and “smart” factories. Conversely, the underuse of terms such as “AR” and “environmental management” implies less emphasis on these areas, likely due to lack of relevance or awareness/funding. However, this knowledge gap presents an opportunity for research and development in these areas, potentially leading to growth and progress within the industries. In summary, these findings highlight the potential for further exploration and advancement in the sector.

The collaboration between The Data City and the Satellite Applications Catapult has been instrumental in identifying fast-growing sectors with significant changes in products and services. The availability of company data and statistical information can offer valuable insights into emerging trends and enabling informed policy decisions. The partnership highlights the importance of such datasets and the potential for further technological advancements in the future. It remains to be seen what innovative developments will arise in the coming years.

If you want to dive deep into the data (or speak about anything else) do get in touch with us – we are always up for a chat.