The AI sector is getting a lot of attention at the moment. As well as being part of one of the ‘growth-driving’ industries in the government’s Industrial Strategy, it was at the centre of recent announcements of US investment in the UK.

But how big is this sector? Who owns the companies? And where in the UK are these companies based? The Data City’s data has the answers.

Fact 1: The AI sector is currently small, but investors are betting on it growing

For all the talk of AI, there aren’t currently that many companies currently working in its development.

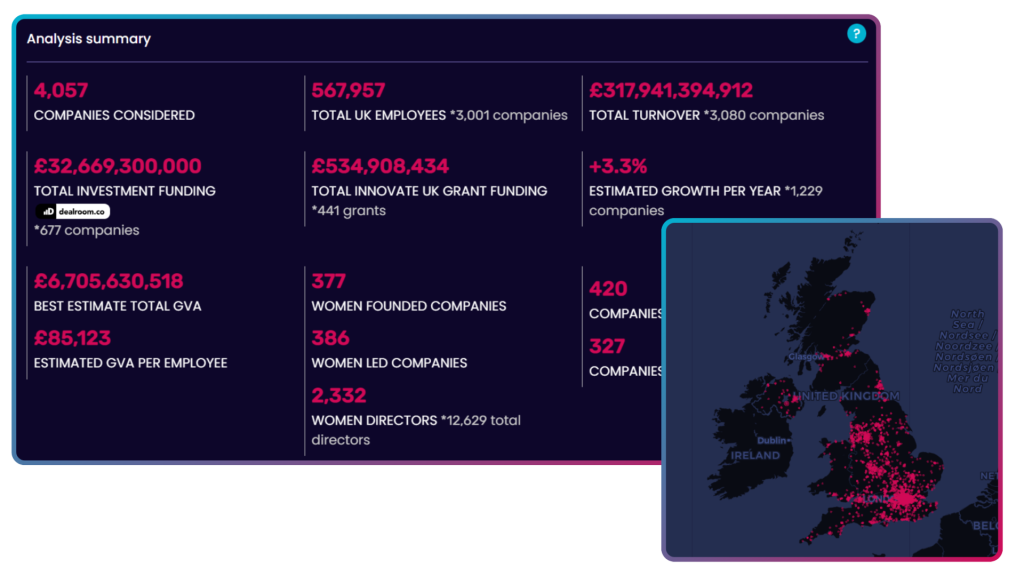

There are just over 4,000 registered companies operating in the UK that fall into The Data City’s ‘Artificial Intelligence Ecosystem’ and ‘Artificial Intelligence Technologies and Applications’ classifications. This is around 0.1% of all UK-registered businesses, and around 2% of all companies at the cutting-edge of the economy (measured by firms that fall into one of The Data City’s Real Time Industrial Classifications (RTICs)).

What’s important though about emerging industries is not where they are now, but where they are going. Short of a crystal ball, this is hard to say. But looking at funding that any one sector is attracting at least provides a guide to what investors think will happen.

And looking at the number of funding rounds shows they are placing bets on AI. These firms have accounted for around 14% of all funding rounds in RTIC companies over the last three years, way above their 2% share of all of these types of business. Only Life Sciences and Net Zero have received a higher number of investments.

Fact 2: US influence in UK AI is higher than average, but UK ownership still leads

A concern that a number of politicians and commentators raised (for example Sir Nick Clegg) around the US investment announcements was one of sovereignty. A major issue for them is that the AI sector in the UK is ultimately controlled by US rather than UK interests.

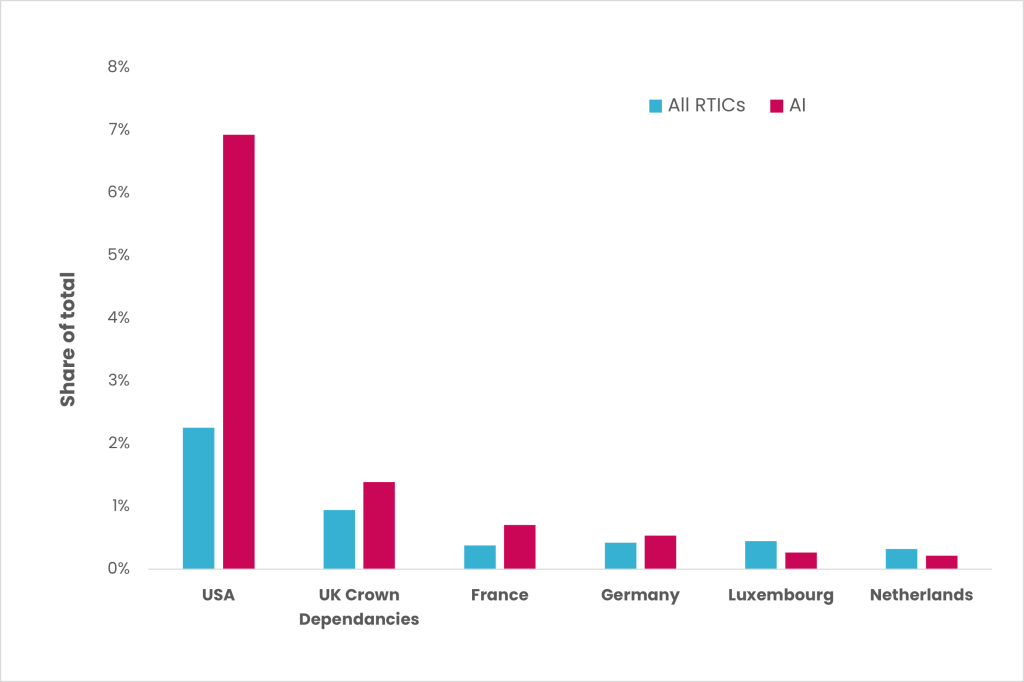

The data shows that US owners do play a larger role in UK AI than in other sectors.

When looking at ownership across all RTICs, 90% of companies are ultimately UK owned. For AI specifically this falls to 77%. Part of the reason for this is US ownership, which increases from 2% for all RTICs to 7% for AI (see Figure 1). But it is also worth remembering that for all the media discussion on US ownership, more than 3 in 4 companies are still under UK ownership.

Figure 1: US interests are much larger in AI than in other frontier sectors

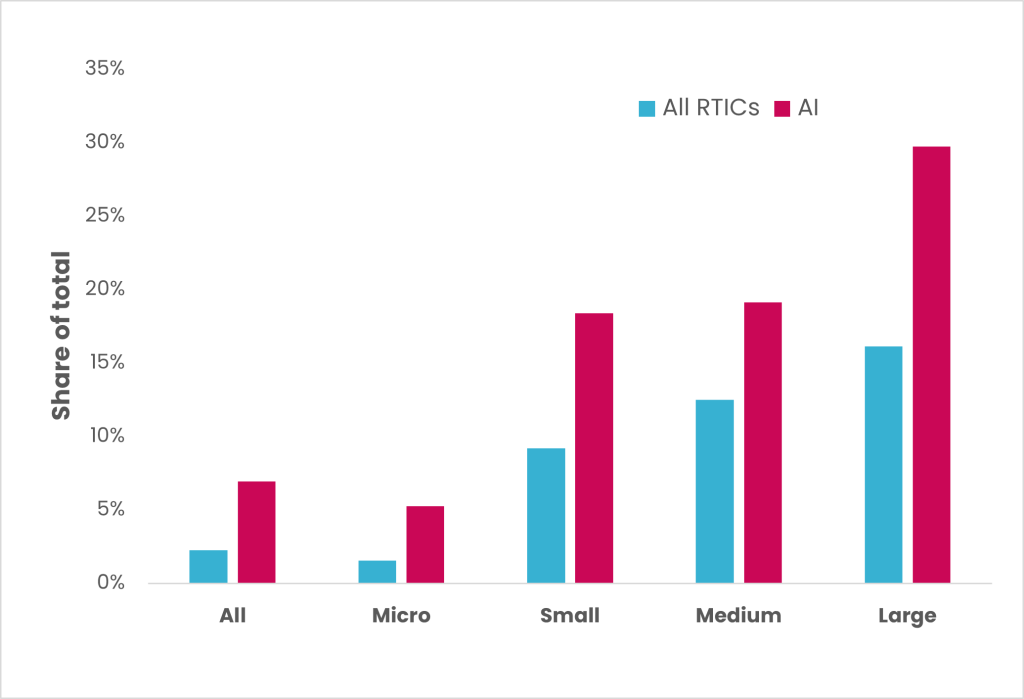

So why are some people concerned? It’s likely because US ownership is much more common amongst larger firms (which because of their size are more visible).

Splitting ownership by company size shows how US ownership increases as firm size increases, both for AI companies and RTIC companies more generally (see Figure 2). It is especially the case for AI – 30% of large AI companies operating in the UK are in US ownership. This is higher than even UK ownership of this group (28%), and means the US is the most common country of ownership.

Figure 2: US interests are especially prominent in large AI firms

Fact 3: AI is urban and heavily focused in the Greater South East

Much of the UK’s AI activities are in the Greater South East. Overall 64% is in this part of the country, and 44% is in London alone.

Other notable areas are Reading and Cambridge and Milton Keynes. For example, while Reading accounts for 0.6% of all businesses in the UK, it accounts for 2.2% of all companies operating in the AI sector.

Elsewhere Edinburgh also has proven attractive to AI activities (0.7% of all businesses v 2.0% of AI businesses). The opposite though is the case in Birmingham. While it is a hub for AI activities in the UK – it has the fifth highest share of the UK’s AI companies – at 1.8%, this is smaller than its share of all businesses (3.1%). This means that the smaller cities of Reading and Edinburgh are larger AI hotspots than the UK’s third-largest economy (see Figure 3).

| # | City | Share of UK AI activities (%) | Share of all UK businesses (%) |

|---|---|---|---|

| 1 | London | 43.7 | 20.9 |

| 2 | Manchester | 3.8 | 3.6 |

| 3 | Reading | 2.2 | 0.6 |

| 4 | Edinburgh | 2.0 | 0.7 |

| 5 | Birmingham | 1.8 | 3.1 |

| All urban | 77.1 | 52.7 |

Source: The Data City; ONS. Note: Cities are defined as primary urban areas.

What does this mean?

There has been a lot of focus on AI recently, but there is very little data to ground this discussion. The Data City’s data shows that it:

- Is small, but investors are betting on it growing.

- Has a larger than average US influence, especially for larger companies, but is still overwhelmingly in UK ownership.

- London is the overwhelming centre of AI in the UK, but Birmingham isn’t playing the role it should be.

These findings should better inform discussions around AI, help guide the Government’s new Sovereign AI Unit and its £500m fund and help shape the government’s Industrial Strategy as it moves from a document to implementation.

For more on the UK Industrial Strategy and the IS-8 sectors, be sure to download our new report.

Looking for more? Sign up for a free trial of our Industry Engine platform to start exploring our data today.