With the announcement of the Industrial Strategy and the eight growth-driving sectors (the IS-8) in June 2025, UK government now has a 10-year plan to significantly increase business investment.

But to help this strategy become a reality, it’s vital we have the right company and sector data in the right hands to help map, understand and track the IS-8 and the frontier industries supporting growth.

As part of our dedication to help build a shared, modern evidence base for the Industrial Strategy and the IS-8 sectors, we’ve published a new report that aims to provide a clear definition of these sectors using our real-time data to classify frontier sectors missing from current definitions.

Policymakers, economists, investors, sector experts and beyond will now be able to utilise our comprehensive mapping of the industrial strategy, engage with us on the development of our methodologies and access this new data set live in our Industry Engine platform.

The report

Our new report ‘Open Sourcing the Industrial Strategy’ is an articulation of The Data City’s unique ability to define and track UK companies and sectors in real time.

This report takes the Government’s mapping of the IS-8 sectors – from Advanced Manufacturing and Defence to Life Sciences and Clean Energy Industries – and builds on it with real-time data, clear sector definitions, and machine learning-powered classifications.

Approaching this piece of analysis, we’ve reviewed the Government’s level of confidence in their sector definitions – from Low to High.

From this, we’ve been able to focus on areas of low confidence, where Standard Industrial Classification (SIC) codes are insufficient. For sectors like Clean Energy Industries, for example, the Government currently relies on survey-based estimates. This approach creates challenges for consistency, accuracy, and measurement over time.

The result is a comprehensive analysis of the data infrastructure behind the Industrial Strategy.

For each of the IS-8 sectors, we’ve:

- Assessed the Government’s existing definition and data sources

- Compared their methodology to The Data City’s RTIC-led approach

- Quantified the differences using business counts, innovation scores and real-world coverage

- Identified where our classifications better capture the full scope of frontier sectors

- Recommended RTICs – many already built in partnership with government – as a clearer, more consistent, and future-ready alternative

The report also highlights where open data, explainable machine learning, and real-time updates can support policymakers, regional stakeholders, and analysts in tracking sector performance, measuring impact, and turning strategy into action.

You can download the full report for free today.

Accessing the data

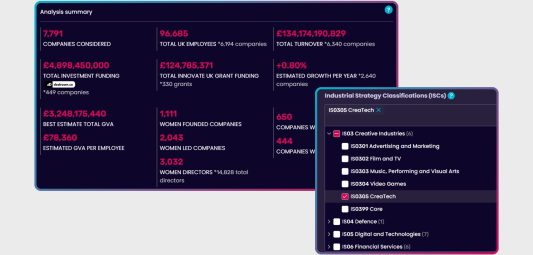

And there’s more. The data behind the IS-8 – including the sector definitions, company lists and frontier classifications – is now live in our platform and ready to explore.

As well as being able to explore the companies that make up the IS-8 and get a macro view of the size and shape of these industries, we’ve also now included IS-8 sub sectors or ‘Frontier Industries’.

A discussed in the Government’s Industrial Strategy Sector Definitions List, users can now drill down into specific frontier industries for each IS-8 sector.

If you’re already a customer, you can access this directly through the Industry Engine.

If not, you can sign up for a free trial today and see what real clarity looks like.

Our ambition

At The Data City, our goal is to create a shared, real-time evidence base for national and local government, academia, and industry.

We want the UK’s Industrial Strategy to be built on solid, consistent data – not outdated classifications or guesswork. That means using modern tools to define sectors properly, especially frontier industries missing from legacy systems like SIC.

We’ve already helped shape this work. Over the past year, we’ve collaborated with government and local partners through our sector mapping guides, ensuring our classifications reflect how people actually understand and engage with the economy.

By doing this, we make sure:

- Everyone is using the same definitions, built on live data

- Sector maps are accurate, explainable and trusted

- We can compare places and regions properly

- It’s possible to track progress and measure impact over time

- Regions can focus on their real strengths – not just chase funding

This isn’t just a better way to classify companies. It’s the data infrastructure the UK needs to turn industrial strategy into real economic growth.

What’s next?

Our report is now available to download on our website.

It includes analysis and recommendations, but it also acts as a discussion paper. We believe in working out in the open and welcome discussion on the data and definitions we’ve provided. Please do get in touch via our website or email us at [email protected] if you would like to discuss further.

Additionally, we are looking to convene an IS-8 working group. The purpose: to explore the data required for a shared evidence base. If you’d like to be part of it, please register your interest via this short form. We’ll be in touch with more information soon.